1040 Nr Form 2016

What is the 1040 NR Form

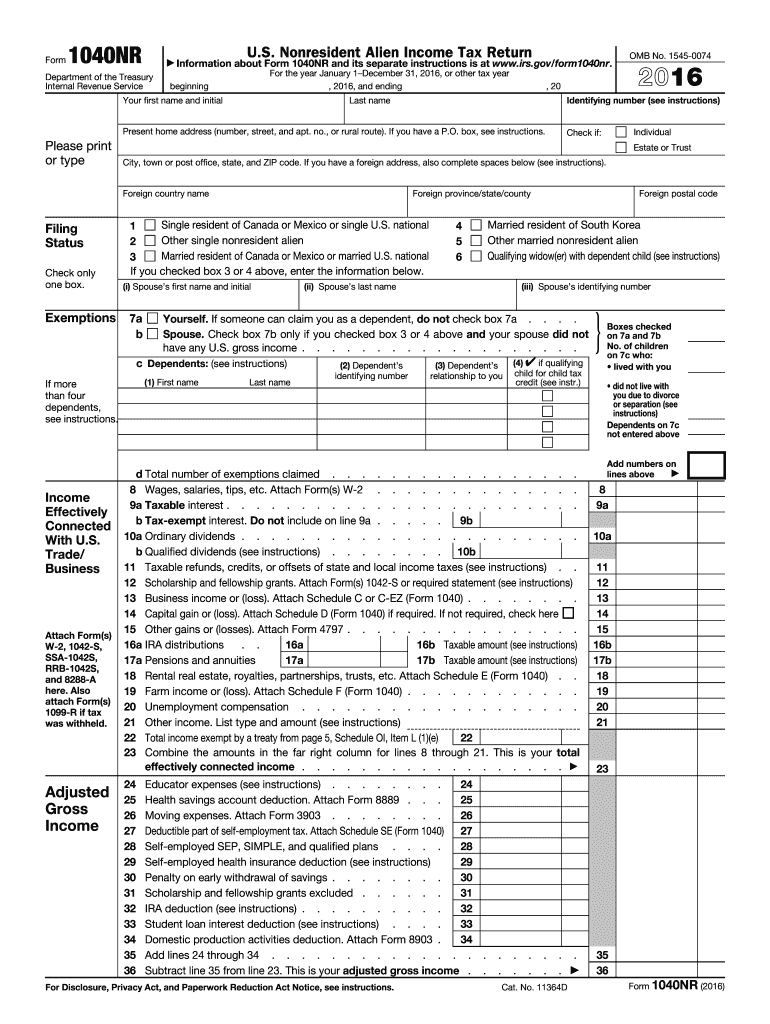

The 1040 NR Form is a U.S. tax return specifically designed for non-resident aliens. This form allows individuals who do not qualify as U.S. residents for tax purposes to report their income effectively. Non-resident aliens typically include foreign students, scholars, and individuals who earn income from U.S. sources but do not meet the criteria for residency under the Internal Revenue Service (IRS) guidelines. Understanding the 1040 NR Form is essential for ensuring compliance with U.S. tax laws and accurately reporting income.

How to use the 1040 NR Form

Using the 1040 NR Form involves several key steps to ensure proper completion and submission. First, gather all necessary documents, including income statements and any applicable deductions. Next, fill out the form by entering personal information, income details, and deductions. It's important to follow the instructions provided by the IRS carefully, as errors can lead to delays or penalties. After completing the form, review it thoroughly before submitting it to ensure accuracy and compliance with tax regulations.

Steps to complete the 1040 NR Form

Completing the 1040 NR Form requires a systematic approach:

- Gather all relevant financial documents, including W-2s and 1099s.

- Provide personal information, such as your name, address, and taxpayer identification number.

- Report your income from U.S. sources, including wages, interest, and dividends.

- Claim any eligible deductions or credits that apply to your situation.

- Sign and date the form to validate it before submission.

Following these steps can help ensure that your tax return is filed accurately and on time.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 NR Form are crucial to avoid penalties. Typically, non-resident aliens must file their tax returns by April 15 of the year following the tax year. However, if you are a non-resident alien who is a student or scholar, you may qualify for an automatic extension until June 15. It's essential to check for any updates from the IRS regarding deadlines, as they may vary from year to year.

Required Documents

When preparing to file the 1040 NR Form, specific documents are necessary to support your tax return. Required documents typically include:

- Form W-2, which reports wages earned from U.S. employers.

- Form 1099 for any additional income received, such as freelance work or interest.

- Passport or visa information to verify your non-resident status.

- Any documentation for deductions or credits you plan to claim.

Having these documents ready can streamline the filing process and ensure accuracy in reporting.

Legal use of the 1040 NR Form

The legal use of the 1040 NR Form is governed by IRS regulations, which stipulate that non-resident aliens must report their income accurately to comply with U.S. tax laws. Failure to file the form correctly can result in penalties, including fines and interest on unpaid taxes. It's important to understand the legal implications of using this form, as it serves as a formal declaration of your tax obligations in the United States. Consulting with a tax professional can provide additional guidance on legal compliance and reporting requirements.

Quick guide on how to complete 1040 nr 2016 form

Effortlessly Prepare 1040 Nr Form on Any Device

The management of online documents has gained signNow traction among organizations and individuals. It offers a perfect environmentally-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage 1040 Nr Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and Electronically Sign 1040 Nr Form with Ease

- Locate 1040 Nr Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced files, tiresome searches for forms, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs within a few clicks from any device you prefer. Edit and electronically sign 1040 Nr Form while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040 nr 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 1040 nr 2016 form

How to make an electronic signature for the 1040 Nr 2016 Form online

How to create an electronic signature for the 1040 Nr 2016 Form in Chrome

How to create an eSignature for putting it on the 1040 Nr 2016 Form in Gmail

How to generate an electronic signature for the 1040 Nr 2016 Form from your smart phone

How to make an electronic signature for the 1040 Nr 2016 Form on iOS devices

How to create an eSignature for the 1040 Nr 2016 Form on Android

People also ask

-

What is the 1040 Nr Form and who needs it?

The 1040 NR Form is a U.S. tax return form for non-resident aliens. It is specifically designed for individuals who earn income in the United States but are not considered residents for tax purposes. Understanding how to properly complete the 1040 NR Form is crucial for compliance and to avoid penalties.

-

How can airSlate SignNow help with filing the 1040 NR Form?

airSlate SignNow provides an efficient platform to eSign and securely send your 1040 NR Form. Our easy-to-use interface allows users to fill out, sign, and submit their tax documents seamlessly, ensuring you meet all deadlines without hassle.

-

Is there a cost associated with using airSlate SignNow for the 1040 NR Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet business needs, including options for individuals who need to file the 1040 NR Form. Our competitive pricing ensures you get a cost-effective solution for sending and eSigning your documents.

-

What features does airSlate SignNow offer for managing the 1040 NR Form?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for your 1040 NR Form. These features streamline the process, making it easier to manage your tax documents and ensure they are completed correctly.

-

Can I integrate airSlate SignNow with other applications for filing the 1040 NR Form?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive, Dropbox, and Microsoft Office, allowing you to access and manage your 1040 NR Form from your preferred platforms. This integration simplifies the workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for the 1040 NR Form?

Using airSlate SignNow for your 1040 NR Form offers several benefits, including enhanced security, ease of use, and the ability to track document status. By utilizing our platform, you can expedite the signing process and ensure your forms are submitted on time.

-

Is airSlate SignNow secure for sending my 1040 NR Form?

Yes, airSlate SignNow prioritizes security and compliance. Our platform employs advanced encryption methods to protect your sensitive information while you send and eSign your 1040 NR Form, ensuring peace of mind throughout the process.

Get more for 1040 Nr Form

- Force form

- Tx custody form

- Buyer seller agreement form

- California notice of cessation construction liens individual ca civil code section 8188 form

- Sale land agreement form for hawaii

- Montana contract for deed from pdf filler form

- Bank resolution form

- Massachusetts lead based paint disclosure for sales transaction form

Find out other 1040 Nr Form

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template