2350 Form 2015

What is the 2350 Form

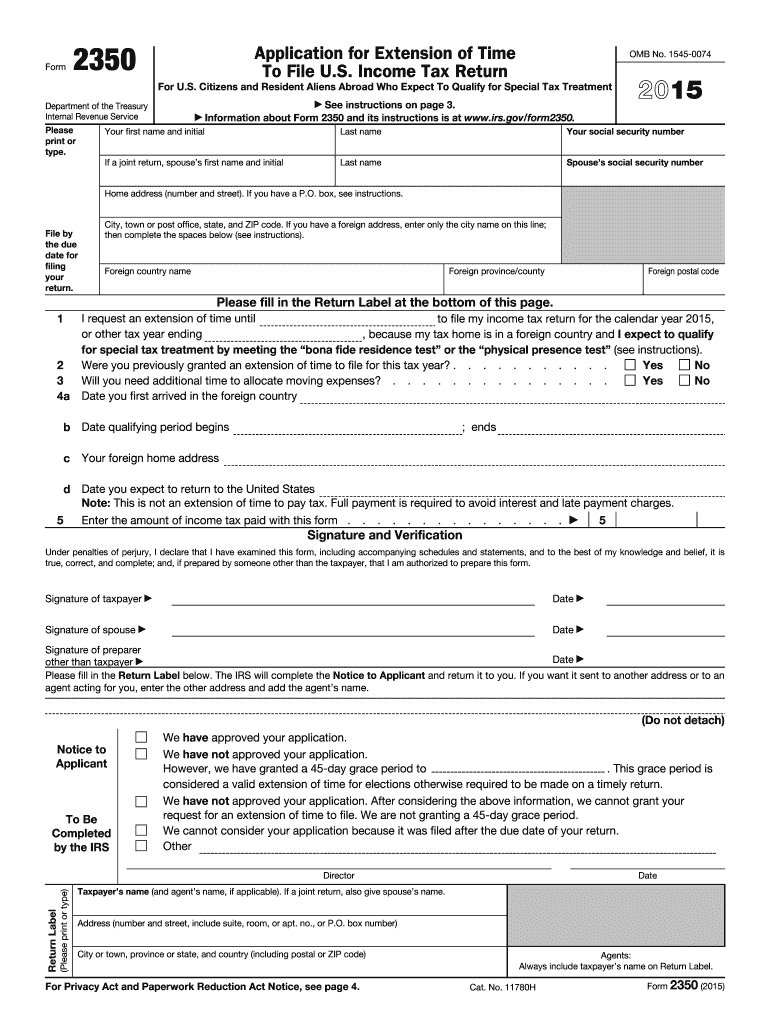

The 2350 Form is a tax document used by U.S. taxpayers to request an extension of time to file their income tax return. This form is particularly relevant for individuals who are living or working abroad and need additional time to meet their tax obligations. By submitting the 2350 Form, taxpayers can ensure they are compliant with IRS regulations while managing their unique circumstances, such as international assignments or residency issues.

How to obtain the 2350 Form

To obtain the 2350 Form, taxpayers can visit the official IRS website, where the form is available for download. The form can also be requested by contacting the IRS directly or by visiting a local IRS office. It is essential to ensure that you have the most current version of the form, as tax regulations can change annually.

Steps to complete the 2350 Form

Completing the 2350 Form involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate the type of return you are filing and the tax year for which you are requesting an extension.

- Provide details about your foreign address, if applicable, and any relevant income information.

- Sign and date the form to certify that the information provided is accurate.

It is crucial to review the form thoroughly before submission to avoid any errors that could delay processing.

Legal use of the 2350 Form

The 2350 Form is legally recognized by the IRS as a valid request for an extension of time to file a tax return. When completed accurately and submitted on time, it provides taxpayers with the necessary legal protection against penalties for late filing. It is important to understand that while the form grants an extension for filing, any taxes owed must still be paid by the original due date to avoid interest and penalties.

Filing Deadlines / Important Dates

Taxpayers should be aware of the deadlines associated with the 2350 Form. The form must be submitted by the original due date of the tax return, which is typically April fifteenth for most individuals. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is advisable to keep track of any changes to tax deadlines that the IRS may announce, especially for those living abroad.

Form Submission Methods (Online / Mail / In-Person)

The 2350 Form can be submitted through various methods. Taxpayers may choose to file online using IRS-approved e-filing software that supports the form. Alternatively, the form can be mailed to the appropriate IRS address based on the taxpayer's location. For those who prefer in-person assistance, visiting a local IRS office is also an option. Each submission method has its own processing times, so it is important to choose one that aligns with your needs.

Quick guide on how to complete 2015 2350 form

Complete 2350 Form seamlessly on any device

Online document management has become prevalent among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, adjust, and eSign your documents rapidly without delays. Handle 2350 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

How to modify and eSign 2350 Form effortlessly

- Locate 2350 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal significance as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign 2350 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 2350 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 2350 form

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is the 2350 Form and how can airSlate SignNow help?

The 2350 Form is a crucial document for businesses that need to report certain tax information to the IRS. airSlate SignNow simplifies the process of sending and eSigning the 2350 Form, ensuring that your documents are securely handled and easily accessible. With our user-friendly platform, you can complete your 2350 Form quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for the 2350 Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options for unlimited eSigning of documents like the 2350 Form. Our pricing is designed to be budget-friendly, allowing businesses to manage their documentation without breaking the bank. Check our website for specific pricing details on using the 2350 Form.

-

What features does airSlate SignNow offer for completing the 2350 Form?

airSlate SignNow provides a range of features that enhance the completion of the 2350 Form, including customizable templates, automated workflows, and secure cloud storage. You can easily fill out the 2350 Form, track its status, and ensure compliance with IRS requirements. These features make document management seamless and efficient.

-

Can I integrate airSlate SignNow with other applications for managing the 2350 Form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when managing the 2350 Form. Popular integrations include CRM systems, cloud storage solutions, and productivity tools, which can enhance your overall document management process.

-

How secure is my data when using airSlate SignNow for the 2350 Form?

Security is a top priority for airSlate SignNow. When you use our platform to fill out and sign the 2350 Form, your data is protected with industry-standard encryption and secure access controls. We comply with all necessary regulations to ensure that your sensitive information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for the 2350 Form compared to traditional methods?

Using airSlate SignNow for the 2350 Form offers numerous benefits over traditional methods. It saves time by allowing you to eSign and send documents instantly, reduces paper usage, and minimizes the risk of errors. The convenience of accessing your documents from anywhere also enhances productivity for your business.

-

How can I get started with airSlate SignNow for the 2350 Form?

Getting started with airSlate SignNow for the 2350 Form is easy! Simply visit our website to sign up for an account, choose a plan that fits your needs, and begin creating or uploading your 2350 Form. Our intuitive interface guides you through the process, making it simple to manage your documents.

Get more for 2350 Form

- Form it 370 pf department of taxation and finance nygov

- Sales and use tax on aircraft florida department of revenue 533500554 form

- Council on state taxation cost form

- California form 3533 b search edit fill sign fax ampamp save pdf

- Instructions for form 592 v california

- 2020 form 592 b resident and nonresident withholding 2020 form 592 b resident and nonresident withholding

- 2019 california form 3502nonprofit corporation request for pre dissolution tax abatement 2019 california form 3502nonprofit

- W 2 duplicate request form nycgov

Find out other 2350 Form

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word