Schedule Se Form 2011

What is the Schedule SE Form

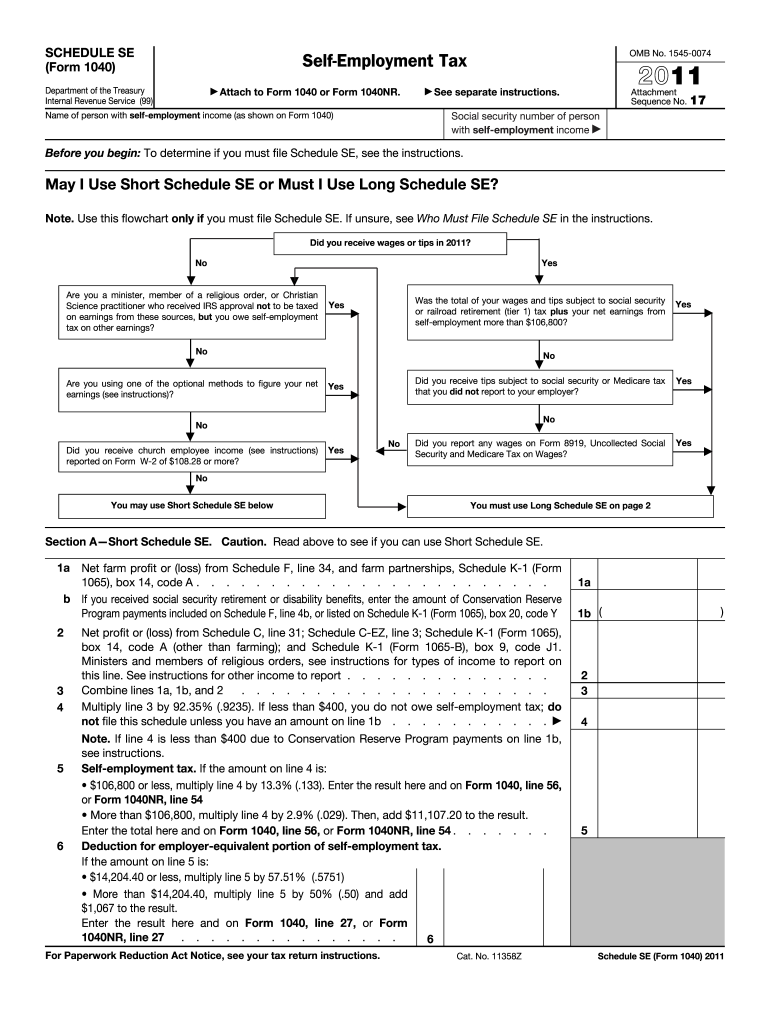

The Schedule SE form, officially known as the Self-Employment Tax form, is a crucial document for individuals who earn income through self-employment. This form is used to calculate the self-employment tax owed, which includes Social Security and Medicare taxes. Self-employed individuals, freelancers, and independent contractors typically need to file this form alongside their annual tax return. Understanding the Schedule SE form is essential for accurately reporting income and ensuring compliance with IRS regulations.

How to Use the Schedule SE Form

Using the Schedule SE form involves several steps to ensure accurate calculations of self-employment tax. First, gather all relevant income information from self-employment sources. Next, determine your net earnings from self-employment, which is calculated by subtracting business expenses from total income. Once you have this figure, you can complete the Schedule SE form by entering your net earnings and following the instructions to calculate the self-employment tax. It is essential to review the form for accuracy before submission.

Steps to Complete the Schedule SE Form

Completing the Schedule SE form requires careful attention to detail. Follow these steps:

- Gather your income and expense records related to self-employment.

- Calculate your net earnings by subtracting total business expenses from gross income.

- Fill out Part I of the form to report your net earnings.

- If your net earnings exceed a specific threshold, complete Part II to calculate your self-employment tax.

- Transfer the calculated tax amount to your Form 1040.

Ensure that all figures are accurate and that you retain copies of the completed form for your records.

Legal Use of the Schedule SE Form

The Schedule SE form is legally binding when completed correctly and submitted to the IRS. It is essential to ensure that all information provided is accurate to avoid potential penalties. The IRS requires this form to be filed by self-employed individuals to ensure they contribute appropriately to Social Security and Medicare. Compliance with IRS guidelines regarding the use of this form is crucial for maintaining good standing and avoiding legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule SE form align with the annual tax return deadlines. Typically, self-employed individuals must file their taxes by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to keep track of any changes in IRS regulations regarding filing deadlines to ensure timely submission and avoid penalties.

Required Documents

To complete the Schedule SE form, you will need several documents, including:

- Records of all income received from self-employment.

- Documentation of business expenses incurred during the tax year.

- Previous tax returns, if applicable, for reference.

- Any additional forms that may relate to self-employment income.

Having these documents readily available will streamline the process of completing the Schedule SE form and ensure accuracy in reporting.

Quick guide on how to complete 2011 schedule se form

Effortlessly Prepare Schedule Se Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can find the suitable template and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, amend, and electronically sign your documents swiftly and without delays. Manage Schedule Se Form on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to Amend and Electronically Sign Schedule Se Form with Ease

- Obtain Schedule Se Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Schedule Se Form and ensure remarkable communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 schedule se form

Create this form in 5 minutes!

How to create an eSignature for the 2011 schedule se form

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the Schedule Se Form and how does it work?

The Schedule Se Form is a tax document used to report income from self-employment or side businesses. With airSlate SignNow, you can easily fill out, send, and eSign the Schedule Se Form electronically, streamlining the process and ensuring accuracy.

-

How can I integrate the Schedule Se Form into my existing workflow?

airSlate SignNow allows seamless integration of the Schedule Se Form into your current workflow through various platforms like Google Drive and Dropbox. This makes managing your documents efficient, as you can access and eSign the Schedule Se Form without switching between applications.

-

What features does airSlate SignNow offer for completing the Schedule Se Form?

airSlate SignNow provides a suite of features such as customizable templates, real-time collaboration, and secure eSigning for the Schedule Se Form. These tools enhance your productivity, allowing you to manage your documents effectively and ensure compliance.

-

What are the benefits of using airSlate SignNow for the Schedule Se Form?

Using airSlate SignNow for the Schedule Se Form offers numerous benefits including reduced paperwork, faster processing times, and improved accuracy. The platform is user-friendly and designed to help you quickly manage your documents, making tax season less stressful.

-

Is airSlate SignNow a cost-effective solution for managing the Schedule Se Form?

Yes, airSlate SignNow is a cost-effective solution for managing the Schedule Se Form. With competitive pricing and no hidden fees, you can efficiently handle your eSigning needs without exceeding your budget.

-

Can I track the status of my Schedule Se Form with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Schedule Se Form, so you know when it has been sent, viewed, and signed. This feature ensures transparency throughout the signing process.

-

What happens if I need to make changes to my Schedule Se Form after sending it?

If you need to make changes to your Schedule Se Form after sending, airSlate SignNow allows you to easily void the previous version and send a new one. This ensures that your final submission is accurate and up-to-date.

Get more for Schedule Se Form

- 2020 schedule a form 8804 penalty for underpayment of estimated section 1446 tax by partnerships

- 2020 form 5074 allocation of individual income tax to guam or the commonwealth of the northern mariana islands cnmi

- Form 1040 schedule a

- 2020 instructions for formsw 2g and 5754 instructions for formsw 2g and 5754

- Form 8283 rev december 2020 noncash charitable contributions

- 2020 form 1095 b health coverage

- 2020 schedule c form 990 or 990 ez political campaign and lobbying activities

- Form 990 schedule o

Find out other Schedule Se Form

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe