Partnership Alaska Department of Revenue Tax Division Form

What is the Alaska partnership return?

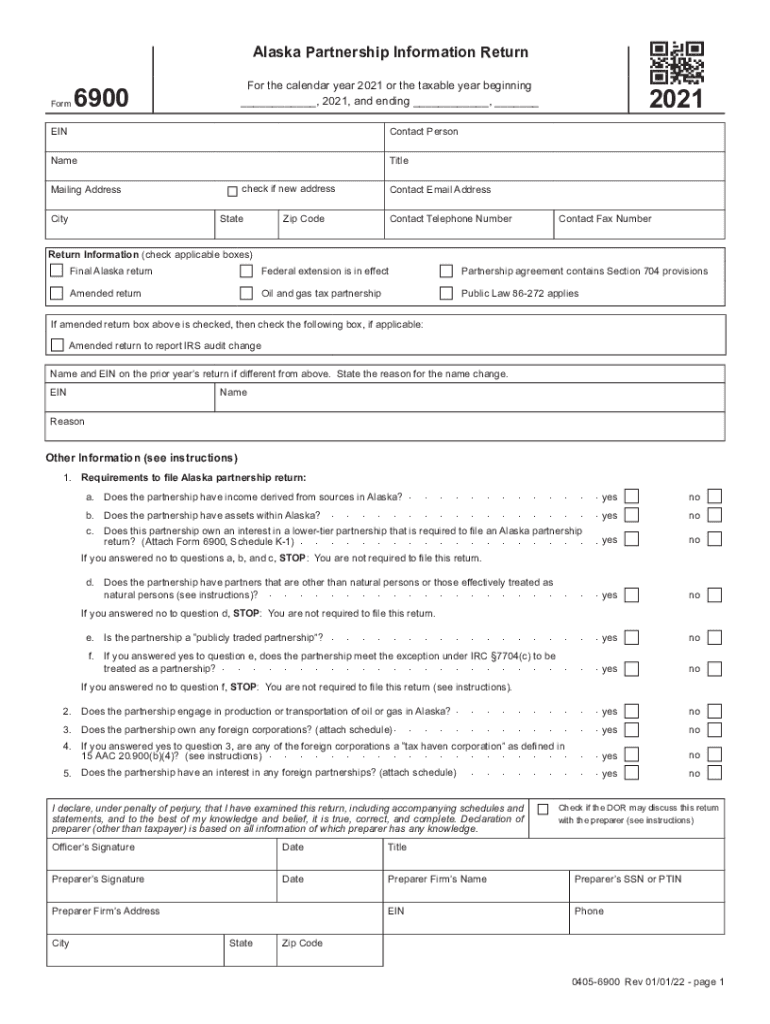

The Alaska partnership return, officially known as the AK 6900 form, is a tax document that partnerships operating in Alaska must file with the Alaska Department of Revenue. This form reports the income, deductions, and credits of the partnership, allowing the state to assess tax liabilities accurately. It is essential for partnerships to comply with state tax regulations to avoid penalties and ensure proper reporting of their financial activities.

Steps to complete the Alaska partnership return

Completing the Alaska partnership return involves several crucial steps:

- Gather necessary financial documents, including income statements, expense reports, and any supporting documentation for deductions.

- Access the AK 6900 form through the Alaska Department of Revenue's website or a trusted electronic document service.

- Fill out the form accurately, ensuring all income and deductions are reported correctly. Pay attention to specific instructions provided for each section.

- Review the completed form for accuracy and completeness. Double-check all calculations and ensure that all required signatures are included.

- Submit the form either electronically through an e-filing service or by mailing a printed copy to the appropriate state office.

Filing deadlines for the Alaska partnership return

The deadline for filing the Alaska partnership return typically aligns with the federal tax filing deadline, which is usually April 15. However, if the partnership operates on a fiscal year basis, the return is due on the 15th day of the fourth month following the end of the fiscal year. It is crucial for partnerships to mark these dates on their calendars to avoid late filing penalties.

Required documents for the Alaska partnership return

When preparing to file the Alaska partnership return, partnerships should have the following documents ready:

- Income statements detailing all sources of income.

- Expense records to substantiate all deductions claimed.

- Partnership agreement outlining the distribution of profits and losses among partners.

- Any relevant schedules or forms that support the information reported on the AK 6900 form.

Legal use of the Alaska partnership return

The Alaska partnership return serves as a legal document that ensures compliance with state tax laws. Filing this return is not only a requirement but also a means to maintain transparency in financial reporting. By accurately reporting income and deductions, partnerships fulfill their legal obligations and contribute to the state's revenue system. Failure to file this return can result in penalties and legal repercussions.

Form submission methods for the Alaska partnership return

Partnerships can submit the Alaska partnership return through various methods:

- Online Submission: Many partnerships opt to file electronically using e-filing services, which can simplify the process and provide immediate confirmation of submission.

- Mail: Partnerships may also choose to print the completed AK 6900 form and send it via postal mail to the designated address provided by the Alaska Department of Revenue.

- In-Person: For those who prefer personal interaction, submitting the form in person at a local tax office is an option, allowing for direct assistance if needed.

Quick guide on how to complete partnership alaska department of revenue tax division

Complete Partnership Alaska Department Of Revenue Tax Division effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Partnership Alaska Department Of Revenue Tax Division on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Partnership Alaska Department Of Revenue Tax Division without breaking a sweat

- Obtain Partnership Alaska Department Of Revenue Tax Division and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign Partnership Alaska Department Of Revenue Tax Division and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the partnership alaska department of revenue tax division

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

The best way to generate an e-signature from your smart phone

The way to create an e-signature for a PDF document on iOS

The best way to generate an e-signature for a PDF file on Android OS

People also ask

-

What is the Alaska partnership return form?

The Alaska partnership return form is a tax form specifically designed for partnerships operating in Alaska. It allows entities to report their income, deductions, and credits to the state. Properly completing this form is critical for compliance with Alaska state tax laws.

-

How can I easily complete the Alaska partnership return form using airSlate SignNow?

With airSlate SignNow, you can easily complete the Alaska partnership return form online. Our platform offers templates and an intuitive interface that simplifies the process. You can fill out, sign, and send your form all in one place, ensuring a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for the Alaska partnership return form?

Yes, there is a subscription fee for using airSlate SignNow, but it is cost-effective compared to traditional methods. The pricing plans offer various features, including unlimited document signing and eSigning, tailored to meet your business needs. You can evaluate different plans based on how often you need to complete the Alaska partnership return form.

-

Can I save my completed Alaska partnership return form in airSlate SignNow?

Absolutely! airSlate SignNow allows you to save your completed Alaska partnership return form securely. You can access it anytime for future reference or changes, ensuring that your records are organized and easily retrievable.

-

What features does airSlate SignNow offer for completing tax forms like the Alaska partnership return form?

airSlate SignNow provides features such as customizable templates, cloud storage, and electronic signatures specifically for documents like the Alaska partnership return form. Additionally, our platform integrates tools for tracking document status, making it easier to manage your submissions.

-

How does airSlate SignNow integrate with other applications while handling the Alaska partnership return form?

airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and many accounting software platforms. This integration allows you to import necessary data directly into the Alaska partnership return form, streamlining your filing process.

-

What are the benefits of using airSlate SignNow for my Alaska partnership return form?

Using airSlate SignNow for your Alaska partnership return form offers numerous benefits, including increased efficiency and reduced paperwork. You can complete the form digitally, ensuring accuracy and compliance, while also saving time and resources typically spent on manual processes.

Get more for Partnership Alaska Department Of Revenue Tax Division

- Md deed 497310161 form

- Md quitclaim form

- Maryland warranty deed form

- Agreement between a maryland not for profit organization and its members to produce compilation recording with profits to go to form

- Deed parents 497310165 form

- Md special form

- Discovery interrogatories from plaintiff to defendant with production requests maryland form

- Maryland defendant form

Find out other Partnership Alaska Department Of Revenue Tax Division

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA