Form 2350 Application for Extension of Time to File U S Income Tax Return 2021

What is the Form 2350 Application for Extension of Time to File U.S. Income Tax Return

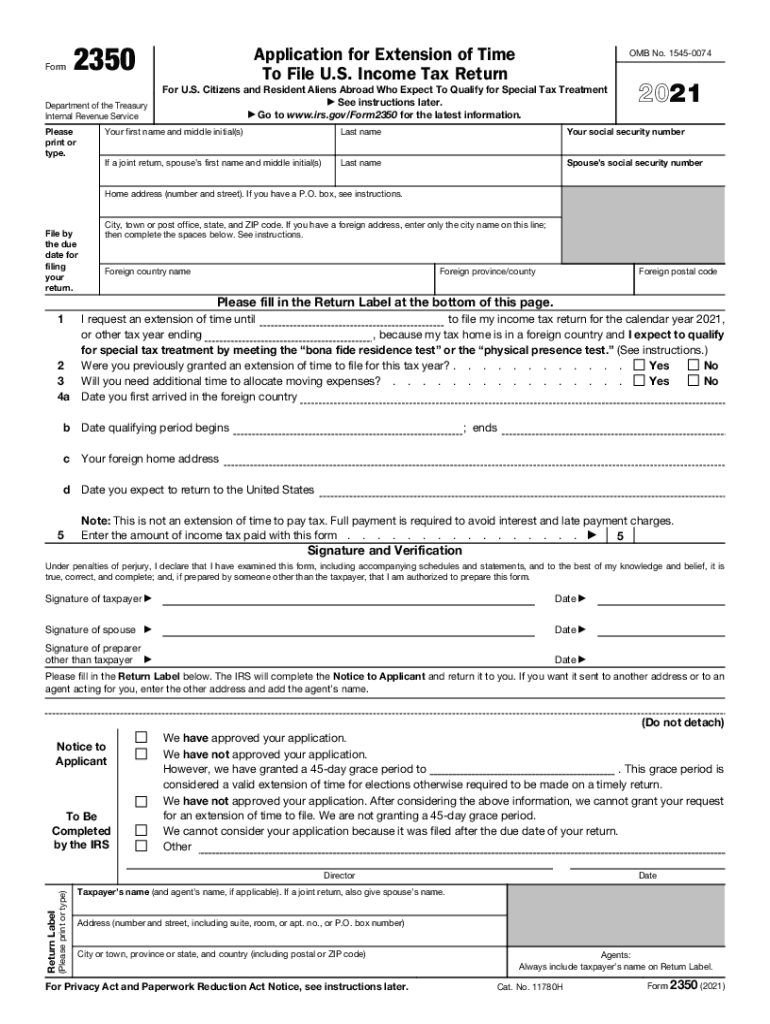

The Form 2350 is an application that allows taxpayers to request an extension of time to file their U.S. income tax return. This form is particularly useful for individuals who need additional time to gather necessary documents or who may qualify for special circumstances that affect their filing status. It is essential for those who are living abroad or who have foreign income, as they may face unique challenges when preparing their tax returns. By filing Form 2350, taxpayers can extend their filing deadline, providing them with the necessary time to ensure accurate and complete submissions.

Steps to Complete the Form 2350 Application for Extension of Time to File U.S. Income Tax Return

Completing the Form 2350 involves several key steps to ensure proper filing. First, gather all relevant income and tax information, including any foreign income documentation. Next, fill out the form with accurate personal details, including your name, address, and Social Security number. Indicate the reason for your extension request, ensuring it aligns with the criteria set by the IRS. After completing the form, review it for accuracy and sign it. Finally, submit the form by the appropriate deadline to avoid penalties.

IRS Guidelines for Form 2350

The IRS provides specific guidelines for using Form 2350, which include eligibility criteria and submission requirements. Taxpayers must ensure they meet the conditions for requesting an extension, such as being a U.S. citizen or resident alien living abroad. The IRS requires that the form be submitted before the original due date of the tax return. It is also important to note that an extension granted through Form 2350 does not extend the time to pay any taxes owed, which must be paid by the original due date to avoid interest and penalties.

Filing Deadlines and Important Dates for Form 2350

Filing deadlines for Form 2350 are crucial for compliance. Typically, the form must be submitted by the original due date of the tax return, which is usually April fifteenth for most taxpayers. However, if the taxpayer is living abroad, they may have until June fifteenth to file their return. If additional time is needed, Form 2350 can provide an extension up to October fifteenth. It is vital to keep track of these deadlines to avoid any late filing penalties.

Eligibility Criteria for Form 2350

Eligibility for using Form 2350 primarily revolves around the taxpayer's residency status and the nature of their income. U.S. citizens and resident aliens living outside the United States can apply for an extension using this form. Additionally, taxpayers who expect to qualify for the foreign earned income exclusion or who have foreign income that complicates their tax situation may also be eligible. Understanding these criteria is essential to ensure compliance and proper use of the form.

Application Process and Approval Time for Form 2350

The application process for Form 2350 is straightforward. After completing the form, it should be mailed to the appropriate IRS address, which can vary based on the taxpayer's location. Approval time for Form 2350 can vary, but taxpayers typically receive confirmation of their extension within a few weeks. It is advisable to keep a copy of the submitted form and any correspondence from the IRS for personal records. Being proactive in following up can help ensure that the extension is processed smoothly.

Quick guide on how to complete 2021 form 2350 application for extension of time to file us income tax return

Prepare Form 2350 Application For Extension Of Time To File U S Income Tax Return effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Form 2350 Application For Extension Of Time To File U S Income Tax Return on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Form 2350 Application For Extension Of Time To File U S Income Tax Return seamlessly

- Find Form 2350 Application For Extension Of Time To File U S Income Tax Return and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or missing documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device. Modify and eSign Form 2350 Application For Extension Of Time To File U S Income Tax Return and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 2350 application for extension of time to file us income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 2350 application for extension of time to file us income tax return

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an e-signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the irs gov extension and how does it work?

The irs gov extension is a tool that allows taxpayers to file for an extension on their tax return. By utilizing this extension, you gain extra time to prepare and submit your paperwork accurately. airSlate SignNow simplifies the process by letting you eSign and send the extension documents seamlessly.

-

How can airSlate SignNow help with my irs gov extension?

airSlate SignNow streamlines the process of submitting your irs gov extension by enabling you to complete and eSign necessary documents online. This efficiency saves you time and ensures that everything is submitted correctly. Additionally, our platform offers convenience and flexibility, so you can manage your extensions anywhere.

-

Is there a cost associated with using airSlate SignNow for my irs gov extension?

Yes, while airSlate SignNow provides a cost-effective solution for handling your irs gov extension, pricing may vary based on the plan you choose. Consider our various subscription options to find the best fit for your business needs. The investment can lead to signNow time savings and improved compliance.

-

What features does airSlate SignNow offer for managing my irs gov extension?

airSlate SignNow offers features such as easy document creation, eSignature capabilities, and automated reminders for your irs gov extension deadlines. These tools help ensure that you never miss a filing deadline again. Our user-friendly interface makes it easy to navigate and manage your documents efficiently.

-

Can I integrate airSlate SignNow with other applications for my irs gov extension?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, enhancing your workflow when managing your irs gov extension. You can connect it with popular tools like Google Drive, Salesforce, and more, allowing for a customized and efficient document management experience.

-

What are the benefits of using airSlate SignNow for my irs gov extension?

Using airSlate SignNow for your irs gov extension brings numerous benefits, such as increased productivity, better document security, and improved tracking. You'll spend less time on paperwork and more time focusing on your business. Plus, with the ability to eSign documents anywhere, it offers unmatched convenience.

-

How secure is the information I submit through airSlate SignNow when dealing with my irs gov extension?

Security is a top priority for airSlate SignNow, especially when handling sensitive information related to your irs gov extension. We utilize advanced encryption technologies to protect your data and keep it confidential. You can trust us to keep your information safe throughout the entire process.

Get more for Form 2350 Application For Extension Of Time To File U S Income Tax Return

- Construction contract cost plus or fixed fee mississippi form

- Painting contract for contractor mississippi form

- Trim carpenter contract for contractor mississippi form

- Fencing contract for contractor mississippi form

- Hvac contract for contractor mississippi form

- Landscape contract for contractor mississippi form

- Commercial contract for contractor mississippi form

- Contract contractor pdf form

Find out other Form 2350 Application For Extension Of Time To File U S Income Tax Return

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF