8867 Form 2013

What is the 8867 Form

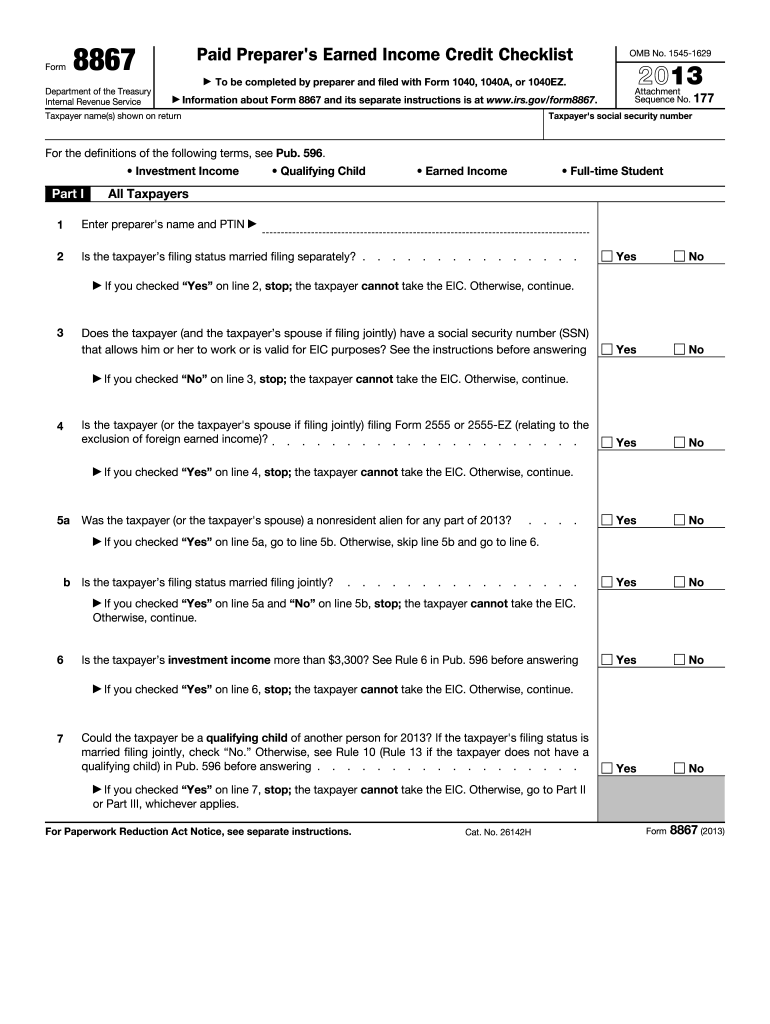

The 8867 Form, officially known as the Paid Preparer's Due Diligence Checklist, is a crucial document used in the U.S. tax system. It is primarily designed for tax preparers to ensure they meet the due diligence requirements when preparing tax returns that claim certain tax credits, such as the Earned Income Tax Credit (EITC). The form helps to confirm that the preparer has verified the eligibility of the taxpayer for these credits, thereby reducing the risk of errors and potential penalties.

How to use the 8867 Form

Using the 8867 Form involves a systematic approach to ensure compliance with IRS regulations. Tax preparers should complete the form as part of the tax return process when claiming applicable credits. The form requires detailed information about the taxpayer's eligibility, including income levels, filing status, and qualifying children. It is essential for preparers to carefully review the information provided by the taxpayer and document their due diligence efforts accurately on the form.

Steps to complete the 8867 Form

Completing the 8867 Form requires several steps to ensure accuracy and compliance. First, gather all necessary information from the taxpayer, including their income details and any relevant documentation regarding dependents. Next, fill out the form by answering each question thoroughly, ensuring that all eligibility criteria for the credits are met. After completing the form, review it for any errors or omissions before submitting it along with the tax return. Finally, retain a copy of the completed form for your records, as it may be required for future reference or audits.

Legal use of the 8867 Form

The legal use of the 8867 Form is governed by IRS regulations, which mandate that tax preparers must exercise due diligence when claiming certain tax credits. The form serves as a safeguard against fraudulent claims and ensures that preparers have verified the taxpayer's eligibility. Failure to complete the form accurately can result in penalties for both the preparer and the taxpayer. Therefore, understanding the legal implications of the 8867 Form is essential for maintaining compliance with tax laws.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 8867 Form. These guidelines outline the necessary steps for tax preparers to follow to ensure they meet due diligence requirements. It is important for preparers to stay updated on any changes to these guidelines, as they can affect the way the form is completed and submitted. The IRS also emphasizes the importance of maintaining thorough records to support the information provided on the form, which can be crucial in case of audits or inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the 8867 Form align with the overall tax return deadlines. Tax preparers must ensure that the form is submitted along with the tax return by the due date, which is typically April 15 for individual tax returns. In cases where an extension is filed, the form must still be completed and submitted by the extended deadline. Being aware of these important dates helps tax preparers avoid penalties and ensures compliance with IRS requirements.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the 8867 Form can result in significant penalties for tax preparers. The IRS imposes fines for failing to exercise due diligence when claiming tax credits, which can amount to hundreds of dollars per violation. Additionally, if a taxpayer's claim is found to be fraudulent or erroneous, both the preparer and the taxpayer may face further legal consequences. Understanding these penalties underscores the importance of accurately completing and submitting the 8867 Form.

Quick guide on how to complete 2013 8867 form

Complete 8867 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the proper form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage 8867 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign 8867 Form seamlessly

- Obtain 8867 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and select the Done button to save your changes.

- Decide how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your requirements in document management with just a few clicks from your preferred device. Modify and eSign 8867 Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 8867 form

Create this form in 5 minutes!

How to create an eSignature for the 2013 8867 form

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is the 8867 Form and why is it important?

The 8867 Form is a critical document used by tax preparers to ensure compliance with the Earned Income Tax Credit (EITC) eligibility requirements. It helps verify that clients qualify for the EITC, which can signNowly impact their tax returns. Using airSlate SignNow to eSign the 8867 Form streamlines the process, making it easier for both tax preparers and clients.

-

How can I use airSlate SignNow for the 8867 Form?

With airSlate SignNow, you can easily upload, fill out, and eSign the 8867 Form. Our platform provides a user-friendly interface that allows you to manage multiple documents efficiently. This eliminates the hassle of printing and scanning, saving you time and resources.

-

Is there a cost associated with using airSlate SignNow for the 8867 Form?

Yes, airSlate SignNow offers flexible pricing plans tailored to fit various business needs. Our competitive pricing allows you to access features that streamline the signing process for documents like the 8867 Form. Explore our plans to find the one that best suits your requirements.

-

What features does airSlate SignNow offer for managing the 8867 Form?

airSlate SignNow provides numerous features for managing the 8867 Form, including templates, customizable fields, and automated reminders. You can also track document status in real-time, ensuring that you never miss a deadline. These features enhance the efficiency of your document workflows.

-

Can I integrate airSlate SignNow with other software for the 8867 Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, such as CRMs and accounting software, to simplify the process of handling the 8867 Form. This integration allows for streamlined data transfer and improved collaboration between teams.

-

What are the benefits of using airSlate SignNow for the 8867 Form?

Using airSlate SignNow for the 8867 Form offers several benefits, including enhanced security, reduced turnaround time, and improved client satisfaction. The eSigning process is quick and legally binding, which helps maintain compliance while providing a better experience for your clients.

-

Is airSlate SignNow compliant with regulations for the 8867 Form?

Yes, airSlate SignNow is fully compliant with the necessary regulations for electronic signatures, ensuring that your 8867 Form is legally recognized. Our platform adheres to industry standards for security and privacy, giving you peace of mind while handling sensitive tax documents.

Get more for 8867 Form

- Access to information and privacy information about

- Loi sur limmigration et la protection des rfugis laws form

- 2019 form canada imm 5257 e fill online printable fillable

- Use of representative form

- Httpsapi15ilovepdfcomv1download pinterest form

- Under the provisions of the british columbia name act form

- Form detail service canada forms

- Pdf 1 appellant i am please select only one an canadaca form

Find out other 8867 Form

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship