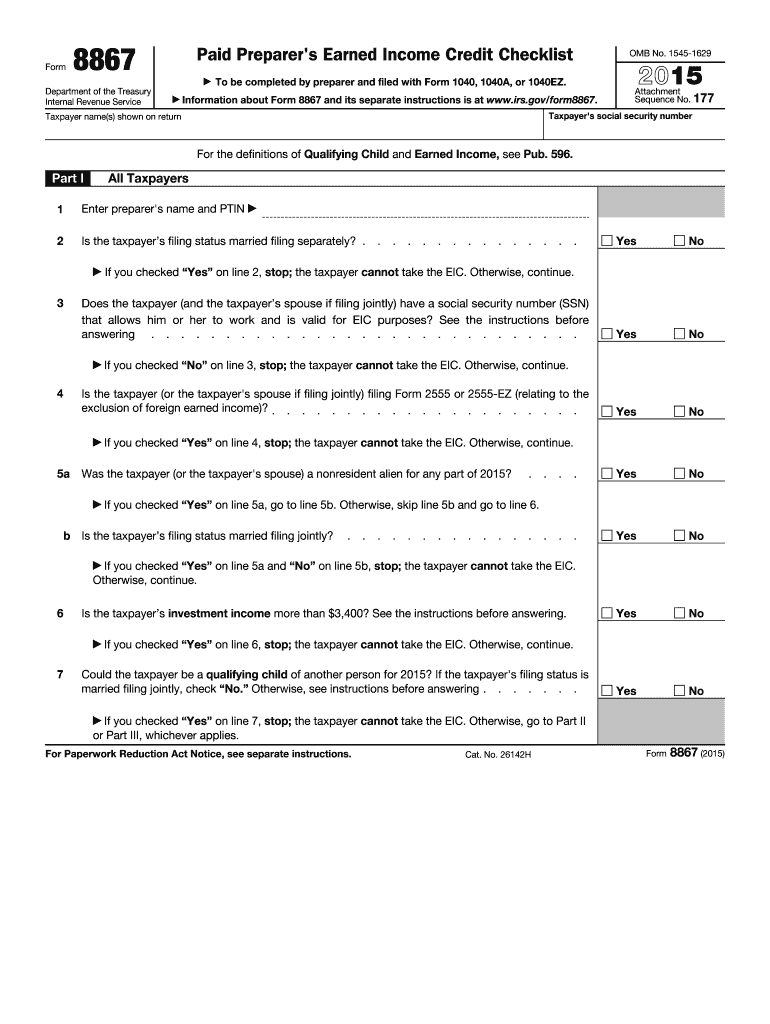

Form 8867 2015

What is the Form 8867

The Form 8867, also known as the Paid Preparer's Due Diligence Checklist, is a tax form used in the United States. It is primarily utilized by tax preparers to demonstrate due diligence in determining a taxpayer's eligibility for certain tax credits, such as the Earned Income Tax Credit (EITC). This form ensures that tax preparers have thoroughly assessed the taxpayer's qualifications and have collected the necessary documentation to support the claims made on the tax return.

How to use the Form 8867

Using the Form 8867 involves several steps. Tax preparers must complete the form each time they prepare a return claiming the EITC or other related credits. The form requires the preparer to answer specific questions regarding the taxpayer’s eligibility and to confirm that they have reviewed supporting documents. It is essential to provide accurate information and retain copies of the form and any related documentation for record-keeping purposes.

Steps to complete the Form 8867

Completing the Form 8867 requires careful attention to detail. Here are the steps involved:

- Gather all necessary information from the taxpayer, including income details and dependent information.

- Review the eligibility criteria for the EITC and other applicable credits.

- Complete the checklist on the form, ensuring that all questions are answered accurately.

- Sign and date the form, confirming that due diligence has been exercised.

- Attach the completed Form 8867 to the taxpayer's tax return before submission.

Legal use of the Form 8867

The legal use of the Form 8867 is crucial for compliance with IRS regulations. Tax preparers are required to complete this form to avoid penalties associated with improper claims for tax credits. The form serves as evidence that the preparer has met the due diligence requirements mandated by the IRS, ensuring that taxpayers receive the credits they are entitled to without fraud or misrepresentation.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8867 align with the annual tax filing season. Tax preparers should be aware of the following important dates:

- The standard tax filing deadline is typically April 15 each year.

- If a taxpayer files for an extension, the extended deadline is usually October 15.

- Preparers must ensure that the Form 8867 is submitted with the tax return by these deadlines to maintain compliance.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form 8867 can result in significant penalties for tax preparers. The IRS imposes fines for each instance of non-compliance, which can accumulate quickly. Additionally, preparers may face increased scrutiny in future filings and potential loss of their ability to prepare tax returns if found to be consistently negligent in their due diligence.

Quick guide on how to complete 2015 form 8867

Complete Form 8867 smoothly on any gadget

Online document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 8867 on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Form 8867 effortlessly

- Obtain Form 8867 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid files, laborious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Form 8867 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 8867

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 8867

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is Form 8867 and why is it important?

Form 8867 is the Paid Preparer's Due Diligence Checklist, which tax preparers must complete to ensure they meet the due diligence requirements for claiming certain tax credits. Using airSlate SignNow can simplify the process of preparing Form 8867, ensuring that you meet all necessary compliance standards while streamlining your workflow.

-

How can airSlate SignNow help me with Form 8867?

airSlate SignNow provides a user-friendly platform that allows you to easily create, send, and eSign Form 8867. With our document automation features, you can ensure accuracy and save time, helping you manage your tax paperwork efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 8867?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including features specifically designed for managing Form 8867. Our cost-effective solution ensures you can handle essential tax documents without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 8867?

airSlate SignNow includes features like customizable templates, secure eSigning, document tracking, and automated reminders, all tailored to assist you with Form 8867. These features enhance your efficiency and help maintain compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for Form 8867?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, making it easier for you to manage Form 8867 alongside your other financial documents. This integration streamlines your workflow and reduces the chances of errors.

-

What are the benefits of using airSlate SignNow for Form 8867?

Using airSlate SignNow for Form 8867 offers numerous benefits, including improved accuracy, enhanced productivity, and compliance with IRS regulations. Our platform helps you manage your documents efficiently, allowing you to focus on providing excellent service to your clients.

-

Is airSlate SignNow compliant with tax regulations regarding Form 8867?

Yes, airSlate SignNow is designed to help you comply with all necessary tax regulations, including those related to Form 8867. Our platform provides secure eSigning and tracking features that ensure your documents meet IRS standards.

Get more for Form 8867

- New source review forms for an air quality standard permit

- Msf 4201 rev 04 20 form

- Form 58s version 5

- Family members of eu eea or ch citizens shall not fill in fields no form

- Easement encroachment form

- Intent to rent form bc fill online printable fillable blank

- A former employees claim for income support payments

- D2049 injury or disease details sheet department of form

Find out other Form 8867

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate