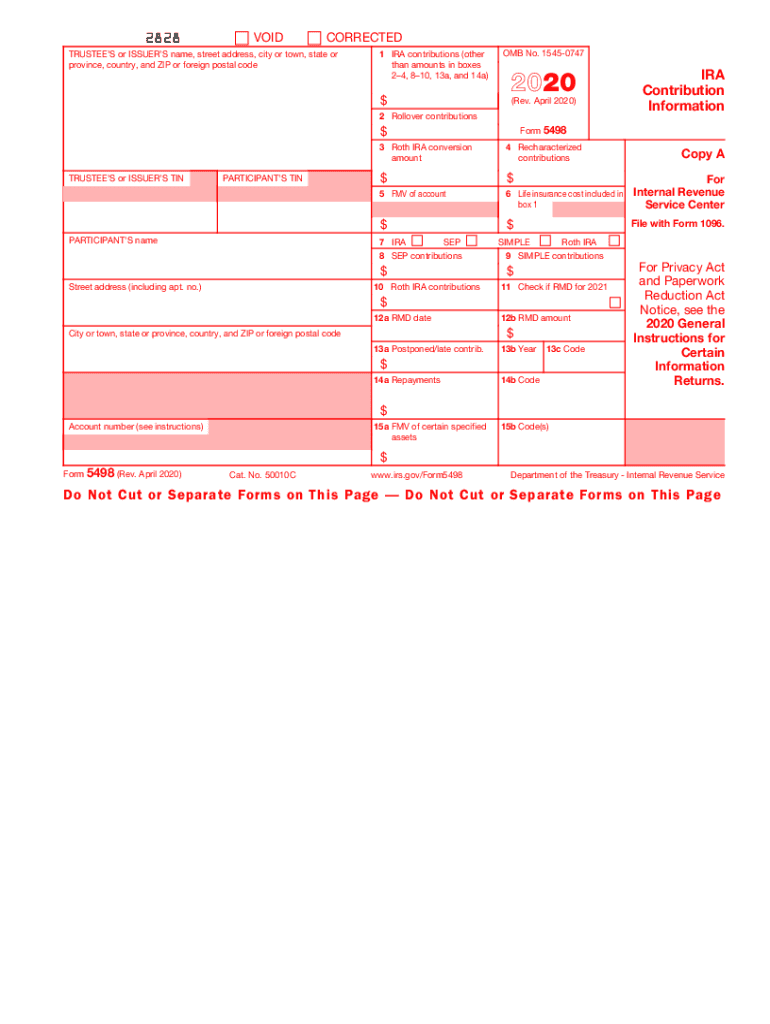

Form 5498 Internal Revenue Service 2020

What is the Form 5498

The IRS Form 5498 is an informational tax form used to report contributions to individual retirement accounts (IRAs), including traditional IRAs, Roth IRAs, and SEP IRAs. It is also used to report the fair market value of the account at the end of the year. This form is essential for both taxpayers and the IRS, as it helps ensure that contributions are reported accurately and that taxpayers are aware of their retirement savings status.

Steps to complete the Form 5498

Completing the IRS Form 5498 involves several key steps:

- Gather necessary information, including your name, Social Security number, and details about your IRA.

- Enter the total contributions made to your IRA for the tax year in the appropriate section.

- Report the fair market value of your IRA as of December thirty-first of the tax year.

- Include any rollover contributions or conversions, if applicable.

- Ensure all information is accurate and complete before submission.

How to obtain the Form 5498

The IRS Form 5498 can be obtained directly from the IRS website, where it is available for download. Additionally, financial institutions that manage IRAs typically provide this form to account holders. It is important to ensure that you receive the correct version of the form for the specific tax year you are reporting.

Filing Deadlines / Important Dates

IRS Form 5498 must be filed by the financial institution that holds the IRA, not the individual taxpayer. The deadline for filing this form is typically May thirty-first of the year following the tax year being reported. However, contributions made for the previous tax year can be accepted until the tax filing deadline, which is usually April fifteenth. It is crucial for taxpayers to keep track of these dates to ensure compliance.

Legal use of the Form 5498

The IRS Form 5498 serves as a legal document that supports the reporting of IRA contributions and balances. It is important for taxpayers to retain a copy of this form for their records, as it may be required for future tax filings or audits. The information reported on this form can affect tax calculations, including deductions and penalties for excess contributions.

Key elements of the Form 5498

Several key elements are included on the IRS Form 5498:

- Taxpayer identification information, including name and Social Security number.

- Type of IRA and account number.

- Total contributions made during the tax year.

- Fair market value of the account at year-end.

- Details regarding rollovers and conversions.

Examples of using the Form 5498

Taxpayers may use the IRS Form 5498 in various scenarios, such as:

- Reporting contributions made to a traditional IRA or Roth IRA.

- Documenting the fair market value of an IRA for financial planning.

- Providing proof of rollover contributions when changing retirement account providers.

Quick guide on how to complete form 5498 internal revenue service

Complete Form 5498 Internal Revenue Service effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the proper form and securely store it online. airSlate SignNow provides all the resources required to create, edit, and eSign your documents swiftly without delays. Handle Form 5498 Internal Revenue Service on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Form 5498 Internal Revenue Service seamlessly

- Locate Form 5498 Internal Revenue Service and then click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review the information thoroughly and then click the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choosing. Edit and eSign Form 5498 Internal Revenue Service while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5498 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 5498 internal revenue service

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What are the IRS Form 5498 instructions for completing this document?

The IRS Form 5498 instructions guide you through the process of reporting contributions to individual retirement accounts (IRAs). It outlines essential information such as the types of contributions to report and the specific deadlines for submission. Understanding these instructions is crucial for compliance and ensuring accurate reporting.

-

How can airSlate SignNow assist in managing IRS Form 5498 documents?

AirSlate SignNow simplifies the process of managing IRS Form 5498 documents by allowing you to electronically sign and send forms securely. Our user-friendly platform enables quick access to templates and provides seamless collaboration with tax professionals. This efficiency helps ensure that you meet all necessary filing requirements.

-

Are there any costs associated with using airSlate SignNow to handle IRS Form 5498?

AirSlate SignNow offers various pricing plans tailored to fit different business needs, including a cost-effective option for managing IRS Form 5498 documents. Pricing depends on the number of users and features required. Visit our website for detailed pricing information and choose the plan that best suits your IRS documentation needs.

-

What features does airSlate SignNow offer for IRS Form 5498 management?

AirSlate SignNow includes features like eSigning, document templates, and secure cloud storage, making it ideal for managing IRS Form 5498. Via our platform, users can automate workflows which reduces processing time and minimizes errors. These features streamline the completion and submission of your IRS Form 5498.

-

Can airSlate SignNow integrate with other software for managing IRS Form 5498?

Yes, airSlate SignNow can integrate with popular accounting and tax preparation software, making it easier to manage IRS Form 5498. These integrations allow for seamless data transfer and improved accuracy in your filings. By connecting with existing tools, you can enhance your overall workflow for tax documentation.

-

What are the benefits of using airSlate SignNow for eSigning IRS Form 5498?

Using airSlate SignNow for eSigning IRS Form 5498 offers several benefits, including enhanced security and convenience. Our platform ensures that your documents are protected through encryption and complies with electronic signature regulations. Customers appreciate the ability to complete forms anytime, anywhere, which increases overall efficiency.

-

Is airSlate SignNow compliant with IRS regulations for Form 5498?

Yes, airSlate SignNow is fully compliant with IRS regulations regarding electronic signatures and documentation, including IRS Form 5498. This compliance means you can trust our platform for secure and accurate handling of your tax documents. Adhering to IRS standards gives peace of mind when submitting important forms.

Get more for Form 5498 Internal Revenue Service

Find out other Form 5498 Internal Revenue Service

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form