Form 1040nr 2013

What is the Form 1040NR

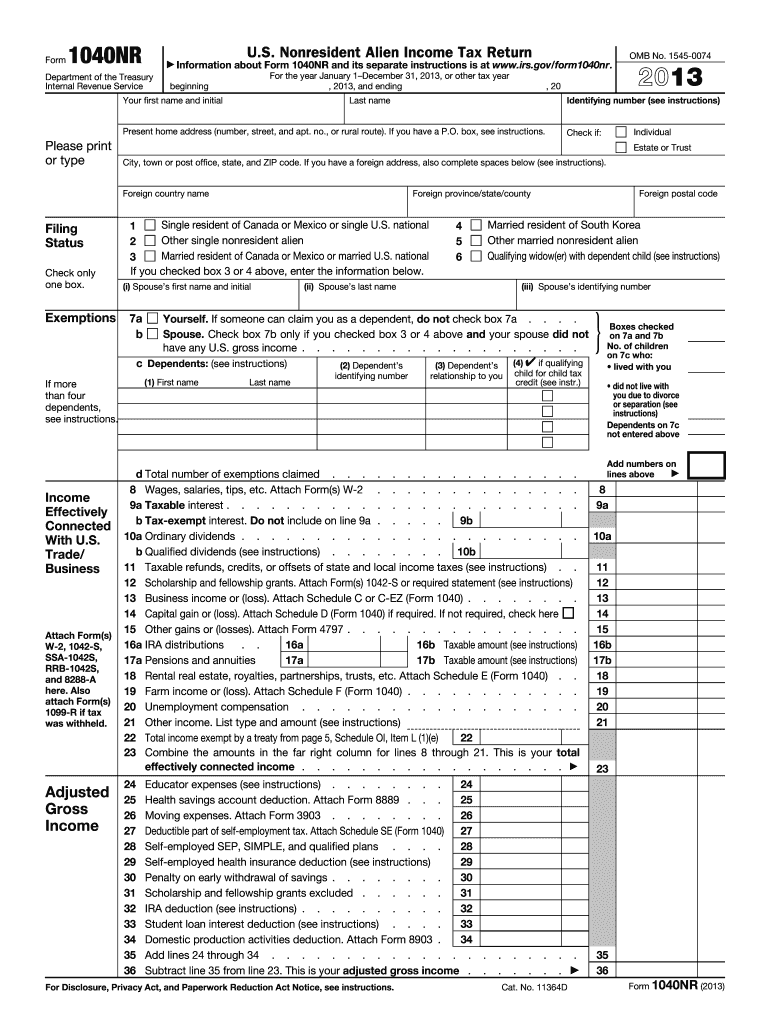

The Form 1040NR, or Non-Resident Alien Income Tax Return, is specifically designed for individuals who are not U.S. citizens or residents but have income sourced from the United States. This form allows non-resident aliens to report their income, claim deductions, and calculate their tax liability. It is essential for individuals who meet the criteria of being a non-resident alien for tax purposes, ensuring compliance with U.S. tax laws.

How to use the Form 1040NR

Using the Form 1040NR involves several steps to ensure accurate reporting of income and tax obligations. First, gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Next, complete the form by entering personal information, income details, and applicable deductions. Once completed, review the form for accuracy and ensure all required signatures are included. Finally, submit the form to the IRS by the designated deadline, either electronically or via mail.

Steps to complete the Form 1040NR

Completing the Form 1040NR requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including proof of income and any deductions.

- Fill in personal information, such as your name, address, and taxpayer identification number.

- Report your income from U.S. sources, including wages, dividends, and rental income.

- Claim any eligible deductions, such as state taxes paid or certain business expenses.

- Calculate your total tax liability based on the income reported.

- Sign and date the form to validate your submission.

Legal use of the Form 1040NR

The legal use of the Form 1040NR is governed by U.S. tax regulations. Non-resident aliens must file this form to comply with tax obligations if they have U.S.-sourced income. It is crucial to ensure that the form is filled out correctly to avoid penalties or legal issues. The IRS recognizes electronically signed forms as valid, provided they meet specific legal standards, enhancing the legitimacy of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040NR can vary based on individual circumstances. Generally, non-resident aliens must file their tax returns by April fifteenth of the following year. If you are unable to meet this deadline, you may apply for an extension, which typically allows an additional six months. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To complete the Form 1040NR accurately, several documents are necessary:

- W-2 forms from employers for reported wages.

- 1099 forms for other income sources, such as freelance work or interest.

- Documentation of any deductions you plan to claim, such as receipts or tax statements.

- Your taxpayer identification number or Social Security number, if applicable.

Quick guide on how to complete form 1040nr 2013

Complete Form 1040nr seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents rapidly without delays. Handle Form 1040nr on any platform using airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The easiest method to alter and eSign Form 1040nr effortlessly

- Obtain Form 1040nr and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that task.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of sharing your form, whether by email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form hunting, or errors requiring new copies to be printed. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 1040nr to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040nr 2013

Create this form in 5 minutes!

How to create an eSignature for the form 1040nr 2013

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is Form 1040nr, and why do I need it?

Form 1040nr is the U.S. income tax return specifically designed for non-resident aliens. If you have earned income in the U.S. or need to claim tax deductions, this form is essential for compliance with IRS regulations. Using airSlate SignNow to eSign your Form 1040nr streamlines the submission process, making it simple and efficient.

-

How can airSlate SignNow help me with my Form 1040nr?

AirSlate SignNow simplifies the process of signing and sending your Form 1040nr electronically. With its user-friendly interface, you can easily upload your form, add signatures, and send it directly to the IRS or your accountant. This not only saves time but also enhances the security of your sensitive tax information.

-

What are the pricing options for using airSlate SignNow for Form 1040nr?

AirSlate SignNow offers several pricing plans, which are designed to fit various needs, whether you're an individual or a business. You can choose from monthly or annual subscriptions, each providing access to features specifically useful for managing documents like Form 1040nr. For detailed pricing, check our website for the latest offers.

-

Is airSlate SignNow compliant with IRS regulations for Form 1040nr?

Yes, airSlate SignNow complies with all applicable regulations, ensuring that your e-signed Form 1040nr meets IRS requirements. Our platform utilizes advanced encryption and security measures, so your documents are safe while maintaining compliance with electronic filing standards. You can confidently submit your form knowing it's handled professionally.

-

Can I integrate airSlate SignNow with other tax filing tools for Form 1040nr?

Absolutely! AirSlate SignNow integrates seamlessly with various tax software and other business applications to enhance your workflow with Form 1040nr. These integrations help ensure that your documentation is organized and easily accessible, making the tax filing process much smoother.

-

What are the benefits of using airSlate SignNow for my Form 1040nr?

Using airSlate SignNow for your Form 1040nr offers numerous benefits, including time savings, enhanced security, and the convenience of e-signature capabilities. You can complete your tax documents online, avoiding the hassle of manual paperwork. Additionally, tracking and managing your documents are made easier, allowing for a much more efficient filing experience.

-

Is there customer support available if I have questions about my Form 1040nr?

Yes, airSlate SignNow provides comprehensive customer support to assist you with any questions regarding your Form 1040nr. Our support team is available via chat, email, and phone, ensuring you receive the help you need promptly. No matter where you are in the process, we're here to guide you.

Get more for Form 1040nr

- Hsmv 81407 replacement installer decals form

- Visitor visa guide inz 1018 form

- Application m 22 rev form

- Illinois enhanced skills driving school application for main license form

- E 45 rev form

- Psiexams contact psi online one stop solution for test takers form

- Service contract provider registration application licensing form

- Ecif pag ibig form

Find out other Form 1040nr

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now