U S Citizens and Resident Aliens AbroadInternal Revenue 2016

What is the U S Citizens And Resident Aliens Abroad Internal Revenue

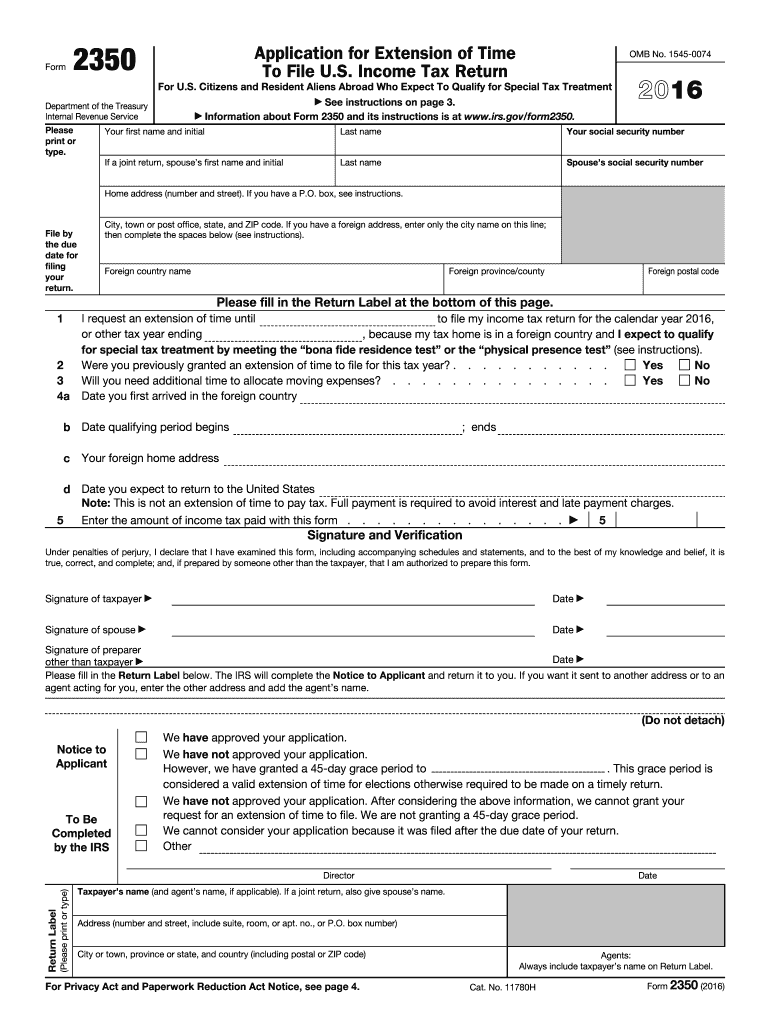

The U S Citizens And Resident Aliens Abroad Internal Revenue form is a crucial document for American citizens and resident aliens living outside the United States. This form is primarily used to report income earned abroad and to ensure compliance with U.S. tax laws. It serves to inform the Internal Revenue Service (IRS) about foreign income, foreign bank accounts, and any applicable tax credits or deductions. Understanding this form is essential for avoiding penalties and ensuring that all tax obligations are met while residing outside the U.S.

Steps to complete the U S Citizens And Resident Aliens Abroad Internal Revenue

Completing the U S Citizens And Resident Aliens Abroad Internal Revenue form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements from foreign sources and information about foreign bank accounts. Next, fill out the form by accurately reporting your worldwide income, claiming any applicable foreign tax credits, and disclosing foreign bank accounts as required. Finally, review the completed form for any errors before submitting it to the IRS by the designated deadline.

Legal use of the U S Citizens And Resident Aliens Abroad Internal Revenue

The legal use of the U S Citizens And Resident Aliens Abroad Internal Revenue form is governed by U.S. tax laws. To be considered valid, the form must be filled out accurately and submitted on time. It is essential to comply with IRS regulations regarding the reporting of foreign income and assets. Failure to do so can result in significant penalties, including fines and interest on unpaid taxes. Utilizing a reliable electronic signature solution can help ensure that the form is executed legally and securely.

Filing Deadlines / Important Dates

Filing deadlines for the U S Citizens And Resident Aliens Abroad Internal Revenue form are critical to avoid penalties. Typically, the form is due on April 15 for most taxpayers. However, individuals residing abroad may qualify for an automatic two-month extension, pushing the deadline to June 15. It is vital to keep track of these dates and ensure timely submission to remain compliant with U.S. tax laws.

Required Documents

To complete the U S Citizens And Resident Aliens Abroad Internal Revenue form, several documents are required. These include:

- Income statements from foreign employers or businesses

- Records of foreign bank accounts, including account numbers and balances

- Any documentation related to foreign tax credits or deductions

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in reporting.

Examples of using the U S Citizens And Resident Aliens Abroad Internal Revenue

Examples of using the U S Citizens And Resident Aliens Abroad Internal Revenue form can vary based on individual circumstances. For instance, an American expatriate working in Canada must report their Canadian income, while also claiming any foreign tax credits for taxes paid to the Canadian government. Another example includes a U.S. citizen who has investments in foreign stocks and must report any dividends earned. Each scenario highlights the importance of accurately reporting foreign income and understanding tax implications.

Quick guide on how to complete us citizens and resident aliens abroadinternal revenue

Prepare U S Citizens And Resident Aliens AbroadInternal Revenue seamlessly on any device

Web-based document management has gained traction among organizations and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, as it allows you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly and without delays. Manage U S Citizens And Resident Aliens AbroadInternal Revenue on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign U S Citizens And Resident Aliens AbroadInternal Revenue without effort

- Obtain U S Citizens And Resident Aliens AbroadInternal Revenue and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight key sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your updates.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document versions. airSlate SignNow manages all your document needs in just a few clicks from any device of your choosing. Edit and eSign U S Citizens And Resident Aliens AbroadInternal Revenue and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct us citizens and resident aliens abroadinternal revenue

Create this form in 5 minutes!

How to create an eSignature for the us citizens and resident aliens abroadinternal revenue

How to generate an electronic signature for the Us Citizens And Resident Aliens Abroadinternal Revenue online

How to generate an electronic signature for the Us Citizens And Resident Aliens Abroadinternal Revenue in Chrome

How to generate an eSignature for putting it on the Us Citizens And Resident Aliens Abroadinternal Revenue in Gmail

How to make an eSignature for the Us Citizens And Resident Aliens Abroadinternal Revenue straight from your mobile device

How to create an electronic signature for the Us Citizens And Resident Aliens Abroadinternal Revenue on iOS

How to generate an electronic signature for the Us Citizens And Resident Aliens Abroadinternal Revenue on Android devices

People also ask

-

What are the key features of airSlate SignNow for U S Citizens And Resident Aliens AbroadInternal Revenue?

airSlate SignNow offers essential features such as secure electronic signatures, customizable templates, and real-time tracking. These features are designed to facilitate document management for U S Citizens And Resident Aliens AbroadInternal Revenue, making compliance easier and more efficient.

-

How does airSlate SignNow benefit U S Citizens And Resident Aliens AbroadInternal Revenue?

The platform streamlines the signing process, allowing U S Citizens And Resident Aliens AbroadInternal Revenue to manage their documents remotely. This not only saves time but also enhances security and ensures that all documents are legally compliant.

-

Is airSlate SignNow cost-effective for U S Citizens And Resident Aliens AbroadInternal Revenue?

Yes, airSlate SignNow provides a cost-effective solution tailored for U S Citizens And Resident Aliens AbroadInternal Revenue. With various pricing plans available, you can choose one that fits your budget while benefiting from all the essential features.

-

What integrations does airSlate SignNow offer for U S Citizens And Resident Aliens AbroadInternal Revenue?

airSlate SignNow integrates seamlessly with popular applications like Google Drive, Dropbox, and Microsoft Office. These integrations are especially beneficial for U S Citizens And Resident Aliens AbroadInternal Revenue who need a cohesive workflow across their favorite tools.

-

How secure is airSlate SignNow for handling documents related to U S Citizens And Resident Aliens AbroadInternal Revenue?

Security is a top priority at airSlate SignNow. The platform employs industry-standard encryption and compliance measures that ensure the safety of documents for U S Citizens And Resident Aliens AbroadInternal Revenue. You can trust that your sensitive data is protected.

-

Can U S Citizens And Resident Aliens AbroadInternal Revenue access airSlate SignNow from multiple devices?

Absolutely! airSlate SignNow is designed to be accessible across various devices including smartphones, tablets, and desktops. This flexibility allows U S Citizens And Resident Aliens AbroadInternal Revenue to manage their documents anytime, anywhere.

-

What customer support options are available for U S Citizens And Resident Aliens AbroadInternal Revenue using airSlate SignNow?

airSlate SignNow offers various customer support options, including live chat, email, and a comprehensive knowledge base. U S Citizens And Resident Aliens AbroadInternal Revenue can count on reliable assistance to resolve any queries or problems they may encounter.

Get more for U S Citizens And Resident Aliens AbroadInternal Revenue

Find out other U S Citizens And Resident Aliens AbroadInternal Revenue

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast