Form 8867 Internal Revenue Service 2011

What is the Form 8867 Internal Revenue Service

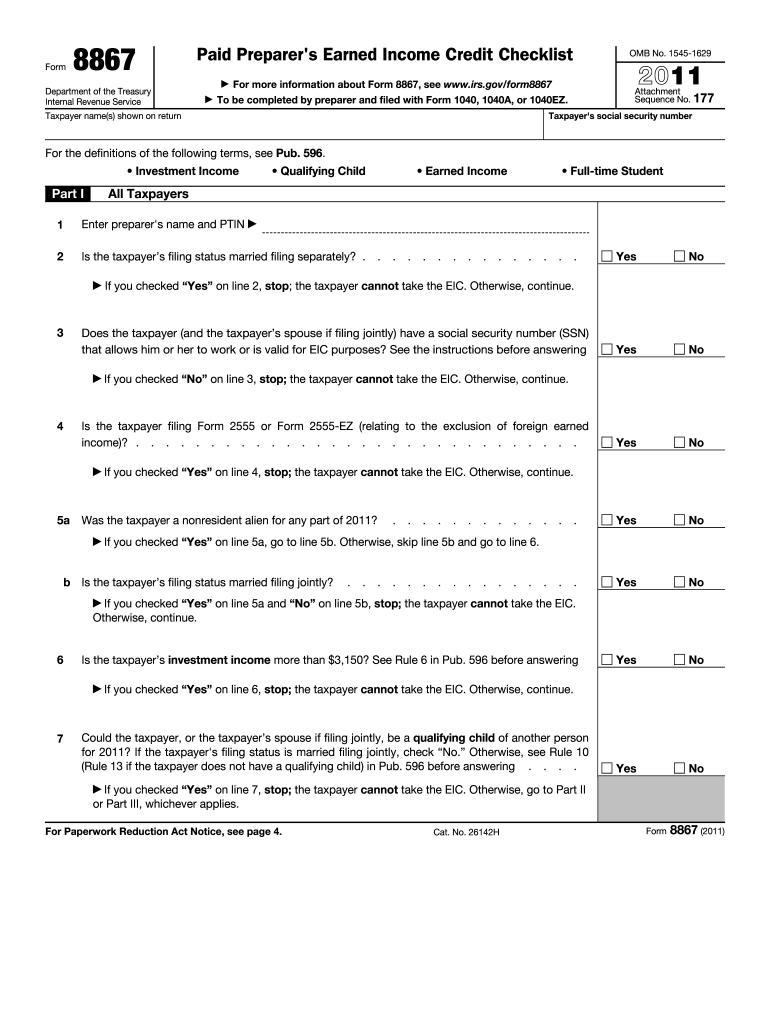

The Form 8867, also known as the Paid Preparer's Due Diligence Checklist, is a document required by the Internal Revenue Service (IRS) for tax preparers who assist clients in claiming certain tax credits. This form is specifically designed to ensure that tax preparers meet their due diligence requirements when preparing returns that claim the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), American Opportunity Tax Credit (AOTC), and the Head of Household filing status. The form serves as a checklist to help preparers gather the necessary information and documentation to support these claims.

How to use the Form 8867 Internal Revenue Service

To effectively use the Form 8867, tax preparers should follow a systematic approach. First, they need to review the eligibility criteria for each tax credit being claimed. Next, the preparer should gather relevant documentation from the taxpayer, such as income statements, Social Security numbers, and proof of residency. After collecting the necessary information, the preparer can complete the form by answering specific questions that verify compliance with IRS due diligence requirements. Finally, the completed Form 8867 must be attached to the taxpayer's return when filed.

Steps to complete the Form 8867 Internal Revenue Service

Completing the Form 8867 involves several key steps:

- Review the eligibility criteria for the tax credits being claimed.

- Gather required documentation from the taxpayer, including income verification and identification.

- Answer the questions on the form accurately, ensuring all information is complete and truthful.

- Attach the completed Form 8867 to the taxpayer's return before submission.

- Keep a copy of the form and supporting documents for record-keeping and compliance purposes.

Legal use of the Form 8867 Internal Revenue Service

The legal use of Form 8867 is crucial for tax preparers to avoid penalties associated with the improper claiming of tax credits. By completing and submitting this form, preparers demonstrate their compliance with IRS regulations regarding due diligence. Failure to properly complete the form or to maintain adequate documentation can result in significant penalties, including the loss of the ability to claim certain credits for clients. Therefore, understanding the legal implications and requirements of the form is essential for tax professionals.

Filing Deadlines / Important Dates

Filing deadlines for Form 8867 align with the due dates for the tax returns it accompanies. Typically, individual tax returns are due on April 15 of each year, unless an extension is filed. Preparers should ensure that Form 8867 is completed and submitted with the tax return by this deadline to avoid penalties. Additionally, it is important to stay informed about any changes in IRS deadlines or regulations that may affect the filing of this form.

Penalties for Non-Compliance

Tax preparers who fail to comply with the requirements associated with Form 8867 may face various penalties. The IRS imposes fines for each failure to meet due diligence requirements when claiming tax credits. These penalties can accumulate quickly, especially if multiple clients are affected. Furthermore, repeated non-compliance may lead to more severe consequences, such as increased scrutiny from the IRS or loss of the ability to prepare tax returns. Maintaining thorough records and adhering to the guidelines outlined in the form is essential to mitigate these risks.

Quick guide on how to complete form 8867 internal revenue service

Complete Form 8867 Internal Revenue Service effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Form 8867 Internal Revenue Service on any platform with airSlate SignNow Android or iOS applications and streamline any document-centered task today.

The easiest way to modify and eSign Form 8867 Internal Revenue Service with ease

- Find Form 8867 Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your PC.

Say goodbye to missing or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 8867 Internal Revenue Service and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8867 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 8867 internal revenue service

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is Form 8867 and why is it important for taxpayers?

Form 8867, as mandated by the Internal Revenue Service, is a critical document for taxpayers claiming the Earned Income Tax Credit (EITC). It ensures that the taxpayer meets all necessary requirements, preventing any errors that could lead to audits or penalties. Completing Form 8867 accurately can signNowly influence your tax benefits.

-

How can airSlate SignNow help with completing Form 8867?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing and submitting Form 8867 for the Internal Revenue Service. With our eSignature capabilities, you can easily gather required signatures and share the completed form securely. This streamlines your workflow, ensuring compliance with IRS regulations.

-

Is airSlate SignNow suitable for businesses that frequently handle Form 8867?

Absolutely, airSlate SignNow is designed for businesses that manage documentation like Form 8867 for the Internal Revenue Service regularly. Our platform provides templates and automation features that enhance efficiency, making it easy to duplicate and customize forms as needed.

-

What features does airSlate SignNow provide for managing Form 8867?

With airSlate SignNow, you get features like template creation, document tracking, and secure cloud storage to manage Form 8867 efficiently. These features not only optimize your workflow but also ensure that all documents remain compliant with Internal Revenue Service requirements, providing peace of mind.

-

How does airSlate SignNow ensure the security of Form 8867 submissions?

Security is paramount at airSlate SignNow. When you submit Form 8867, our platform utilizes strong encryption protocols and ensures that all data shared is compliant with Internal Revenue Service standards. This guarantees that sensitive taxpayer information remains confidential and secure.

-

What pricing options are available for using airSlate SignNow for Form 8867?

airSlate SignNow offers competitive pricing plans tailored to meet various business needs. Depending on your volume of usage for documents like Form 8867 in relation to the Internal Revenue Service, you can choose from basic to premium plans to ensure you get the best value for your needs.

-

Does airSlate SignNow integrate with other financial software for Form 8867 processing?

Yes, airSlate SignNow seamlessly integrates with a variety of financial and tax preparation software, making the processing of Form 8867 more efficient. These integrations facilitate easy data transfer, reducing the chances of errors and ensuring that your compliance with Internal Revenue Service requirements is streamlined.

Get more for Form 8867 Internal Revenue Service

- Janina fisher and chart form

- Printable non hazardous waste manifest form

- Equipment service report form

- Moving estimate form pdf

- Ps form 8141

- Can i apply for an extension to file my return alabama form

- Underpayment of estimated tax by individuals penalty form

- Il 1040 x instructions illinois department of revenue form

Find out other Form 8867 Internal Revenue Service

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship