Form 8867 Guide 2023US Expat Tax Service 2023

What is Form 8867?

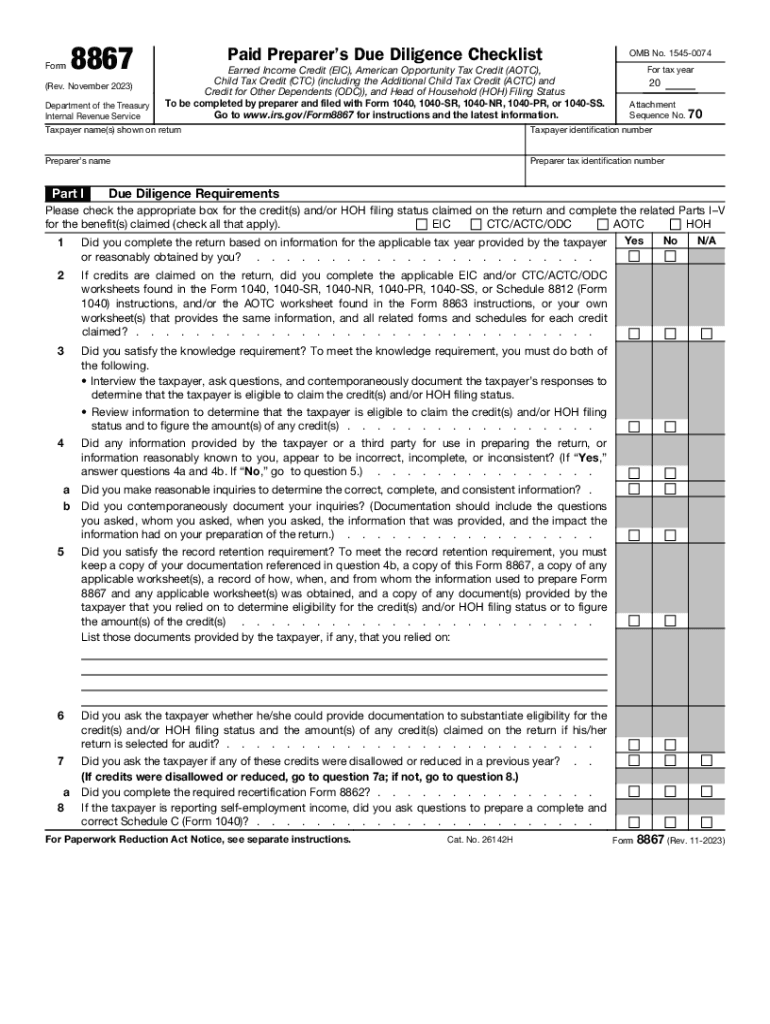

Form 8867, also known as the Paid Preparer's Due Diligence Checklist, is a crucial document for tax preparers in the United States. This form is specifically designed to ensure that tax preparers meet the due diligence requirements when claiming the Earned Income Credit (EIC) and other related tax benefits. The 8867 form helps to verify the eligibility of taxpayers for these credits, promoting compliance with IRS regulations. It is essential for preparers to understand the importance of this form to avoid penalties and ensure accurate filings.

Steps to Complete Form 8867

Completing Form 8867 involves several steps that tax preparers must follow to ensure compliance with IRS guidelines. The process begins with gathering necessary information from the taxpayer, including their income, filing status, and qualifying children. Next, preparers must fill out the form by answering specific questions related to the taxpayer's eligibility for the EIC. Each section of the form must be completed accurately, as any errors can lead to delays or penalties. Finally, the completed form should be submitted along with the taxpayer's return, ensuring that all required documentation is attached.

Key Elements of Form 8867

Form 8867 contains several key elements that tax preparers must be aware of. These include the taxpayer's information, a checklist of due diligence questions, and the preparer's signature. The checklist is particularly important as it guides preparers through the necessary steps to confirm eligibility for the EIC. Additionally, the form requires preparers to document their findings and any relevant information that supports the taxpayer's claims. Understanding these elements is vital for ensuring that the form is completed correctly and in compliance with IRS requirements.

IRS Guidelines for Form 8867

The IRS provides specific guidelines for the use of Form 8867, which tax preparers must adhere to. These guidelines outline the due diligence requirements that preparers must follow when assisting clients in claiming the EIC. Preparers are expected to ask relevant questions, review documentation, and maintain records that support the claims made on the tax return. Failure to comply with these guidelines can result in significant penalties, making it essential for preparers to stay informed about any updates or changes in IRS regulations regarding Form 8867.

Eligibility Criteria for EIC

To successfully complete Form 8867, tax preparers must understand the eligibility criteria for the Earned Income Credit. This credit is available to low-to-moderate-income working individuals and families, and specific requirements must be met. These include having earned income, meeting certain income thresholds, and having qualifying children who meet age, relationship, and residency tests. Preparers must ensure that their clients meet these criteria to claim the EIC, as improper claims can lead to audits and penalties.

Penalties for Non-Compliance

Tax preparers who fail to comply with the requirements of Form 8867 may face significant penalties imposed by the IRS. These penalties can include fines for each failure to meet due diligence requirements, which can accumulate quickly, especially if multiple clients are affected. Additionally, preparers may risk losing their ability to file tax returns on behalf of clients if they repeatedly fail to adhere to IRS guidelines. Understanding these penalties underscores the importance of thoroughness and accuracy when completing Form 8867.

Quick guide on how to complete form 8867 guide 2023us expat tax service

Complete Form 8867 Guide 2023US Expat Tax Service effortlessly on any device

Web-based document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without any holdups. Manage Form 8867 Guide 2023US Expat Tax Service on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to update and eSign Form 8867 Guide 2023US Expat Tax Service with ease

- Find Form 8867 Guide 2023US Expat Tax Service and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to submit your form, by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8867 Guide 2023US Expat Tax Service and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8867 guide 2023us expat tax service

Create this form in 5 minutes!

How to create an eSignature for the form 8867 guide 2023us expat tax service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 8867 en espanol form?

The 8867 en espanol form, known as the Paid Preparer's Due Diligence Checklist, is crucial for tax professionals in ensuring compliance with IRS requirements. It helps verify eligibility for tax credits, safeguarding both the taxpayer and the preparer. Using this form can prevent costly errors and enhance the accuracy of tax filings.

-

How can airSlate SignNow assist with the 8867 en espanol process?

airSlate SignNow streamlines the signing process for the 8867 en espanol form, making it accessible and efficient. With features like templates and cloud storage, you can easily manage eSigned documents. This solution reduces delays and enhances your workflow, allowing tax preparers to focus on their clients.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet different business needs, starting with a free trial for new users. Each plan includes essential features for handling forms like 8867 en espanol efficiently. Businesses can choose the level of service that aligns with their requirements, maximizing value at a competitive price.

-

What features does airSlate SignNow offer for document management?

With airSlate SignNow, you can access features such as custom templates, eSignature tracking, and secure cloud storage. These tools help you manage your documents, including the 8867 en espanol form, seamlessly. The platform ensures that your documents are stored securely while remaining accessible from anywhere.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow integrates with various software solutions, enabling a cohesive workflow for your business. You can connect it with CRM systems, accounting software, and more, enhancing the functionality required for managing documents like the 8867 en espanol form. This integration facilitates better data sharing and reduces manual entry.

-

What are the benefits of using airSlate SignNow for the 8867 en espanol form?

Using airSlate SignNow for the 8867 en espanol form provides several advantages, including enhanced compliance, quicker turnaround times, and improved document security. The platform ensures that you adhere to IRS guidelines while also fostering collaboration with clients and colleagues. Ultimately, it streamlines your tax preparation process.

-

Is airSlate SignNow user-friendly for beginners?

Absolutely! airSlate SignNow is designed with an intuitive interface, making it easy for beginners to navigate. Whether you're filling out the 8867 en espanol form or managing other documents, the platform’s user-friendly design ensures a smooth experience without extensive training.

Get more for Form 8867 Guide 2023US Expat Tax Service

- Property at your death form

- I may make a new will and this revocation is not intended to revoke any will i may make in the form

- Was gift split with spouse form

- Location of cemetery form

- With the terms of the will and laws of the state of texas in reference to the procedures and form

- If you need a copy of this sub lease for your records please make a copy form

- Entertainment services contract form

- Iou form template debt acknowledgementiou i the

Find out other Form 8867 Guide 2023US Expat Tax Service

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template