Irs Form 8867 2016

What is the IRS Form 8867

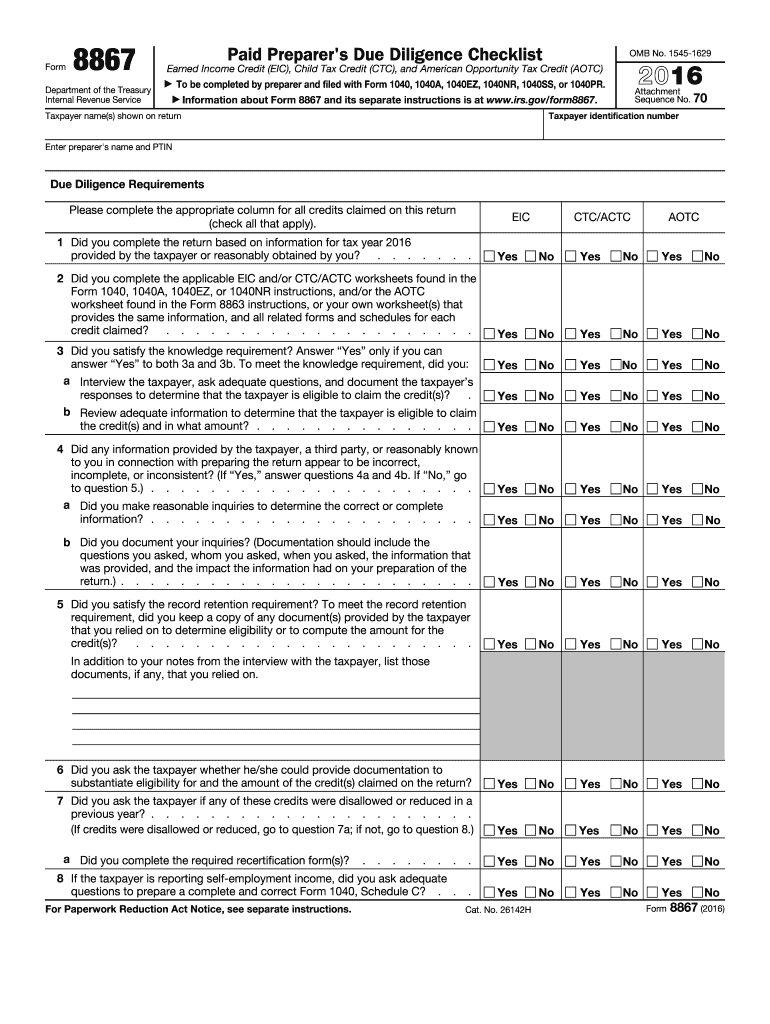

The IRS Form 8867, known as the Paid Preparer's Due Diligence Checklist, is a crucial document used by tax preparers to ensure they meet the due diligence requirements when preparing tax returns that claim certain tax benefits. This form is particularly relevant for tax credits such as the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), and American Opportunity Credit (AOC). By completing this form, tax preparers affirm that they have taken the necessary steps to verify the eligibility of their clients for these credits, thereby reducing the risk of errors and potential penalties.

How to use the IRS Form 8867

To use the IRS Form 8867 effectively, tax preparers should follow a systematic approach. First, they need to gather all relevant information from their clients, including income details, dependent information, and any other documentation that supports the claim for tax credits. Next, the preparer should complete the form by answering all questions accurately, ensuring that they have conducted the required due diligence. It is essential to retain copies of the form and any supporting documents for their records, as these may be requested by the IRS in case of an audit.

Steps to complete the IRS Form 8867

Completing the IRS Form 8867 involves several key steps:

- Gather all necessary client information, including income, dependents, and relevant tax documents.

- Review the eligibility criteria for the tax credits being claimed.

- Fill out the form by answering all questions, ensuring accuracy in each section.

- Sign and date the form, confirming that due diligence has been performed.

- Keep a copy of the completed form and all supporting documentation for your records.

Legal use of the IRS Form 8867

The legal use of the IRS Form 8867 is essential for tax preparers to comply with IRS regulations. By submitting this form, preparers confirm that they have exercised due diligence in verifying their clients' eligibility for tax credits. Failure to complete this form correctly can lead to penalties, including fines and disqualification from preparing tax returns. It is vital for preparers to stay informed about the latest IRS guidelines regarding the use of this form to ensure compliance and protect their clients' interests.

Filing Deadlines / Important Dates

Tax preparers should be aware of the filing deadlines associated with the IRS Form 8867. Typically, this form must be submitted along with the client's tax return by the tax filing deadline, which is usually April fifteenth for most taxpayers. However, if the taxpayer is granted an extension, the form must be filed by the extended deadline. It is important to keep track of these dates to avoid late penalties and ensure timely processing of tax returns.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the IRS Form 8867 can result in significant penalties for tax preparers. If a preparer fails to complete the form or does not exercise due diligence in verifying eligibility for tax credits, they may face penalties ranging from $500 to $1,000 per violation. Additionally, repeated failures can lead to the loss of the ability to prepare tax returns. Therefore, it is crucial for preparers to understand the importance of this form and adhere to IRS regulations.

Quick guide on how to complete irs form 8867 2016

Prepare Irs Form 8867 effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary format and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents rapidly and without hassle. Handle Irs Form 8867 on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest method to alter and eSign Irs Form 8867 with ease

- Find Irs Form 8867 and click on Get Form to commence.

- Utilize the features we offer to complete your document.

- Select important sections of your documents or redact sensitive information using tools that airSlate SignNow provides for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or a sharing link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your device of choice. Edit and eSign Irs Form 8867 and guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 8867 2016

Create this form in 5 minutes!

How to create an eSignature for the irs form 8867 2016

How to generate an electronic signature for the Irs Form 8867 2016 online

How to create an electronic signature for your Irs Form 8867 2016 in Google Chrome

How to make an electronic signature for signing the Irs Form 8867 2016 in Gmail

How to generate an eSignature for the Irs Form 8867 2016 from your smart phone

How to generate an eSignature for the Irs Form 8867 2016 on iOS

How to generate an eSignature for the Irs Form 8867 2016 on Android

People also ask

-

What is IRS Form 8867 and why is it important?

IRS Form 8867, also known as the Paid Preparer's Due Diligence Checklist, is a crucial document for tax preparers. It ensures that they follow the necessary due diligence when claiming certain tax benefits, like the Earned Income Tax Credit. Understanding IRS Form 8867 can help you avoid penalties and ensure compliance with IRS regulations.

-

How can airSlate SignNow assist with IRS Form 8867?

With airSlate SignNow, you can easily send and eSign IRS Form 8867, streamlining the process for both taxpayers and preparers. Our platform provides a secure and efficient way to manage documents, ensuring that all necessary forms are completed and signed promptly. This helps you maintain compliance and enhances your overall workflow.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8867?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans provide access to features that simplify the handling of IRS Form 8867 and other documents. You can choose a plan that fits your budget while benefiting from our easy-to-use platform.

-

What features does airSlate SignNow offer for managing IRS Form 8867?

airSlate SignNow features include customizable templates, secure cloud storage, and real-time tracking for IRS Form 8867. Additionally, our platform allows you to collaborate with clients easily, ensuring that all necessary information is included and signed accurately. These features enhance the efficiency of your document management process.

-

Can I integrate airSlate SignNow with other software for IRS Form 8867 processing?

Absolutely! airSlate SignNow integrates seamlessly with popular software applications, making it easier to process IRS Form 8867 alongside your existing tools. Whether you use accounting software or CRM systems, our integrations enable a smooth workflow and improved efficiency in managing tax documents.

-

How does airSlate SignNow ensure the security of IRS Form 8867?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and secure storage solutions to protect sensitive information, including IRS Form 8867. You can rest assured that your documents are safe, compliant, and accessible only to authorized users.

-

What are the benefits of using airSlate SignNow for IRS Form 8867?

Using airSlate SignNow for IRS Form 8867 offers numerous benefits, including increased efficiency, reduced paper usage, and faster turnaround times. Our intuitive platform allows for quick document preparation and signing, helping you meet deadlines and improve client satisfaction. Plus, you’ll save time and resources with our automated workflows.

Get more for Irs Form 8867

Find out other Irs Form 8867

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy