About Schedule SE Form 1040, Self Employment Tax 2020

Understanding the Schedule SE Form 1040 for Self Employment Tax

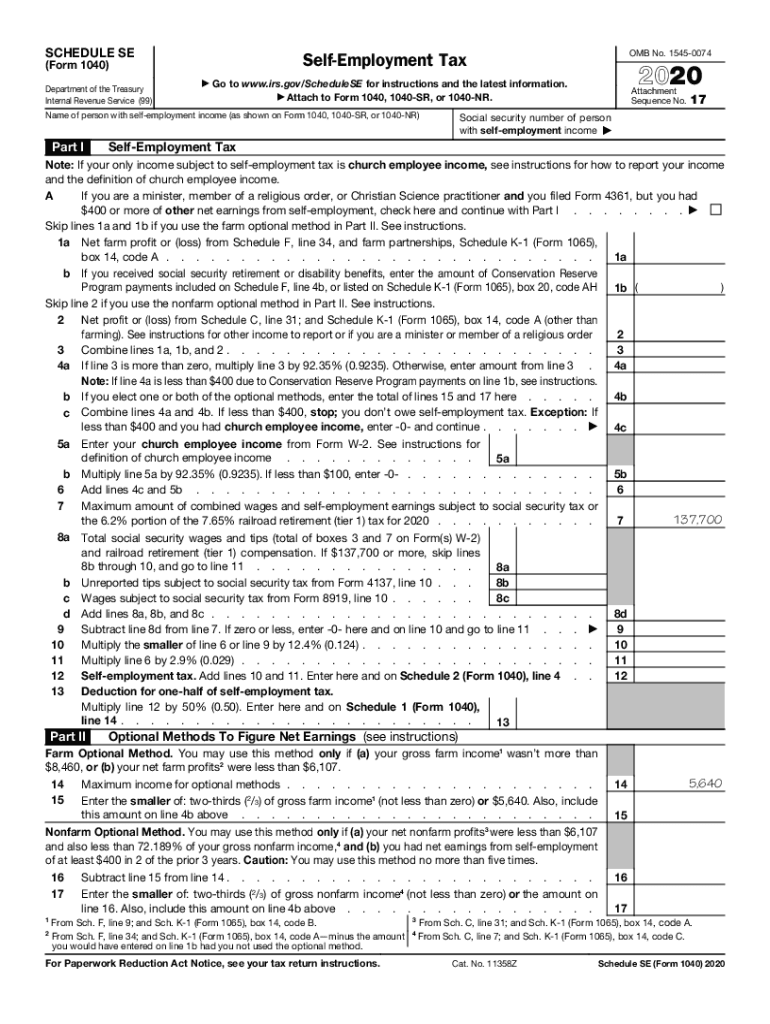

The Schedule SE form, officially known as the Form 1040 Schedule SE, is essential for self-employed individuals in the United States. This form calculates the self employment tax, which is primarily used to fund Social Security and Medicare. If you earn income from self-employment, this form is necessary to report your earnings and determine your tax obligations. The self employment tax rate is currently set at 15.3%, which includes both Social Security and Medicare taxes.

Steps to Complete the Schedule SE Form 1040

Filling out the Schedule SE form involves several key steps:

- Gather your income information: Collect all relevant documents that detail your self-employment income, including 1099 forms and any other income statements.

- Determine your net earnings: Calculate your net profit or loss from self-employment by subtracting allowable business expenses from your total income.

- Complete the form: Fill out the Schedule SE, starting with your net earnings. Follow the instructions carefully to ensure accuracy.

- Transfer the tax amount: After calculating your self employment tax, transfer the amount to your Form 1040.

- Review and submit: Double-check all entries for accuracy before submitting your forms to the IRS.

IRS Guidelines for Schedule SE Form 1040

The IRS provides specific guidelines for completing the Schedule SE form. It is important to understand the eligibility criteria, which generally include anyone who earns $400 or more in self-employment income. Additionally, the IRS outlines how to report income from various sources, including sole proprietorships, partnerships, and LLCs. Familiarizing yourself with these guidelines can help ensure compliance and avoid potential penalties.

Filing Deadlines for Schedule SE Form 1040

Timely filing of the Schedule SE form is crucial to avoid penalties. The standard deadline for filing your federal tax return, including the Schedule SE, is April 15 of each year. If you require additional time, you may file for an extension, but remember that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents for Schedule SE Form 1040

To accurately complete the Schedule SE form, you will need several documents:

- Income statements: Such as 1099 forms or records of cash transactions.

- Business expense records: Documentation of all allowable expenses related to your self-employment activities.

- Previous tax returns: These can provide helpful context and reference for your current filing.

Penalties for Non-Compliance with Schedule SE Form 1040

Failure to file the Schedule SE form or pay the required self employment tax can result in significant penalties. The IRS may impose a failure-to-file penalty, which is typically five percent of the unpaid tax for each month your return is late, up to a maximum of 25 percent. Additionally, interest accrues on any unpaid taxes, compounding the financial impact of non-compliance.

Quick guide on how to complete about schedule se form 1040 self employment tax

Complete About Schedule SE Form 1040, Self Employment Tax effortlessly on any device

The management of documents online has increased in popularity among organizations and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow offers all the features you require to create, modify, and electronically sign your documents promptly without delays. Administer About Schedule SE Form 1040, Self Employment Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and electronically sign About Schedule SE Form 1040, Self Employment Tax seamlessly

- Obtain About Schedule SE Form 1040, Self Employment Tax and then click Get Form to initiate.

- Employ the tools we supply to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign About Schedule SE Form 1040, Self Employment Tax to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about schedule se form 1040 self employment tax

Create this form in 5 minutes!

How to create an eSignature for the about schedule se form 1040 self employment tax

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What is self employment tax and how does it affect me?

Self employment tax is a tax that self-employed individuals pay to cover Social Security and Medicare. It is calculated based on your net earnings from self-employment. Understanding self employment tax is crucial for anyone running their own business, as it affects your overall tax liability and financial planning.

-

How can airSlate SignNow help me manage self employment tax documents?

airSlate SignNow allows you to easily eSign and manage important documents related to your self employment tax. With its intuitive interface, you can quickly create, share, and store contracts, invoices, and tax-related documents. This ensures that all your records are organized, making tax time less stressful.

-

What features does airSlate SignNow offer for self-employed individuals?

airSlate SignNow offers features like eSigning, document templates, and workflow automation that are particularly useful for self-employed individuals. You can manage all your contracts and tax documents in one place, simplifying the process of dealing with self employment tax records. These tools help streamline your business operations.

-

Is airSlate SignNow cost-effective for managing self employment tax?

Yes, airSlate SignNow is a cost-effective solution for managing self employment tax documents. With various pricing plans designed for different business needs, you can choose the one that fits your financial situation. The efficiency gained by using airSlate SignNow can ultimately save you time and reduce costs associated with tax preparation.

-

Can I use airSlate SignNow on my mobile device to handle self employment tax related tasks?

Absolutely! airSlate SignNow is designed to be accessible on mobile devices, allowing you to manage self employment tax documents on the go. Whether you're eSigning contracts or sending invoices, the mobile app ensures you stay productive, even outside of the office.

-

What integrations does airSlate SignNow offer that can help with self employment tax?

airSlate SignNow integrates seamlessly with popular accounting and financial software that assist with self employment tax calculations. These integrations make it easy to keep your financial records aligned, helping you track income and expenses efficiently. This can simplify the preparation process for your self employment tax.

-

How secure is my data while using airSlate SignNow for self employment tax purposes?

Security is a top priority at airSlate SignNow, particularly when handling sensitive self employment tax information. The platform uses encryption and other security measures to protect your data. You can confidently use airSlate SignNow, knowing that your personal and financial information is safeguarded.

Get more for About Schedule SE Form 1040, Self Employment Tax

- Sbi account name correction form pdf

- Denr smr form

- Lcr form 102

- Ministry of education solomon islands past exam papers form

- Memorial hermann doctors note form

- Florida federation of fairs convention fun shoot may 11th form

- Transcriptletter of graduation request form

- Approvals cmbfhlmhclthe chapel of four chaplai form

Find out other About Schedule SE Form 1040, Self Employment Tax

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF