Internal Revenue Service U S TaxesU S Consulate General in 2020

Understanding the 2020 IRS Form 2350

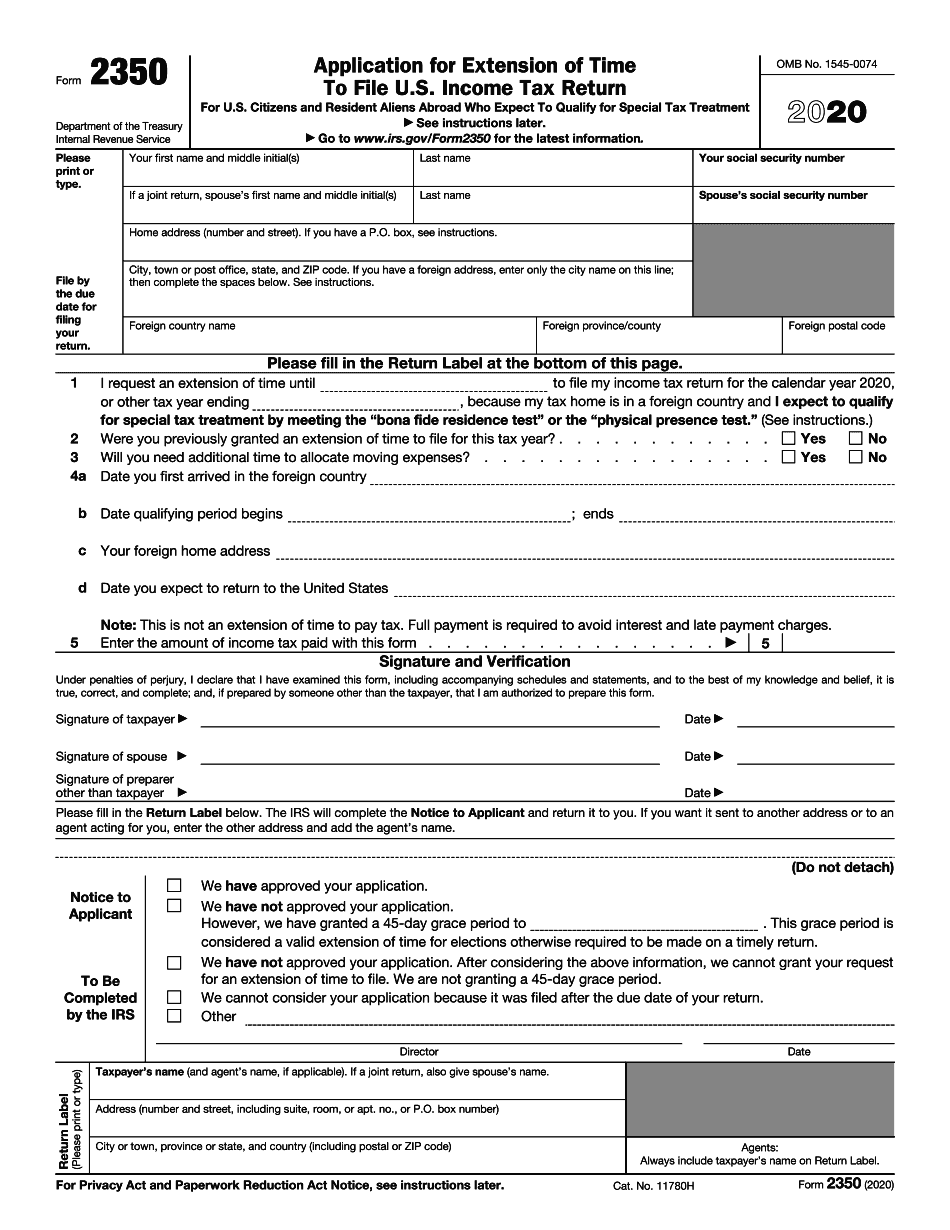

The 2020 IRS Form 2350 is used by U.S. citizens and resident aliens who are living abroad and need to apply for an extension to file their tax returns. This form is particularly relevant for those who require additional time to meet their tax obligations due to living outside the United States. It allows taxpayers to extend their filing deadline while ensuring compliance with IRS regulations.

Key Elements of the 2020 Form 2350

When filling out the 2020 Form 2350, it is essential to include specific information to ensure its validity. Key elements include:

- Personal Information: Include your name, address, and Social Security number.

- Tax Year: Clearly indicate the tax year for which you are requesting an extension.

- Reason for Extension: Specify the reason for needing additional time, such as residing outside the U.S. or awaiting foreign income documentation.

Steps to Complete the 2020 IRS Form 2350

Completing the 2020 Form 2350 involves several straightforward steps:

- Gather necessary documents, including your income information and any relevant foreign tax documents.

- Fill out your personal information accurately on the form.

- Specify the tax year and the reason for the extension.

- Review the form for any errors or omissions.

- Submit the form electronically or via mail to the appropriate IRS address.

Filing Deadlines for the 2020 Form 2350

It is crucial to be aware of the filing deadlines associated with the 2020 Form 2350. The form must be submitted by the original due date of your tax return, which is typically April fifteenth. If you are living abroad, you may qualify for an automatic two-month extension, but filing Form 2350 ensures you can request further time if needed.

Penalties for Non-Compliance with Form 2350

Failing to file the 2020 Form 2350 or not submitting your tax return by the extended deadline can result in penalties. These may include:

- Late Filing Penalty: A percentage of the unpaid tax amount may be charged for each month the return is late.

- Interest Charges: Interest may accrue on any unpaid taxes from the original due date until payment is made.

Digital vs. Paper Version of the 2020 Form 2350

Taxpayers have the option to file the 2020 Form 2350 either digitally or by mailing a paper version. Filing electronically can expedite processing and provide immediate confirmation of submission. However, some individuals may prefer the traditional paper method for record-keeping purposes. Regardless of the method chosen, ensure that all information is accurate and complete to avoid delays.

Quick guide on how to complete internal revenue service us taxesus consulate general in

Effortlessly Prepare Internal Revenue Service U S TaxesU S Consulate General In on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage Internal Revenue Service U S TaxesU S Consulate General In on any device using the airSlate SignNow applications for Android or iOS and improve any document-related process today.

Effortlessly Modify and eSign Internal Revenue Service U S TaxesU S Consulate General In

- Locate Internal Revenue Service U S TaxesU S Consulate General In and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to deliver your form: via email, SMS, or invitation link, or download it to your computer.

Forget about losing or misplacing documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Internal Revenue Service U S TaxesU S Consulate General In and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct internal revenue service us taxesus consulate general in

Create this form in 5 minutes!

How to create an eSignature for the internal revenue service us taxesus consulate general in

The best way to make an eSignature for your PDF document online

The best way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to the 2020 2350?

airSlate SignNow is a powerful eSignature platform that enables businesses to electronically sign and send documents efficiently. The 2020 2350 is a key regulatory requirement that many businesses must comply with, and airSlate SignNow helps streamline this process. By using airSlate SignNow, you can ensure compliance with the 2020 2350 by securely managing and signing important documents.

-

What are the pricing options for airSlate SignNow in relation to the 2020 2350?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it easy to find a solution that fits your budget. The cost-effectiveness of airSlate SignNow is essential for companies looking to comply with the 2020 2350 requirement without overspending. Different plans provide various features, ensuring you get the right tools for your needs.

-

What features does airSlate SignNow provide for managing the 2020 2350 compliance?

airSlate SignNow offers several features that facilitate compliance with the 2020 2350, including secure eSigning, document tracking, and customizable workflows. These capabilities help ensure that all documents are signed in accordance with legal requirements. Additionally, airSlate SignNow's ease of use allows teams to focus more on their work rather than worrying about compliance issues.

-

How can airSlate SignNow benefit businesses striving for 2020 2350 compliance?

By adopting airSlate SignNow, businesses can streamline their document signing processes, making it easier to comply with the 2020 2350. Its user-friendly interface minimizes training time, allowing your team to quickly adapt. Enhanced security features also protect sensitive information, which is vital for maintaining compliance and user trust.

-

Can airSlate SignNow integrate with other software to support 2020 2350 workflows?

Yes, airSlate SignNow offers integrations with numerous business applications, facilitating seamless workflows that can cater to the 2020 2350 compliance needs. Whether using CRMs, document management systems, or cloud storage solutions, airSlate SignNow can adapt to your existing technology. This flexibility ensures a smoother transition and effective document management.

-

Is airSlate SignNow suitable for all business sizes concerning the 2020 2350?

Absolutely! airSlate SignNow is designed for businesses of all sizes, making it an ideal choice for compliance with the 2020 2350, regardless of your organization's scale. Its scalable features allow small startups and large enterprises to find solutions that fit their specific requirements. All users can benefit from the same professional-level eSigning capabilities.

-

What industries can benefit from airSlate SignNow when dealing with 2020 2350 requirements?

Various industries, including healthcare, finance, and education, can signNowly benefit from using airSlate SignNow for 2020 2350 compliance. Each industry has unique document management needs and regulatory requirements. AirSlate SignNow’s versatility ensures that organizations in these fields can efficiently manage their eSigning processes while meeting compliance standards.

Get more for Internal Revenue Service U S TaxesU S Consulate General In

Find out other Internal Revenue Service U S TaxesU S Consulate General In

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement