Form 1040 Nr 2014

What is the Form 1040 NR

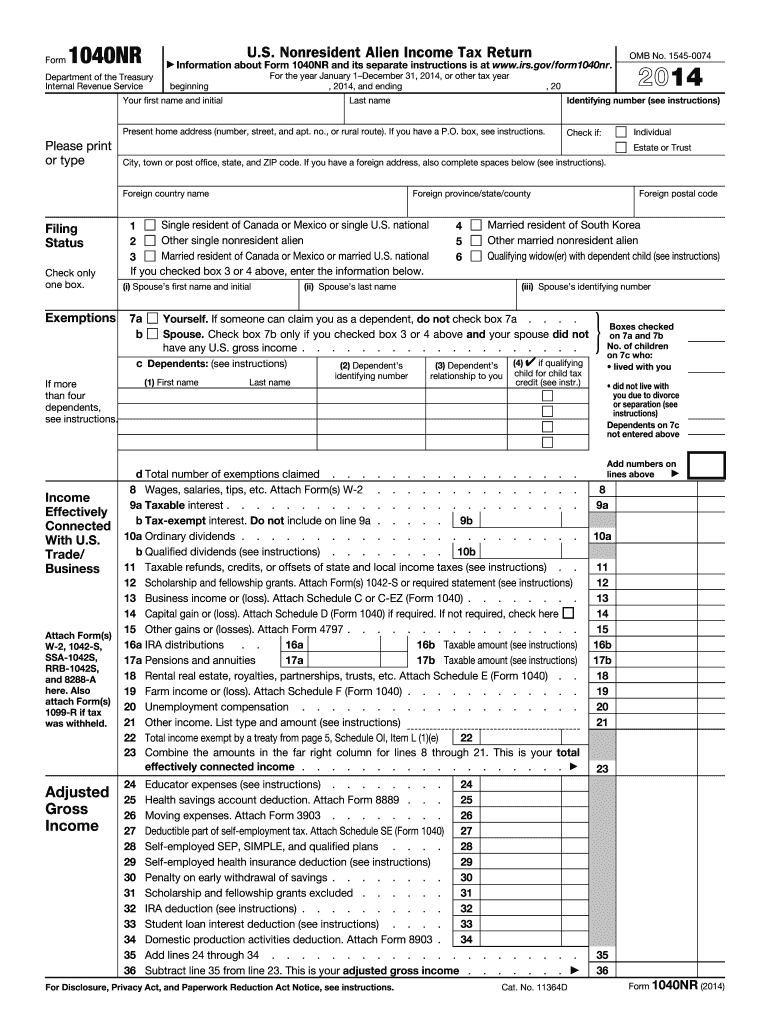

The Form 1040 NR is a U.S. tax return specifically designed for non-resident aliens. This form allows individuals who do not meet the criteria for residency to report their income effectively. Non-resident aliens may include foreign students, scholars, or individuals working temporarily in the United States. The form is essential for ensuring compliance with U.S. tax laws while accurately reflecting the income earned within the country.

How to use the Form 1040 NR

Using the Form 1040 NR involves several steps to ensure proper completion and submission. First, gather all necessary documentation, including income statements and any relevant tax forms. Next, carefully fill out the form, providing accurate information regarding your income, deductions, and credits. It is crucial to follow the IRS instructions closely to avoid errors. Once completed, the form can be submitted electronically or via mail, depending on your preference and eligibility.

Steps to complete the Form 1040 NR

Completing the Form 1040 NR requires attention to detail. Here are the key steps:

- Gather necessary documents, including W-2s and 1099s.

- Fill out personal information, including your name, address, and taxpayer identification number.

- Report your income in the designated sections, ensuring all figures are accurate.

- Claim any applicable deductions and credits to reduce your taxable income.

- Review the completed form for accuracy before submission.

Legal use of the Form 1040 NR

The Form 1040 NR must be used in compliance with U.S. tax regulations. It is legally binding when filled out correctly and submitted on time. Non-resident aliens are required to file this form if they have U.S.-sourced income or if they meet specific filing criteria. Adhering to IRS guidelines ensures that the form is recognized as valid for tax purposes, and failure to comply may result in penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 NR are critical to avoid penalties. Typically, the deadline for submitting this form is April 15 for the previous tax year. However, if you are a non-resident alien living outside the United States, you may qualify for an automatic extension until June 15. It is essential to check for any updates or changes to these deadlines each tax year to ensure timely submission.

Required Documents

To complete the Form 1040 NR, certain documents are necessary. These include:

- W-2 forms from employers, detailing wages earned.

- 1099 forms for other income sources, such as freelance work.

- Any relevant tax treaties that may affect your tax obligations.

- Identification documents, including your passport and taxpayer identification number.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040 NR can be submitted through various methods. Non-resident aliens may file electronically using IRS-approved software or services. Alternatively, the form can be mailed to the appropriate IRS address based on your location. In-person submission is generally not available for this form, making electronic filing or mail the primary options for compliance.

Quick guide on how to complete form 1040 nr 2014

Effortlessly Prepare Form 1040 Nr on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, alter, and electronically sign your documents promptly without delays. Manage Form 1040 Nr on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign Form 1040 Nr without hassle

- Locate Form 1040 Nr and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Form 1040 Nr and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 nr 2014

Create this form in 5 minutes!

How to create an eSignature for the form 1040 nr 2014

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is the Form 1040 Nr, and who needs it?

The Form 1040 Nr is specifically designed for non-resident aliens who are required to file taxes in the United States. If you are a foreign national earning income in the U.S., you will need to complete this form to report your income and calculate any taxes owed. Using airSlate SignNow, you can easily eSign and submit your Form 1040 Nr securely.

-

How can airSlate SignNow help with filing the Form 1040 Nr?

airSlate SignNow offers a user-friendly platform that allows you to eSign your Form 1040 Nr quickly and securely. Our service ensures that your documents are legally binding and compliant, making it easier for you to manage your tax filings. With our intuitive interface, you can complete and send your Form 1040 Nr without any hassle.

-

What are the pricing plans for using airSlate SignNow for Form 1040 Nr?

airSlate SignNow offers flexible pricing plans tailored for individuals and businesses looking to manage documents like the Form 1040 Nr. You can choose from a variety of options to find the one that best fits your needs, ensuring you only pay for the features you use. Check our website for the latest pricing information and special offers.

-

Is airSlate SignNow compliant with tax regulations for the Form 1040 Nr?

Yes, airSlate SignNow complies with all relevant tax regulations, ensuring that your Form 1040 Nr is processed securely and effectively. We use advanced security measures to protect your sensitive information while providing a legally valid eSignature solution for your tax documents. Trust us to help you file your Form 1040 Nr with confidence.

-

Can I integrate airSlate SignNow with other tax software for Form 1040 Nr?

Absolutely! airSlate SignNow easily integrates with various tax software solutions, enabling you to streamline your filing process for the Form 1040 Nr. This integration allows you to import and export documents seamlessly, making tax preparation more efficient and organized.

-

What features does airSlate SignNow offer for managing my Form 1040 Nr?

airSlate SignNow provides a range of features designed to simplify the management of your Form 1040 Nr, including customizable templates, automated workflows, and secure storage. With our platform, you can easily track the status of your documents and receive notifications when actions are required. Enjoy a hassle-free experience with all the tools you need at your fingertips.

-

How secure is my data when using airSlate SignNow for Form 1040 Nr?

Security is our top priority at airSlate SignNow, especially when handling sensitive documents like the Form 1040 Nr. We utilize robust encryption and secure cloud storage to protect your data from unauthorized access. Rest assured that your information is safe and compliant with industry standards.

Get more for Form 1040 Nr

- State of south carolina affidavit horry county form

- Supervised child visitation form tennessee

- In the chancery court for davidson county tennessee form

- State of south carolina in the family court eformscom

- Temporary tag template texas pdf form

- Fillable online childs consent to name change filed by form

- Return to harris county appraisal district p form

- Health care power of attorney form texas

Find out other Form 1040 Nr

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document