Form 1040 NR Irs Gov 2022

What is the Form 1040 NR?

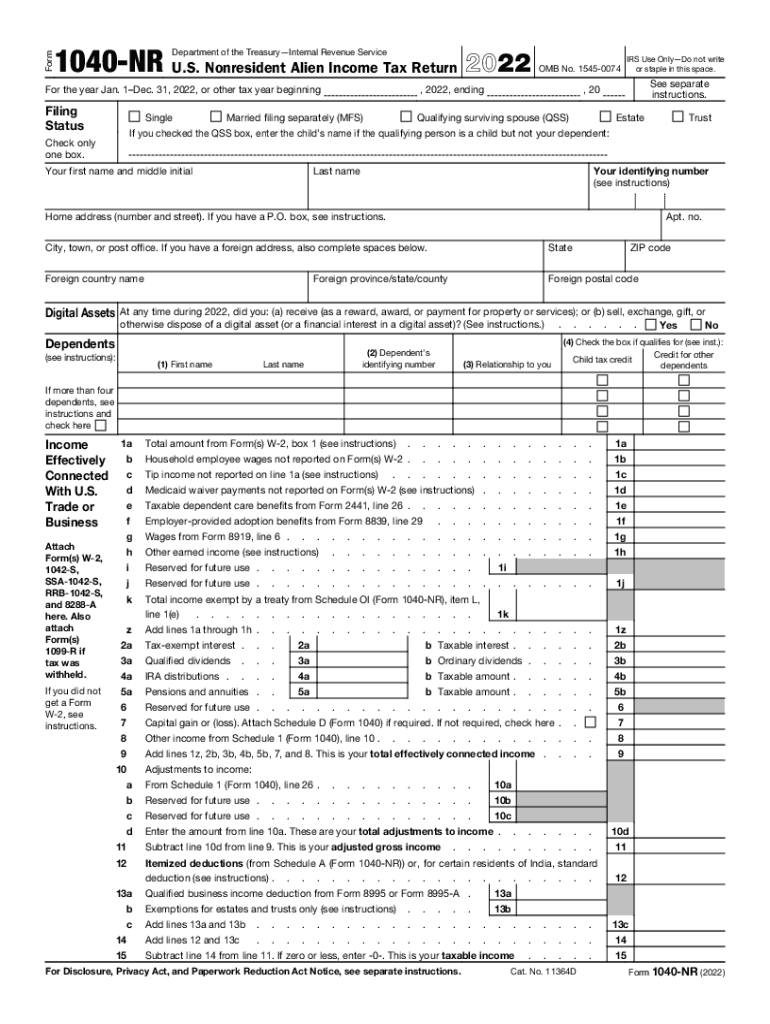

The Form 1040 NR, or nonresident alien income tax return, is a tax form used by individuals who are not U.S. citizens or residents but have income sourced in the United States. This form is essential for reporting income, claiming deductions, and determining tax liability for nonresident aliens. The IRS requires this form to ensure that nonresidents comply with U.S. tax laws, even if they do not reside in the country. Understanding the purpose and requirements of the Form 1040 NR is crucial for accurate tax reporting.

Steps to Complete the Form 1040 NR

Completing the Form 1040 NR involves several steps that ensure accurate reporting of income and deductions. Here are the key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status and eligibility for deductions based on your specific circumstances.

- Fill out the form, providing personal information, income details, and applicable deductions.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal Use of the Form 1040 NR

The Form 1040 NR is legally binding when completed correctly and submitted to the IRS. It is vital for nonresident aliens to understand that providing false information can lead to severe penalties, including fines and legal repercussions. The form must be filed in accordance with IRS guidelines to ensure compliance with U.S. tax laws. Additionally, using a reliable eSignature solution can enhance the legal standing of the document, ensuring it meets all necessary requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 NR are crucial for nonresident aliens to avoid penalties. Typically, the deadline is April 15 for those who received income in the previous calendar year. However, if you are a nonresident alien living outside the U.S., you may qualify for an automatic two-month extension, making the deadline June 15. It is important to stay informed about these dates, as late filings can incur additional fees and interest on unpaid taxes.

Required Documents

To complete the Form 1040 NR accurately, several documents are necessary. These include:

- Income statements such as W-2s and 1099s.

- Proof of residency status, if applicable.

- Documentation for any deductions or credits claimed.

- Identification information, including your ITIN or SSN.

Having these documents ready will streamline the filing process and help ensure compliance with IRS regulations.

Form Submission Methods

The Form 1040 NR can be submitted in several ways, providing flexibility for nonresident aliens. Options include:

- Electronic filing through IRS-approved software, which can expedite processing.

- Mailing a paper copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, although this option may be limited.

Choosing the right submission method can impact processing times and overall convenience.

Quick guide on how to complete 2022 form 1040 nr irsgov

Effortlessly prepare Form 1040 NR Irs gov on any device

The management of online documents has become increasingly popular among both businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Form 1040 NR Irs gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Form 1040 NR Irs gov with ease

- Locate Form 1040 NR Irs gov and click Get Form to initiate.

- Use the tools we offer to complete your document.

- Select pertinent sections of the documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only a few seconds and carries the same legal validity as a traditional ink signature.

- Review all information and then click the Done button to save your modifications.

- Decide how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Alter and eSign Form 1040 NR Irs gov while ensuring exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 1040 nr irsgov

Create this form in 5 minutes!

People also ask

-

What is a nonresident return and why do I need it?

A nonresident return is a tax form that individuals must file if they earn income in a state where they do not reside. Understanding the requirements for your nonresident return is crucial to ensure compliance with tax laws. airSlate SignNow can help streamline the process by facilitating the eSigning of essential documents related to your nonresident return.

-

How can airSlate SignNow assist with preparing my nonresident return?

airSlate SignNow provides an intuitive platform for managing documents and eSigning them quickly, which is essential for preparing your nonresident return. The tool allows you to upload and share necessary tax forms securely. With airSlate SignNow, you can efficiently collaborate with tax professionals to ensure your nonresident return is accurately filed.

-

What are the pricing options for using airSlate SignNow for my nonresident return?

airSlate SignNow offers various pricing plans that cater to both individuals and businesses needing assistance with their nonresident return. Each plan provides access to essential features like unlimited eSigning and document templates. Choosing the right pricing tier can help you maximize the benefits while efficiently managing your nonresident return.

-

Does airSlate SignNow integrate with tax preparation software for nonresident returns?

Yes, airSlate SignNow integrates seamlessly with several tax preparation software platforms, making it easier to manage your nonresident return. These integrations allow you to import your tax documents directly into SignNow for efficient eSigning and sharing. This connectivity enhances your overall tax preparation process for nonresident returns.

-

What are the benefits of using airSlate SignNow for my nonresident return?

Using airSlate SignNow for your nonresident return provides several advantages, including streamlined document management, secure eSigning, and reduced processing time. The platform is designed to simplify the complexities of tax documentation, ensuring that your nonresident return is handled with precision. Plus, its cost-effective nature makes it accessible for everyone.

-

How does airSlate SignNow ensure the security of my nonresident return documents?

airSlate SignNow prioritizes the security of your documents, including your nonresident return, with advanced encryption and robust data protection measures. All documents are stored securely in the cloud, ensuring that your sensitive information remains confidential. Trusting airSlate SignNow means you can confidently manage your nonresident return without worrying about data bsignNowes.

-

Can I use airSlate SignNow on my mobile device for my nonresident return?

Absolutely! airSlate SignNow offers a mobile application that allows you to manage and eSign documents related to your nonresident return on-the-go. This flexibility means that no matter where you are, you can easily access your documents, complete your nonresident return, and stay on top of your tax obligations.

Get more for Form 1040 NR Irs gov

- Landscaping contractor package kentucky form

- Commercial contractor package kentucky form

- Excavation contractor package kentucky form

- Renovation contractor package kentucky form

- Concrete mason contractor package kentucky form

- Demolition contractor package kentucky form

- Security contractor package kentucky form

- Insulation contractor package kentucky form

Find out other Form 1040 NR Irs gov

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now