Form 2350 Application for Extension of Time to File U S Income Tax Return 2022

What is the Form 2350 Application For Extension Of Time To File U S Income Tax Return

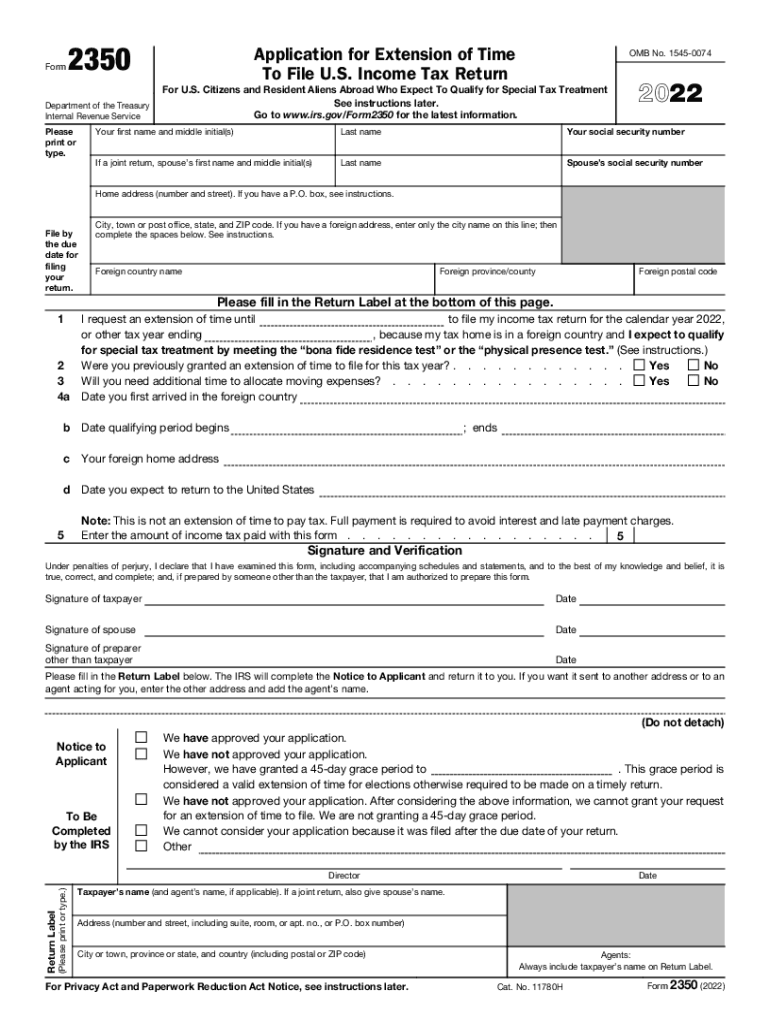

The Form 2350 is an official document used by U.S. taxpayers to request an extension of time to file their income tax return. Specifically, this form is designed for individuals who need additional time to file their tax returns due to living abroad or other circumstances that may delay their ability to meet the standard filing deadline. By submitting Form 2350, taxpayers can receive an automatic extension, allowing them to file their returns up to six months later than the original due date.

Steps to Complete the Form 2350 Application For Extension Of Time To File U S Income Tax Return

Completing the Form 2350 involves several key steps to ensure accuracy and compliance with IRS requirements. First, gather necessary information, including your name, address, and Social Security number. Next, indicate the tax year for which you are requesting the extension. It is essential to provide a valid reason for the extension, such as being outside the United States on the original due date. After filling out the required fields, review the form for any errors. Finally, sign and date the form before submitting it to the IRS.

How to Obtain the Form 2350 Application For Extension Of Time To File U S Income Tax Return

Taxpayers can obtain the Form 2350 from the IRS website or through various tax preparation services. The form is available in a printable PDF format, making it easy to download and fill out. Additionally, some tax software programs may include the form as part of their offerings, allowing users to complete it digitally. Ensure that you are using the correct version of the form for the tax year in question to avoid any complications during the filing process.

Legal Use of the Form 2350 Application For Extension Of Time To File U S Income Tax Return

The legal use of Form 2350 is governed by IRS regulations. When properly completed and submitted, it grants taxpayers an extension to file their income tax return without incurring penalties for late filing. However, it is important to note that while the form extends the filing deadline, it does not extend the deadline for any tax payments owed. Taxpayers are still responsible for paying any estimated taxes by the original due date to avoid interest and penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with Form 2350 is crucial for taxpayers. The standard deadline for filing individual income tax returns is April 15. However, if you are living abroad, you may qualify for an automatic two-month extension, making your deadline June 15. By submitting Form 2350, you can extend this deadline further, typically until October 15. It is essential to keep track of these dates to ensure compliance and avoid penalties.

Eligibility Criteria

To be eligible to use Form 2350, taxpayers must meet specific criteria. Primarily, this form is intended for individuals who are U.S. citizens or resident aliens living outside the United States on the original due date of their tax return. Additionally, taxpayers must have a valid reason for needing the extension, such as being unable to gather necessary documentation due to their overseas location. It is important to review eligibility requirements carefully to ensure compliance with IRS guidelines.

Quick guide on how to complete 2022 form 2350 application for extension of time to file us income tax return

Prepare Form 2350 Application For Extension Of Time To File U S Income Tax Return effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a fantastic eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct template and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form 2350 Application For Extension Of Time To File U S Income Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The simplest way to modify and eSign Form 2350 Application For Extension Of Time To File U S Income Tax Return with ease

- Find Form 2350 Application For Extension Of Time To File U S Income Tax Return and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize essential parts of your documents or obscure confidential data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and holds the same legal significance as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tiring document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 2350 Application For Extension Of Time To File U S Income Tax Return and ensure outstanding communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 2350 application for extension of time to file us income tax return

Create this form in 5 minutes!

People also ask

-

What is the federal tax extension form 2018, and why do I need it?

The federal tax extension form 2018 allows taxpayers to extend their filing deadline for their federal tax returns. It's essential for individuals who need extra time to gather documents or complete their returns. Using this form can help avoid penalties and provide peace of mind while ensuring compliance with tax obligations.

-

How can airSlate SignNow help me with the federal tax extension form 2018?

airSlate SignNow simplifies the process of filling out and eSigning the federal tax extension form 2018. Our platform offers a user-friendly interface and allows you to quickly complete and send the form digitally. With airSlate SignNow, you can save time and reduce the hassle of manual paperwork.

-

Is there a cost associated with using airSlate SignNow for the federal tax extension form 2018?

Yes, airSlate SignNow operates on a subscription model that offers various pricing plans to fit your needs. Each plan provides access to our features, including eSigning and document management for forms like the federal tax extension form 2018. You'll find our services to be a cost-effective solution for your document workflow.

-

What features does airSlate SignNow offer for managing the federal tax extension form 2018?

With airSlate SignNow, you can easily create, edit, and eSign the federal tax extension form 2018. Our platform also supports document templates, reminders for important deadlines, and secure cloud storage to keep your forms organized. These features streamline the tax extension process and enhance your overall productivity.

-

Are there any integration options available with airSlate SignNow for the federal tax extension form 2018?

Yes, airSlate SignNow integrates seamlessly with various applications, including popular accounting and tax software. These integrations make it easy to incorporate the federal tax extension form 2018 into your existing workflows and synchronize your data for greater efficiency. This ensures a smooth experience when managing your tax documentation.

-

Can I track the status of my federal tax extension form 2018 with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your federal tax extension form 2018. You will receive notifications when the form is viewed, signed, or completed, giving you peace of mind and keeping you informed throughout the process.

-

What benefits does using airSlate SignNow provide for submitting the federal tax extension form 2018?

Using airSlate SignNow to submit the federal tax extension form 2018 offers numerous benefits, including saving time, reducing paper clutter, and ensuring a secure submission process. Additionally, our platform enhances collaboration, allowing multiple users to eSign the form quickly and efficiently. Overall, it streamlines your tax management and enhances compliance.

Get more for Form 2350 Application For Extension Of Time To File U S Income Tax Return

- New york affidavit 497322003 form

- New york affidavit 497322004 form

- New york affidavit 497322005 form

- New york child support form

- Ny collection unit form

- New york child support new york form

- Ny note issue form

- Notice of volunteer ambulance workers injury or death for workers compensation new york form

Find out other Form 2350 Application For Extension Of Time To File U S Income Tax Return

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile