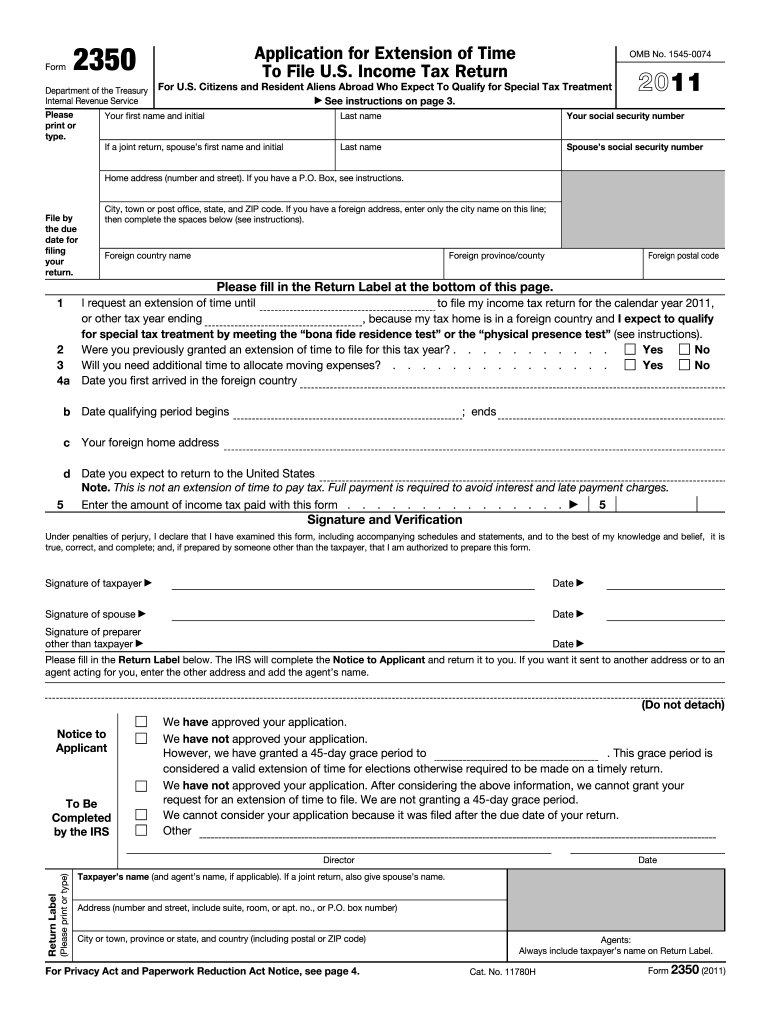

Tax Exempt Form 2350 Fillable 2011

What is the Tax Exempt Form 2350 Fillable

The Tax Exempt Form 2350 Fillable is a document used by organizations to apply for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This form is essential for non-profit entities seeking to obtain exemption from federal income tax. By completing this form, applicants provide necessary information regarding their organization's purpose, structure, and activities, which the IRS uses to determine eligibility for tax-exempt status.

How to use the Tax Exempt Form 2350 Fillable

Using the Tax Exempt Form 2350 Fillable involves a straightforward process. First, access the fillable version of the form, which allows for easy entry of information. Carefully read the instructions provided with the form to ensure all required fields are completed accurately. Once filled out, the form can be saved electronically, printed, and signed. It's important to ensure that all information is accurate and complete to avoid delays in processing.

Steps to complete the Tax Exempt Form 2350 Fillable

Completing the Tax Exempt Form 2350 Fillable requires several key steps:

- Gather necessary information about your organization, including its mission, activities, and financial data.

- Access the fillable form and enter the required information in each section.

- Review the form for accuracy and completeness, ensuring all fields are filled out correctly.

- Sign the form electronically or print it for a handwritten signature.

- Submit the completed form to the IRS, following the submission guidelines provided.

Legal use of the Tax Exempt Form 2350 Fillable

The Tax Exempt Form 2350 Fillable is legally binding when completed and submitted according to IRS regulations. To ensure its legal standing, the form must be filled out truthfully and accurately. Misrepresentation or incomplete information can lead to penalties or denial of tax-exempt status. It is advisable to consult legal counsel or a tax professional when preparing the form to ensure compliance with all legal requirements.

Key elements of the Tax Exempt Form 2350 Fillable

Several key elements are essential when filling out the Tax Exempt Form 2350 Fillable:

- Organization Information: This includes the name, address, and contact information of the organization.

- Purpose and Activities: A detailed description of the organization's mission and the activities it will engage in to fulfill that mission.

- Financial Information: Information regarding the organization's budget, funding sources, and expected income.

- Governance Structure: Details about the board of directors or governing body, including their roles and responsibilities.

IRS Guidelines

The IRS provides specific guidelines for completing the Tax Exempt Form 2350 Fillable. These guidelines outline the necessary information required, the eligibility criteria for tax exemption, and the submission process. Organizations must adhere to these guidelines to ensure their application is processed efficiently. Failure to comply with IRS guidelines may result in delays or rejection of the application.

Quick guide on how to complete tax exempt form 2350 fillable 2011

Complete Tax Exempt Form 2350 Fillable seamlessly on any device

Digital document management has become favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documentation, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly and without interruption. Handle Tax Exempt Form 2350 Fillable on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Tax Exempt Form 2350 Fillable effortlessly

- Locate Tax Exempt Form 2350 Fillable and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just a few seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors requiring new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Tax Exempt Form 2350 Fillable and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax exempt form 2350 fillable 2011

Create this form in 5 minutes!

How to create an eSignature for the tax exempt form 2350 fillable 2011

The way to make an electronic signature for a PDF file online

The way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the Tax Exempt Form 2350 Fillable?

The Tax Exempt Form 2350 Fillable is a digital document that allows individuals and businesses to claim exemption from certain taxes. This fillable form simplifies the process, enabling users to complete and submit their applications efficiently. By using airSlate SignNow, you can effortlessly create, edit, and store your Tax Exempt Form 2350 Fillable.

-

How can I fill out the Tax Exempt Form 2350 Fillable using airSlate SignNow?

Filling out the Tax Exempt Form 2350 Fillable with airSlate SignNow is simple. You can upload the form directly to our platform, fill in the required fields, and customize it as needed. Our user-friendly interface makes it easy to complete and manage your Tax Exempt Form 2350 Fillable without any hassle.

-

Is there a cost associated with using the Tax Exempt Form 2350 Fillable on airSlate SignNow?

Yes, while airSlate SignNow offers a range of pricing plans, you can access the Tax Exempt Form 2350 Fillable as part of our subscription service. Our plans are designed to be cost-effective, providing valuable services for businesses of all sizes. Using our platform ensures you gain great value while managing your Tax Exempt Form 2350 Fillable.

-

What features does airSlate SignNow offer for handling the Tax Exempt Form 2350 Fillable?

airSlate SignNow includes features such as electronic signatures, form templates, and document tracking for managing the Tax Exempt Form 2350 Fillable. These features streamline your process, making it faster and more efficient. Our platform ensures that every step, from filling out to signing the Tax Exempt Form 2350 Fillable, is secure and compliant.

-

Can I integrate airSlate SignNow with other applications while using the Tax Exempt Form 2350 Fillable?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to seamlessly manage your workflow while using the Tax Exempt Form 2350 Fillable. This compatibility enhances your productivity and makes it easier to connect your documents with other tools essential for your business operations.

-

What are the benefits of using airSlate SignNow for the Tax Exempt Form 2350 Fillable?

Using airSlate SignNow for the Tax Exempt Form 2350 Fillable saves you time and increases efficiency. With our secure platform, you can ensure that your document is accurately completed and submitted on time. Additionally, our eSignature feature provides a legal and efficient way to finalize your Tax Exempt Form 2350 Fillable.

-

Is the Tax Exempt Form 2350 Fillable compliant with legal regulations?

Yes, the Tax Exempt Form 2350 Fillable created and managed through airSlate SignNow complies with legal regulations. Our platform meets industry standards for security and legality, ensuring that your electronic signatures and submissions are valid. You can use our services with confidence for your Tax Exempt Form 2350 Fillable.

Get more for Tax Exempt Form 2350 Fillable

- Iowa lien form

- Ia corporation 497305264 form

- Storage business package iowa form

- Child care services package iowa form

- Special or limited power of attorney for real estate sales transaction by seller iowa form

- Special or limited power of attorney for real estate purchase transaction by purchaser iowa form

- Limited power of attorney where you specify powers with sample powers included iowa form

- Limited power of attorney for stock transactions and corporate powers iowa form

Find out other Tax Exempt Form 2350 Fillable

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement