About Schedule SE Form 1040, Self Employment TaxAbout Schedule SE Form 1040, Self Employment Tax2020 Instructions for Schedule S 2022

Understanding Schedule SE for Self Employment Tax

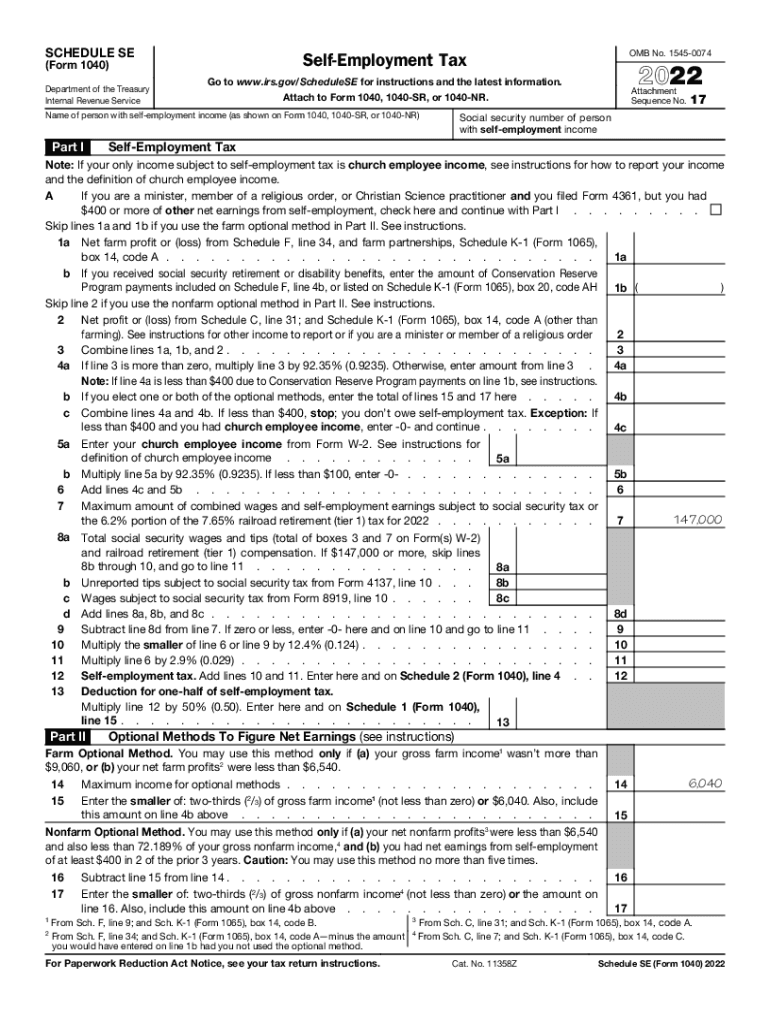

Schedule SE (Self-Employment Tax) is an essential form for individuals who earn income through self-employment. This form is used to calculate the self-employment tax owed, which covers Social Security and Medicare taxes for self-employed individuals. The IRS requires this form to ensure that self-employed taxpayers contribute to these vital social programs, similar to how employees have these taxes withheld from their paychecks.

When filling out Schedule SE for 2021, it is crucial to accurately report your net earnings from self-employment. This includes income from sole proprietorships, partnerships, and other business ventures. The self-employment tax rate for 2021 is 15.3%, which consists of 12.4% for Social Security and 2.9% for Medicare. Understanding these components helps in calculating the total tax liability.

Steps to Complete Schedule SE for 2021

Completing Schedule SE involves several key steps to ensure accuracy and compliance with IRS regulations. Start by gathering all relevant financial documents, including income statements and expense records. Follow these steps:

- Determine your net earnings from self-employment by subtracting your business expenses from your total income.

- Use the appropriate section of Schedule SE to report your net earnings. If your net earnings exceed $400, you must file this form.

- Calculate your self-employment tax using the provided formulas on the form.

- Transfer the calculated amount to your Form 1040, where it will be included in your total tax liability.

Ensure all figures are accurate to avoid potential penalties or issues with your tax return.

Legal Use of Schedule SE for Self Employment Tax

Schedule SE is legally recognized by the IRS as the official method for calculating self-employment tax. To ensure compliance, it is important to understand the legal implications of filing this form. The IRS mandates that all self-employed individuals who earn $400 or more in net earnings must file Schedule SE.

Filing this form accurately not only fulfills your legal obligations but also protects you from potential audits or penalties. It is advisable to keep thorough records of your income and expenses, as these may be required in case of an audit.

IRS Guidelines for Schedule SE

The IRS provides specific guidelines for completing Schedule SE, which are essential for ensuring compliance. These guidelines cover eligibility criteria, filing procedures, and important deadlines. Key points include:

- Net earnings must be calculated correctly, including all sources of self-employment income.

- Filing deadlines typically align with the standard tax return deadlines, usually April 15 of the following year.

- Extensions may be available, but any taxes owed must be paid by the original deadline to avoid penalties.

Staying informed about these guidelines helps ensure that you meet all requirements and avoid complications during tax season.

Required Documents for Schedule SE

To complete Schedule SE accurately, you will need several documents that provide a clear picture of your financial situation. Essential documents include:

- Income statements, such as 1099 forms or records of cash income.

- Expense documentation, including receipts and invoices related to your business activities.

- Previous tax returns, which can provide context for your current filing.

Having these documents organized will streamline the process and help ensure that you report accurate figures on your Schedule SE.

Filing Methods for Schedule SE

Schedule SE can be filed in various ways, allowing flexibility for self-employed individuals. The primary methods include:

- Online filing through tax preparation software, which often includes guided prompts for completing Schedule SE.

- Mailing a paper form to the IRS, which may be preferred by those who are more comfortable with traditional methods.

- In-person filing at designated IRS offices, although this option may vary based on location and availability.

Choosing the right method depends on your personal preferences and comfort with technology.

Quick guide on how to complete about schedule se form 1040 self employment taxabout schedule se form 1040 self employment tax2020 instructions for schedule se

Complete About Schedule SE Form 1040, Self Employment TaxAbout Schedule SE Form 1040, Self Employment Tax2020 Instructions For Schedule S effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly option to traditional printed and signed papers, as you can locate the correct form and safely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents promptly without delays. Manage About Schedule SE Form 1040, Self Employment TaxAbout Schedule SE Form 1040, Self Employment Tax2020 Instructions For Schedule S on any device using airSlate SignNow Android or iOS applications and streamline any document-focused process today.

The easiest way to modify and eSign About Schedule SE Form 1040, Self Employment TaxAbout Schedule SE Form 1040, Self Employment Tax2020 Instructions For Schedule S without hassle

- Locate About Schedule SE Form 1040, Self Employment TaxAbout Schedule SE Form 1040, Self Employment Tax2020 Instructions For Schedule S and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and has the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced paperwork, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you prefer. Edit and eSign About Schedule SE Form 1040, Self Employment TaxAbout Schedule SE Form 1040, Self Employment Tax2020 Instructions For Schedule S and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about schedule se form 1040 self employment taxabout schedule se form 1040 self employment tax2020 instructions for schedule se

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it work?

airSlate SignNow is a powerful platform that allows businesses to send and eSign documents effortlessly. It streamlines the signing process, enabling users to create, distribute, and sign documents quickly, which is essential for enhancing productivity. With airSlate SignNow, users can manage all their document signing needs in one convenient location.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to cater to businesses of all sizes. Each plan includes a variety of features, ensuring that you can find an option that fits your budget while still giving you access to essential e-signature functionalities. Visit our pricing page for detailed information on each option.

-

What features does airSlate SignNow offer?

airSlate SignNow comes equipped with a range of features that enhance your eSigning experience, including templates, document sharing, and advanced security options. Users can also track document statuses in real-time, making it easier to manage signing workflows efficiently. These features collectively make airSlate SignNow a top choice for electronic signatures.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes the security of your documents by implementing industry-standard encryption protocols. Our platform is compliant with regulations such as GDPR and eIDAS, ensuring that your data is managed with the highest security standards. This commitment to security allows you to sign documents with confidence.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integration with a variety of popular applications, including CRMs, cloud storage solutions, and project management tools. These integrations allow businesses to automate workflows and enhance productivity without the need for extensive technical knowledge. You can easily connect airSlate SignNow with your favorite apps to simplify your processes.

-

What benefits does airSlate SignNow provide to businesses?

Utilizing airSlate SignNow brings signNow benefits, such as increased efficiency, reduced turnaround times, and improved accountability in document signing. By automating the e-signature process, businesses save valuable time and resources while ensuring compliance and security. This results in smoother operations and a better overall experience for all parties involved.

-

Is airSlate SignNow user-friendly for beginners?

Absolutely! airSlate SignNow is designed with a user-friendly interface, making it accessible for users of all technical skill levels. Our platform offers intuitive navigation and helpful resources such as tutorials and customer support, ensuring that even beginners can easily understand and utilize the e-signature features effectively.

Get more for About Schedule SE Form 1040, Self Employment TaxAbout Schedule SE Form 1040, Self Employment Tax2020 Instructions For Schedule S

- Ohio widow 497322698 form

- Legal last will and testament form for widow or widower with minor children ohio

- Legal last will form for a widow or widower with no children ohio

- Legal last will and testament form for a widow or widower with adult and minor children ohio

- Legal last will and testament form for divorced and remarried person with mine yours and ours children ohio

- Legal last will and testament form with all property to trust called a pour over will ohio

- Ohio revocation 497322704 form

- Last will and testament for other persons ohio form

Find out other About Schedule SE Form 1040, Self Employment TaxAbout Schedule SE Form 1040, Self Employment Tax2020 Instructions For Schedule S

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors