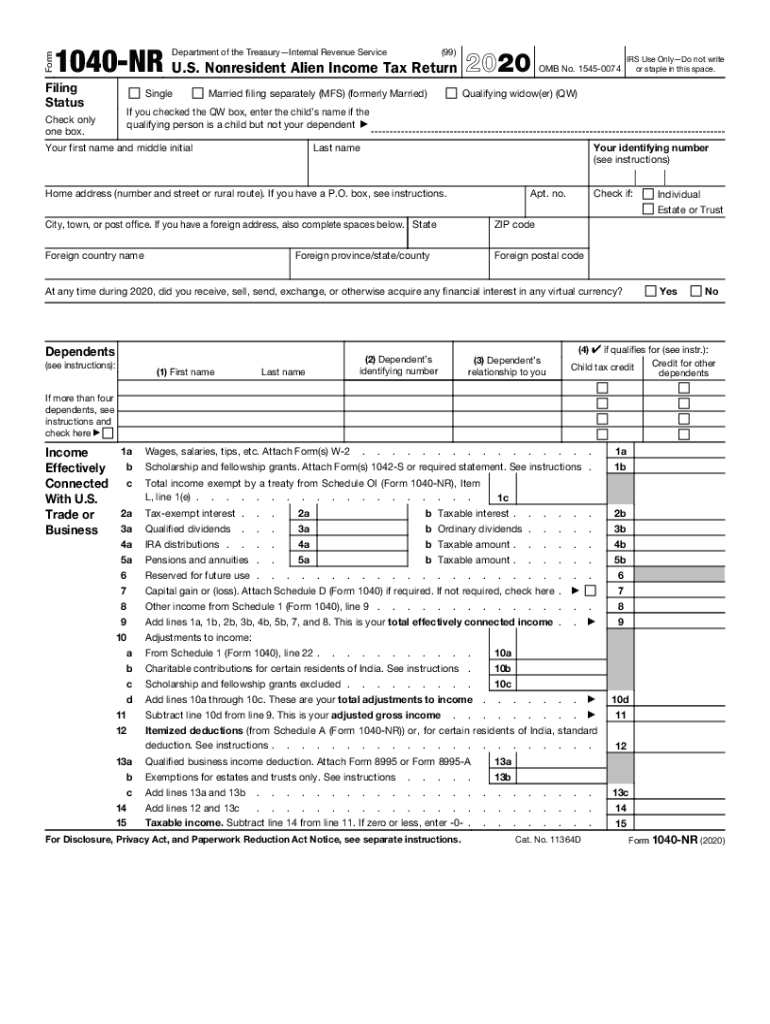

About Form 1040 NR, U S Nonresident Alien Income Tax Return 2020

What is the federal 1040 form 2020?

The federal 1040 form 2020 is a key tax document used by U.S. taxpayers to report their annual income to the Internal Revenue Service (IRS). This form is essential for individuals and families to calculate their tax liability, claim deductions, and determine eligibility for tax credits. The 1040 form can be used by various taxpayer types, including those who are self-employed, retirees, and students. It is important to understand the specific requirements and sections of this form to ensure accurate and compliant filing.

Steps to complete the federal 1040 form 2020

Completing the federal 1040 form 2020 involves several important steps:

- Gather necessary documents, including W-2s, 1099s, and other income statements.

- Determine your filing status, which affects your tax rate and eligibility for certain deductions.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income by entering amounts from various sources on the appropriate lines of the form.

- Claim deductions and credits to reduce your taxable income, such as the standard deduction or itemized deductions.

- Calculate your total tax liability and any payments already made through withholding or estimated payments.

- Sign and date the form before submission, ensuring all information is accurate.

Filing Deadlines / Important Dates

For the federal 1040 form 2020, the standard filing deadline is April 15, 2021. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of any changes to deadlines due to special circumstances, such as natural disasters or IRS announcements. Filing early can help avoid last-minute issues and ensure timely processing of refunds.

Required Documents

To accurately complete the federal 1040 form 2020, taxpayers need to gather specific documents, including:

- W-2 forms from employers to report wages and tax withholdings.

- 1099 forms for other income sources, such as freelance work or interest income.

- Records of any deductible expenses, such as medical bills or mortgage interest statements.

- Social Security numbers for dependents and other relevant tax identification numbers.

Form Submission Methods

Taxpayers can submit the federal 1040 form 2020 through various methods:

- Electronically, using e-filing options available through tax software or authorized e-file providers.

- By mail, sending a printed copy of the completed form to the appropriate IRS address based on the taxpayer's location.

- In-person at designated IRS offices, though this option may require an appointment.

Penalties for Non-Compliance

Failing to file the federal 1040 form 2020 on time or inaccurately reporting income can result in penalties. The IRS may impose fines for late filing, which typically accumulate daily. Additionally, underreporting income can lead to interest charges on unpaid tax amounts. It is crucial for taxpayers to understand the consequences of non-compliance and to ensure that their filings are accurate and timely.

Quick guide on how to complete about form 1040 nr us nonresident alien income tax return

Effortlessly prepare About Form 1040 NR, U S Nonresident Alien Income Tax Return on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to swiftly create, modify, and eSign your documents without delays. Handle About Form 1040 NR, U S Nonresident Alien Income Tax Return on any device using airSlate SignNow apps for Android or iOS, and simplify any document-related task today.

How to modify and eSign About Form 1040 NR, U S Nonresident Alien Income Tax Return effortlessly

- Find About Form 1040 NR, U S Nonresident Alien Income Tax Return and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, endless form navigating, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks on any device you choose. Edit and eSign About Form 1040 NR, U S Nonresident Alien Income Tax Return and guarantee excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1040 nr us nonresident alien income tax return

Create this form in 5 minutes!

How to create an eSignature for the about form 1040 nr us nonresident alien income tax return

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is the federal 1040 form 2020?

The federal 1040 form 2020 is the standard tax form used by U.S. taxpayers to report their annual income and calculate their tax obligations. It includes sections for reporting income, tax credits, and deductions. Using the federal 1040 form 2020 accurately is essential for compliant tax filing.

-

How can airSlate SignNow help with the federal 1040 form 2020?

airSlate SignNow allows users to electronically sign and send the federal 1040 form 2020 with ease. Our platform simplifies the process by enabling users to quickly prepare, sign, and share documents securely. This not only saves time but also ensures your tax documents are handled efficiently.

-

Is airSlate SignNow a cost-effective solution for handling the federal 1040 form 2020?

Yes, airSlate SignNow offers a cost-effective solution for managing your federal 1040 form 2020 and other documents. Our competitive pricing plans cater to businesses of all sizes, providing a robust e-signature solution without breaking the bank. You can streamline your document processes while staying within budget.

-

What features does airSlate SignNow offer for the federal 1040 form 2020?

airSlate SignNow provides a range of features specifically designed for handling the federal 1040 form 2020. These features include electronic signatures, customizable templates, document tracking, and secure cloud storage. With these tools, users can ensure accuracy and compliance when preparing their tax documents.

-

Can I integrate airSlate SignNow with other software for the federal 1040 form 2020?

Absolutely! airSlate SignNow offers integrations with various accounting and document management software, which can enhance your workflow for the federal 1040 form 2020. Integrating with your existing systems means you can efficiently manage your tax documents alongside other important business operations.

-

How secure is airSlate SignNow when handling the federal 1040 form 2020?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the federal 1040 form 2020. Our platform employs SSL encryption and follows strict compliance standards to protect your data. You can trust that your tax information is safe and secure with us.

-

What benefits can I expect from using airSlate SignNow for the federal 1040 form 2020?

By using airSlate SignNow for the federal 1040 form 2020, you can expect increased efficiency and simplified document management. Our platform minimizes paperwork, speeds up the signing process, and provides a clear audit trail. These benefits can signNowly reduce the stress associated with tax filing.

Get more for About Form 1040 NR, U S Nonresident Alien Income Tax Return

- Publication 1141 rev august 2022 general rules and specifications for substitute forms w 2 and w 3

- Taxes illinois form

- Mo 99 information

- 2019 ct tax form

- About schedule lep form 1040 request for change in language

- About schedule 8812 form 1040 credits for qualifying children and

- Publication 1321 rev 10 2022 special instructions for bona fide residents of puerto rico who must file a us individual income form

- Form mo 1065 2022 partnership return of income

Find out other About Form 1040 NR, U S Nonresident Alien Income Tax Return

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe