Form 1040 NR U S Nonresident Alien Income Tax Return 2023

What is the Form 1040 NR U S Nonresident Alien Income Tax Return

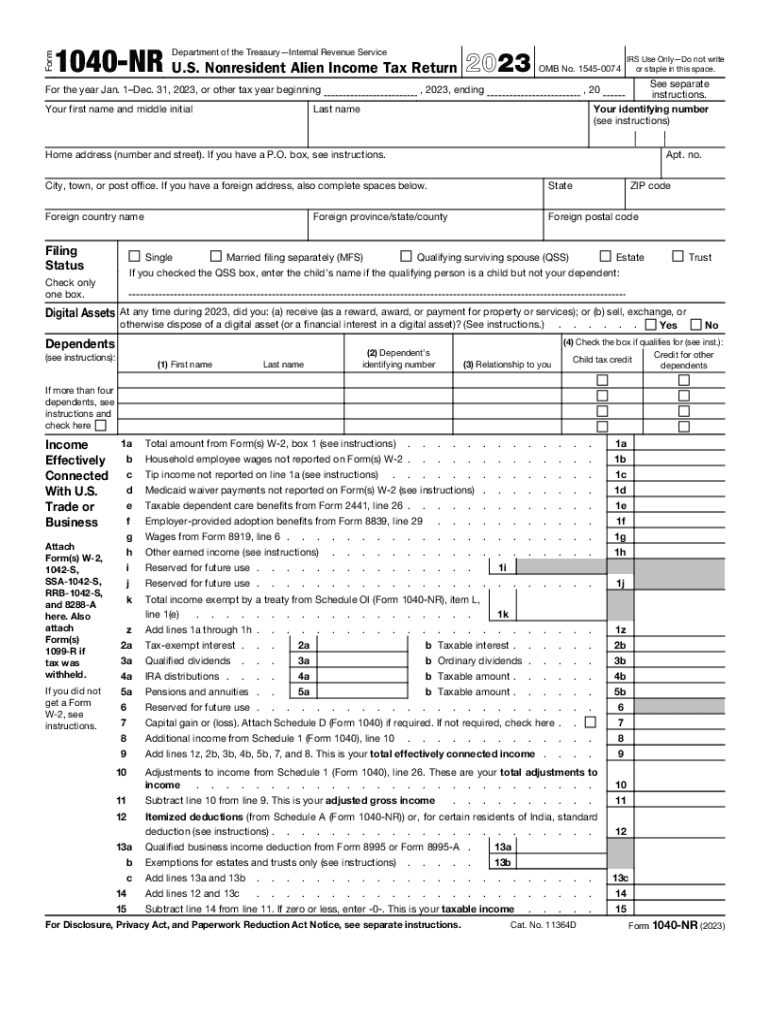

The Form 1040 NR is the U.S. Nonresident Alien Income Tax Return, designed for individuals who are not U.S. citizens or residents but have income from U.S. sources. This form allows nonresident aliens to report their income, claim deductions, and determine their tax liability. It is essential for those who have engaged in business activities, received wages, or earned investment income in the United States.

Steps to complete the Form 1040 NR U S Nonresident Alien Income Tax Return

Completing the Form 1040 NR involves several key steps:

- Gather necessary documentation, including income statements, tax identification numbers, and any relevant deductions.

- Fill out personal information, such as name, address, and filing status.

- Report all income earned in the U.S., including wages, dividends, and rental income.

- Claim any eligible deductions, such as state and local taxes or certain business expenses.

- Calculate the total tax liability based on the reported income and deductions.

- Sign and date the form before submission.

How to obtain the Form 1040 NR U S Nonresident Alien Income Tax Return

The Form 1040 NR can be obtained from the IRS website or by contacting the IRS directly. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, tax preparation software may offer the option to complete the form electronically, providing a more streamlined filing experience.

Filing Deadlines / Important Dates

For the tax year 2017, the deadline to file the Form 1040 NR is typically April 15 of the following year. However, if you are a nonresident alien and do not receive wages subject to U.S. income tax withholding, you may have until June 15 to file your return. It is crucial to be aware of these deadlines to avoid penalties and interest on unpaid taxes.

Required Documents

When filing the Form 1040 NR, several documents are necessary to ensure accurate reporting:

- Form W-2 from employers, if applicable.

- Form 1099 for other income sources, such as freelance work or interest income.

- Receipts for deductible expenses, including educational costs or business-related expenses.

- Any tax treaty documents that may apply to your situation.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1040 NR. These include instructions on how to report various types of income, claim deductions, and apply tax treaty benefits. It is important to refer to the IRS instructions for the 2017 tax year to ensure compliance with current tax laws and regulations.

Quick guide on how to complete form 1040 nr u s nonresident alien income tax return

Effortlessly Prepare Form 1040 NR U S Nonresident Alien Income Tax Return on Any Device

Managing documents online has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without hold-ups. Handle Form 1040 NR U S Nonresident Alien Income Tax Return on any device using the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The Easiest Way to Edit and Electronically Sign Form 1040 NR U S Nonresident Alien Income Tax Return Smoothly

- Obtain Form 1040 NR U S Nonresident Alien Income Tax Return and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form 1040 NR U S Nonresident Alien Income Tax Return to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 nr u s nonresident alien income tax return

Create this form in 5 minutes!

How to create an eSignature for the form 1040 nr u s nonresident alien income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the 1040nr instructions 2017?

The 1040nr instructions 2017 provide detailed guidance for non-resident aliens on how to correctly file their tax returns. Key features include information on income exempt from tax, deductions available, and how to report different types of income. Understanding these features can simplify the filing process and help avoid mistakes.

-

How can airSlate SignNow help with 1040nr instructions 2017?

AirSlate SignNow streamlines the process of sending and signing documents needed for the 1040nr instructions 2017. By using our platform, users can easily gather necessary signatures and have access to templates that comply with 2017 tax requirements. This efficiency can save time and reduce the stress of tax season.

-

What is the pricing structure for using airSlate SignNow with 1040nr instructions 2017?

AirSlate SignNow offers several pricing plans that cater to various needs, starting from a free trial to more comprehensive packages. Depending on your requirements for managing documents related to 1040nr instructions 2017, you can choose a plan that suits your business size and budget. This flexibility can help ensure you get the features you need without overspending.

-

Is it easy to integrate airSlate SignNow for 1040nr instructions 2017 documentation?

Yes, airSlate SignNow offers various integrations that make it easy to work with the documentation needed for 1040nr instructions 2017. Whether you're using accounting software or cloud storage solutions, our platform can seamlessly connect with these tools, streamlining your workflow. This integration enhances productivity and makes tax preparation less cumbersome.

-

How does airSlate SignNow ensure the security of documents related to 1040nr instructions 2017?

Security is a top priority for airSlate SignNow when handling documents related to 1040nr instructions 2017. We implement industry-standard encryption methods and secure storage to ensure your sensitive information is protected at all times. Additionally, our platform provides audit trails for tracking document access and revisions.

-

Can I access 1040nr instructions 2017 online through airSlate SignNow?

Absolutely! With airSlate SignNow, you can access the 1040nr instructions 2017 online, making it convenient for users to review and refer to the documents from anywhere. Our cloud-based platform ensures that all your documents are available on-demand, facilitating tax filing without the hassle of physical paperwork.

-

What support options are available for questions about 1040nr instructions 2017?

AirSlate SignNow offers various support options to assist with queries related to 1040nr instructions 2017. Users can access comprehensive resources such as FAQs, guides, and video tutorials, along with customer support teams available contact via chat or email. This robust support system ensures you’re never left without help during tax preparation.

Get more for Form 1040 NR U S Nonresident Alien Income Tax Return

- Legal last will and testament form for single person with adult children maine

- Legal last will and testament for married person with minor children from prior marriage maine form

- Legal last will and testament for domestic partner with children from prior marriage maine form

- Legal last will and testament form for married person with adult children from prior marriage maine

- Legal last will and testament form for divorced person not remarried with adult children maine

- Legal last will and testament form for domestic partner with adult children from prior marriage maine

- Legal last will and testament form for divorced person not remarried with no children maine

- Legal last will and testament form for divorced person not remarried with minor children maine

Find out other Form 1040 NR U S Nonresident Alien Income Tax Return

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample