Schedule Se Form 2014

What is the Schedule SE Form

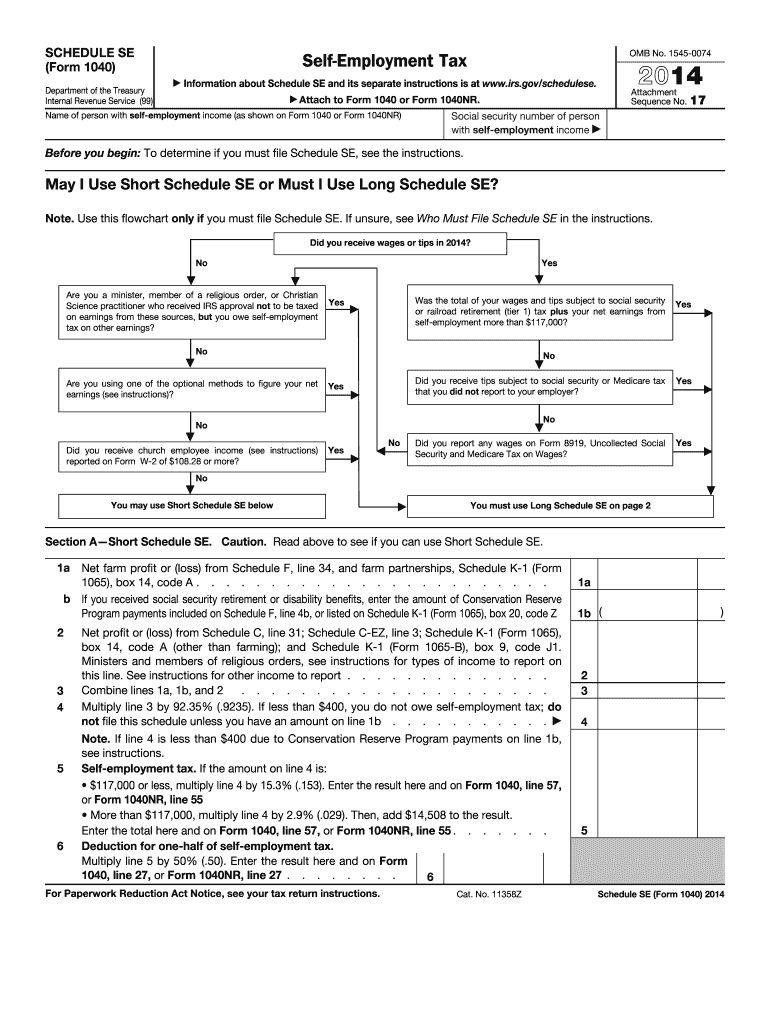

The Schedule SE Form is a tax document used by self-employed individuals to calculate their self-employment tax. This form is essential for reporting income from self-employment and determining the amount owed to the IRS. It is typically filed alongside the individual’s Form 1040 during tax season. The self-employment tax comprises Social Security and Medicare taxes, which are crucial for funding these federal programs. Understanding this form is vital for anyone who earns income independently, as it ensures compliance with tax obligations.

How to use the Schedule SE Form

Using the Schedule SE Form involves several steps to ensure accurate reporting of self-employment income. First, gather all relevant income documentation, including profit and loss statements. Next, complete the form by inputting your net earnings from self-employment. You will also need to calculate the self-employment tax based on your earnings. The form includes specific sections that guide you through these calculations. Finally, attach the completed Schedule SE to your Form 1040 before submitting it to the IRS.

Steps to complete the Schedule SE Form

Completing the Schedule SE Form requires careful attention to detail. Follow these steps:

- Gather your income information, including all sources of self-employment income.

- Calculate your net earnings by subtracting any allowable business expenses from your total income.

- Fill out the required sections of the Schedule SE, including your net earnings and any adjustments.

- Use the provided tax rate tables to determine your self-employment tax based on your net earnings.

- Review the form for accuracy and completeness before attaching it to your Form 1040.

Legal use of the Schedule SE Form

The Schedule SE Form is legally recognized as a valid document for reporting self-employment income and calculating self-employment tax. To ensure its legal standing, it must be completed accurately and submitted on time. Compliance with IRS regulations is essential, as failure to file or inaccuracies can lead to penalties. The form must be signed and dated, affirming that the information provided is true and correct to the best of your knowledge.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule SE Form align with the annual tax return due date. Typically, individual tax returns, including Schedule SE, are due by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to filing dates, as late submissions can result in penalties and interest on unpaid taxes. Taxpayers are encouraged to file early to avoid last-minute complications.

Examples of using the Schedule SE Form

There are various scenarios in which individuals may need to use the Schedule SE Form. Common examples include:

- Freelancers providing services such as graphic design or writing.

- Small business owners operating sole proprietorships.

- Independent contractors working in fields like construction or consulting.

- Individuals earning income from rental properties or side businesses.

Each of these situations requires accurate reporting of income and expenses to ensure proper tax calculation and compliance.

Quick guide on how to complete 2014 schedule se form

Effortlessly Complete Schedule Se Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly alternative to traditional printed and signed documents, enabling you to easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, adjust, and eSign your documents swiftly without any delays. Manage Schedule Se Form on any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The easiest method to modify and eSign Schedule Se Form without exerting yourself

- Find Schedule Se Form and click Get Form to initiate.

- Utilize the resources we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Choose how you prefer to submit your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign Schedule Se Form while ensuring effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 schedule se form

Create this form in 5 minutes!

How to create an eSignature for the 2014 schedule se form

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What is the Schedule Se Form and how does it work?

The Schedule Se Form is a tax form used by self-employed individuals to calculate and report their Social Security and Medicare taxes. With airSlate SignNow, you can easily complete and eSign your Schedule Se Form, ensuring a streamlined process that saves you time and minimizes errors. Our platform makes document management effortless, allowing you to focus on your business.

-

How can airSlate SignNow help me with my Schedule Se Form submissions?

airSlate SignNow provides a straightforward way to complete and submit your Schedule Se Form electronically. You can fill out the form, eSign it, and send it directly to your tax professional or the IRS, all from one convenient location. Our user-friendly interface ensures that every step is clear and efficient.

-

What are the pricing plans for using airSlate SignNow for the Schedule Se Form?

airSlate SignNow offers flexible pricing plans that accommodate various business needs, making it cost-effective for anyone needing to manage their Schedule Se Form. Depending on your requirements, you can choose a plan that fits your budget while still providing access to all essential features for document signing and management.

-

Are there any features specifically designed for the Schedule Se Form?

Yes, airSlate SignNow includes features tailored for handling the Schedule Se Form, such as automated templates and customizable fields, which allow you to pre-fill frequently used information. Additionally, our platform supports secure eSignatures, so you can confidently submit your tax forms without any worries about compliance.

-

Can I integrate airSlate SignNow with other tools to manage my Schedule Se Form?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, enhancing your workflow when dealing with the Schedule Se Form. Whether you are using accounting software or collaboration tools, our integration capabilities ensure your document management process is unified and efficient.

-

What benefits will I gain by using airSlate SignNow for my Schedule Se Form?

Using airSlate SignNow for your Schedule Se Form offers numerous benefits, including improved efficiency, time-saving capabilities, and enhanced security. You can easily track the progress of your forms and receive notifications once they are signed, making it easier to manage your tax obligations without stress.

-

Is airSlate SignNow secure for handling sensitive Schedule Se Form information?

Yes, airSlate SignNow prioritizes security, ensuring that your Schedule Se Form and all accompanying data are protected with state-of-the-art encryption. Our platform complies with industry standards for data protection, so you can confidently eSign and share your sensitive documents without concerns about unauthorized access.

Get more for Schedule Se Form

Find out other Schedule Se Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors