Form 1040 NR U S Nonresident Alien Income Tax Return 2024

What is the 1040NR form?

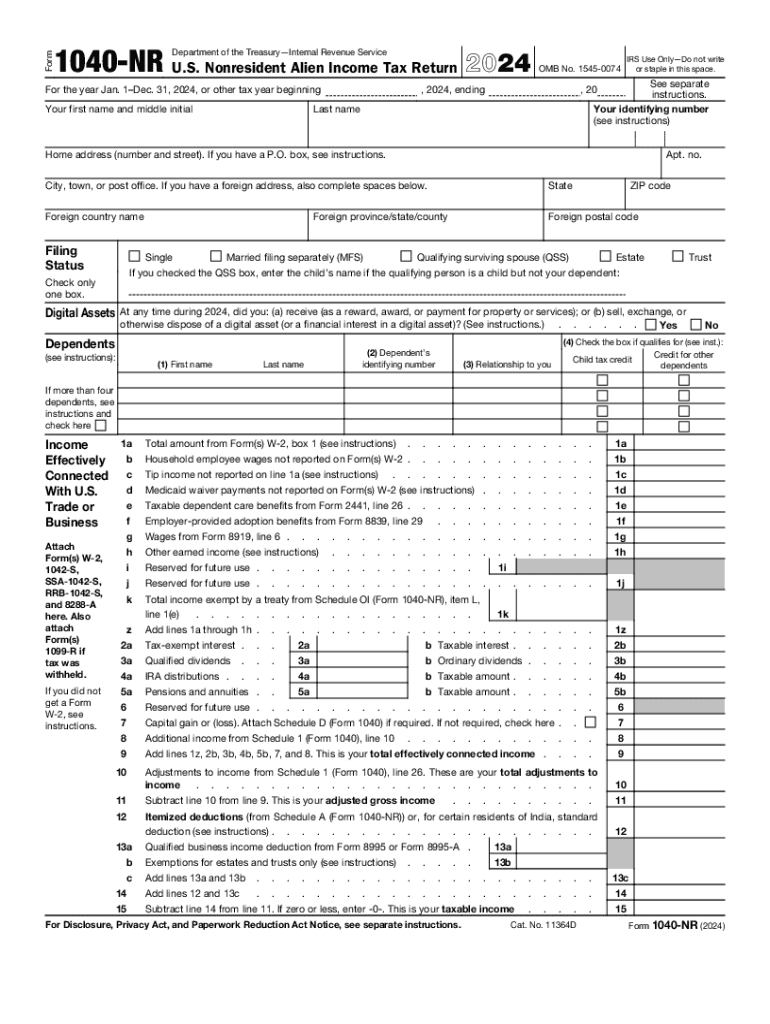

The 1040NR form, officially known as the U.S. Nonresident Alien Income Tax Return, is specifically designed for nonresident aliens who are required to report their income earned in the United States. This form is essential for individuals who do not meet the criteria for U.S. residency for tax purposes but have U.S.-sourced income. Nonresident aliens may include foreign students, scholars, and individuals temporarily working in the U.S. Understanding this form is crucial for compliance with U.S. tax laws.

Key elements of the 1040NR form

The 1040NR form includes several key elements that taxpayers must complete accurately. These elements consist of personal information, income details, and deductions applicable to nonresident aliens. Important sections include:

- Filing Status: Taxpayers must indicate their filing status, which can affect their tax rate.

- Income Reporting: All U.S.-sourced income, such as wages, dividends, and rental income, must be reported.

- Deductions: Nonresident aliens may be eligible for specific deductions, such as state and local taxes.

- Tax Calculation: The form provides a method to calculate the tax owed based on the nonresident alien tax rate.

Steps to complete the 1040NR form

Completing the 1040NR form involves several steps to ensure accuracy and compliance. Here is a general outline of the process:

- Gather Documentation: Collect all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and taxpayer identification number.

- Report Income: Accurately report all income earned in the U.S. on the form.

- Claim Deductions: If applicable, include any deductions you qualify for as a nonresident alien.

- Calculate Tax: Use the provided instructions to calculate your total tax liability.

- Sign and Date: Ensure the form is signed and dated before submission.

How to obtain the 1040NR form

The 1040NR form can be obtained easily through various methods. Taxpayers can:

- Download: Access the IRS website to download the latest version of the 1040NR form in PDF format.

- Request by Mail: Contact the IRS to request a physical copy of the form to be sent to your address.

- Visit Local IRS Office: Obtain the form directly from a local IRS office if personal assistance is needed.

Filing Deadlines / Important Dates

It is crucial for nonresident aliens to be aware of the filing deadlines for the 1040NR form to avoid penalties. Generally, the deadline for filing is April fifteenth for income earned in the previous calendar year. However, if a nonresident alien is outside the U.S. on the due date, they may qualify for an automatic extension. Keeping track of these dates ensures compliance and helps avoid unnecessary fees.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 1040NR form. These guidelines outline eligibility criteria, instructions for filling out the form, and details about required documentation. It is essential to refer to the latest IRS publications for any updates or changes to the tax laws affecting nonresident aliens. Adhering to these guidelines will help ensure accurate reporting and compliance with U.S. tax regulations.

Handy tips for filling out Form 1040 NR U S Nonresident Alien Income Tax Return online

Quick steps to complete and e-sign Form 1040 NR U S Nonresident Alien Income Tax Return online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Get access to a GDPR and HIPAA compliant solution for optimum simplicity. Use signNow to e-sign and share Form 1040 NR U S Nonresident Alien Income Tax Return for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 nr u s nonresident alien income tax return 771138453

Create this form in 5 minutes!

How to create an eSignature for the form 1040 nr u s nonresident alien income tax return 771138453

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040nr form and who needs to file it?

The 1040nr form is a tax return form used by non-resident aliens in the United States to report their income. If you are a non-resident alien who earned income in the U.S., you are required to file this form. Understanding the 1040nr form is crucial for compliance with U.S. tax laws.

-

How can airSlate SignNow help with the 1040nr form?

airSlate SignNow provides a seamless way to eSign and send your 1040nr form electronically. With our user-friendly platform, you can easily manage your tax documents, ensuring they are signed and submitted on time. This simplifies the process of handling important tax forms like the 1040nr.

-

What features does airSlate SignNow offer for managing the 1040nr form?

Our platform offers features such as customizable templates, secure eSigning, and document tracking specifically for forms like the 1040nr. You can also collaborate with tax professionals directly within the platform, making it easier to complete your tax obligations. These features enhance the efficiency of managing your 1040nr form.

-

Is airSlate SignNow cost-effective for filing the 1040nr form?

Yes, airSlate SignNow is a cost-effective solution for managing your 1040nr form. We offer various pricing plans to suit different needs, ensuring that you can access essential eSigning features without breaking the bank. This affordability makes it an ideal choice for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other software for my 1040nr form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to streamline the process of managing your 1040nr form. Whether you use accounting software or document management systems, our integrations enhance your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for the 1040nr form?

Using airSlate SignNow for your 1040nr form offers numerous benefits, including increased efficiency, enhanced security, and ease of use. Our platform ensures that your documents are securely signed and stored, reducing the risk of errors and delays. This allows you to focus on what matters most—completing your tax obligations.

-

How secure is airSlate SignNow when handling the 1040nr form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect your 1040nr form and other sensitive documents. You can trust that your information is safe while using our platform for eSigning and document management.

Get more for Form 1040 NR U S Nonresident Alien Income Tax Return

Find out other Form 1040 NR U S Nonresident Alien Income Tax Return

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement