2350 Form 2012

What is the 2350 Form

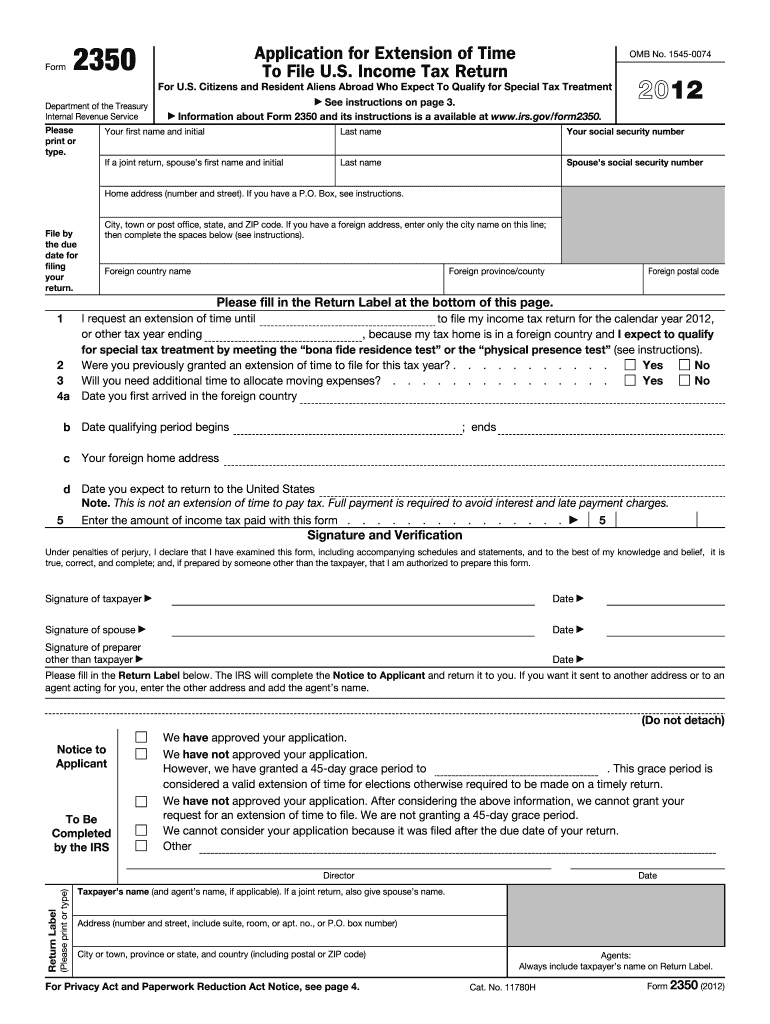

The 2350 Form is an essential document used by U.S. taxpayers to request an extension of time to file their income tax returns. This form is particularly relevant for individuals who are living abroad or are members of the military, allowing them to extend their filing deadline under specific circumstances. Understanding the purpose and requirements of the 2350 Form is crucial for ensuring compliance with IRS regulations and avoiding potential penalties.

How to use the 2350 Form

Using the 2350 Form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including your personal details and income sources. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. After completing the form, review it carefully for any errors or omissions. Finally, submit the form to the IRS by the specified deadline, either electronically or by mail, depending on your preference and circumstances.

Steps to complete the 2350 Form

Completing the 2350 Form involves a systematic approach to ensure all necessary information is accurately provided. Follow these steps:

- Download the latest version of the 2350 Form from the IRS website.

- Provide your name, address, and Social Security number at the top of the form.

- Indicate the tax year for which you are requesting an extension.

- Specify the reason for the extension, particularly if you are living abroad or serving in the military.

- Sign and date the form to certify that the information provided is true and accurate.

Once completed, ensure to keep a copy for your records before submitting it to the IRS.

Legal use of the 2350 Form

The legal use of the 2350 Form is governed by IRS regulations, which stipulate that it must be filed by taxpayers who meet specific criteria. This form allows individuals to request an additional extension beyond the standard filing deadline, particularly for those residing outside the United States. To ensure compliance, it is essential to file the form timely and accurately, as failure to do so may result in penalties or interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the 2350 Form are critical to avoid penalties. Typically, the form must be submitted by the original due date of the tax return, which is usually April fifteenth for most taxpayers. However, if you are living abroad, you may qualify for an automatic two-month extension. It is important to note that while the form extends the time to file, it does not extend the time to pay any taxes owed. Therefore, ensure to pay any estimated taxes by the original deadline to avoid interest and penalties.

Who Issues the Form

The 2350 Form is issued by the Internal Revenue Service (IRS), which is the U.S. government agency responsible for tax collection and enforcement of tax laws. The IRS provides the form along with guidelines on how to complete it, ensuring that taxpayers have the necessary resources to comply with federal tax regulations. It is important to use the most current version of the form, as updates may occur annually.

Quick guide on how to complete 2012 2350 form

Complete 2350 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Manage 2350 Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven operation today.

The easiest way to modify and eSign 2350 Form effortlessly

- Locate 2350 Form and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Mark important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal significance as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about missing or lost documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign 2350 Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 2350 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 2350 form

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is the 2350 Form and how does it work with airSlate SignNow?

The 2350 Form is a document used for various applications, including tax purposes and financial reporting. With airSlate SignNow, you can easily upload, send, and electronically sign the 2350 Form, ensuring a streamlined and efficient process for your business needs. Our platform simplifies the signing process, allowing multiple parties to collaborate seamlessly.

-

How much does airSlate SignNow cost for using the 2350 Form?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs. The cost depends on the features you choose, but generally, our plans are designed to be cost-effective, allowing you to manage documents like the 2350 Form without breaking the bank. You can check our website for the latest pricing details and any special offers.

-

What features does airSlate SignNow offer for the 2350 Form?

airSlate SignNow provides a suite of features specifically designed to enhance document management, including templates, automated workflows, and real-time tracking. When working with the 2350 Form, you can customize your document, set signing orders, and receive notifications as soon as it’s signed, ensuring a smooth workflow.

-

Is airSlate SignNow secure for handling the 2350 Form?

Yes, airSlate SignNow prioritizes security and complies with industry standards to protect your documents, including the 2350 Form. We utilize encryption, secure data storage, and authentication measures to ensure that your sensitive information remains safe and confidential throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for the 2350 Form?

Absolutely! airSlate SignNow offers integrations with a variety of applications, allowing you to streamline your workflow for the 2350 Form. Whether you need to connect with CRMs, cloud storage services, or other document management tools, our platform makes it easy to incorporate the 2350 Form into your existing systems.

-

How can airSlate SignNow benefit my business when using the 2350 Form?

Using airSlate SignNow for the 2350 Form can signNowly improve your business efficiency by reducing the time spent on paperwork and enhancing collaboration. Our electronic signature solution allows for faster turnaround times, minimizes errors associated with manual processes, and provides you with a clear audit trail for compliance.

-

Is there a mobile app for airSlate SignNow to manage the 2350 Form?

Yes, airSlate SignNow offers a mobile app that enables you to manage the 2350 Form on the go. With our app, you can easily send, sign, and track documents from your smartphone or tablet, ensuring that you can handle important paperwork anytime, anywhere.

Get more for 2350 Form

- 5381dcpdf occupational duties questionnaire application supplement individual disability dc form

- For internal use only patientpop form

- Florida pharmacy prior authorization form simply

- Blue dental choice q plan for children florida blue dental form

- Escambia county school district digital classrooms plan form

- Community contribution request form mn mayo clinic

- Your name todays date form

- Bhealthb screening opt out bformb broward county public schools bb

Find out other 2350 Form

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online