Schedule K 1, Form N 20, Rev , Partner's Share Hawaii Gov 2013

What is the Schedule K-1, Form N-20, Rev, Partner's Share Hawaii gov

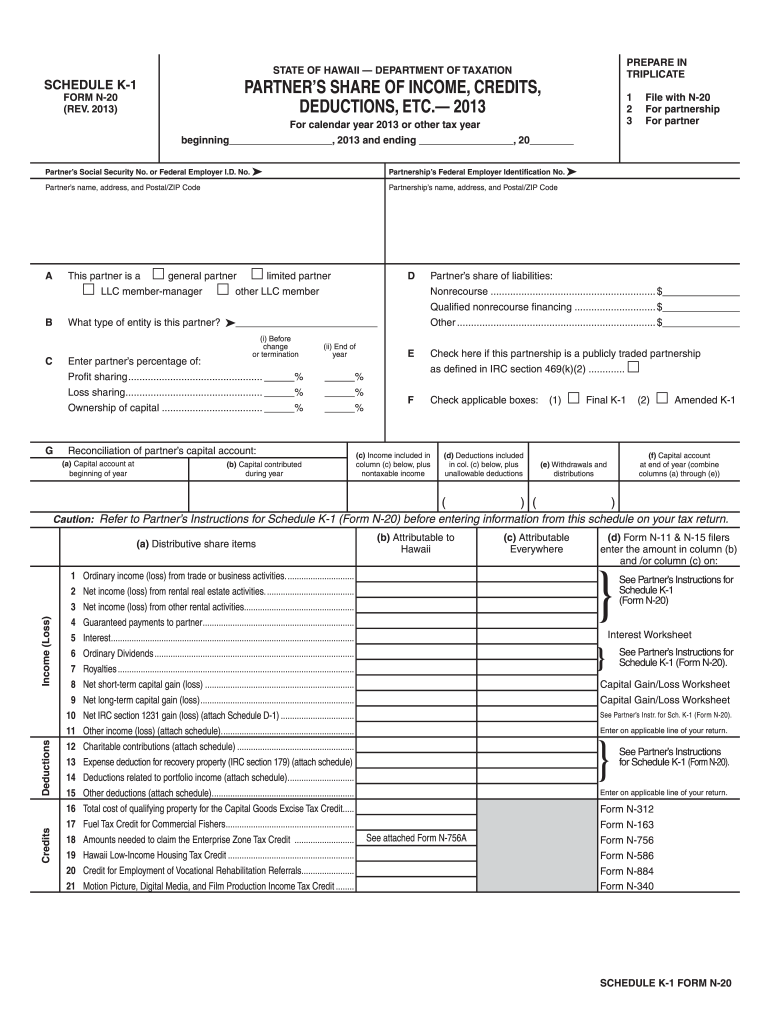

The Schedule K-1, Form N-20, Rev, Partner's Share is a tax document used in Hawaii for reporting each partner's share of income, deductions, and credits from a partnership. This form is essential for partnerships to provide their partners with the necessary information to complete their individual tax returns. It includes details about the partner's share of the partnership's income, losses, and other tax-related items. Understanding this form is crucial for ensuring accurate tax reporting and compliance with state tax laws.

How to use the Schedule K-1, Form N-20, Rev, Partner's Share Hawaii gov

Using the Schedule K-1, Form N-20, Rev, Partner's Share involves several key steps. First, partners must receive their individual K-1 forms from the partnership. Each partner should review the information provided, ensuring accuracy in reported income, deductions, and credits. Once verified, partners will use the details from their K-1 to complete their personal income tax returns, typically on Form 1040. It is important to keep a copy of the K-1 for personal records and future reference.

Steps to complete the Schedule K-1, Form N-20, Rev, Partner's Share Hawaii gov

Completing the Schedule K-1, Form N-20, Rev, Partner's Share requires careful attention to detail. The following steps outline the process:

- Obtain the form from the Hawaii Department of Taxation or your partnership.

- Fill in the partner's name, address, and identifying number.

- Report the partner's share of the partnership's income, deductions, and credits as provided by the partnership.

- Ensure all information is accurate and complete.

- Sign and date the form, if required.

- Submit the completed form to the appropriate tax authority along with your personal tax return.

Legal use of the Schedule K-1, Form N-20, Rev, Partner's Share Hawaii gov

The Schedule K-1, Form N-20, Rev, Partner's Share is legally recognized as a valid document for reporting partnership income in Hawaii. It must be accurately completed and submitted to ensure compliance with state tax laws. Partners are responsible for the information reported on their K-1 forms, and any discrepancies can lead to penalties or audits. It is advisable to retain copies of the K-1 for at least three years for record-keeping and potential future reference.

Key elements of the Schedule K-1, Form N-20, Rev, Partner's Share Hawaii gov

Key elements of the Schedule K-1, Form N-20, Rev, Partner's Share include:

- Partner's name and identification number.

- Partnership name and tax identification number.

- Details of the partner's share of income, losses, and deductions.

- Information on credits and other tax-related items.

- Signature of the authorized partner or representative.

State-specific rules for the Schedule K-1, Form N-20, Rev, Partner's Share Hawaii gov

Hawaii has specific rules regarding the use of the Schedule K-1, Form N-20, Rev, Partner's Share. These rules outline the requirements for partnerships operating in the state, including how to report income and deductions specific to Hawaii tax law. Partnerships must ensure compliance with local regulations and deadlines for filing, which may differ from federal requirements. Understanding these state-specific rules is vital for accurate tax reporting and avoiding penalties.

Quick guide on how to complete schedule k 1 form n 20 rev 2013 partneramp39s share hawaiigov

Your assistance manual on how to prepare your Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov

If you’re looking to find out how to finalize and transmit your Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov, here are some straightforward recommendations on how to simplify tax submission.

Firstly, you just need to create your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax paperwork effortlessly. With its editing tools, you can alternate between text, checkboxes, and eSignatures and return to modify information as necessary. Optimize your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing options.

Adhere to the steps below to complete your Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov within minutes:

- Create your account and begin working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through editions and schedules.

- Click Get form to access your Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov in our editor.

- Input the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to append your legally-binding eSignature (if required).

- Review your document and rectify any errors.

- Store changes, print your copy, forward it to your recipient, and download it to your device.

Utilize this guide to submit your taxes electronically with airSlate SignNow. Please remember that filing on paper may increase return errors and postpone refunds. Naturally, before electronically filing your taxes, verify the IRS website for declaration guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form n 20 rev 2013 partneramp39s share hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form n 20 rev 2013 partneramp39s share hawaiigov

How to generate an eSignature for the Schedule K 1 Form N 20 Rev 2013 Partneramp39s Share Hawaiigov online

How to make an eSignature for your Schedule K 1 Form N 20 Rev 2013 Partneramp39s Share Hawaiigov in Chrome

How to generate an electronic signature for putting it on the Schedule K 1 Form N 20 Rev 2013 Partneramp39s Share Hawaiigov in Gmail

How to make an electronic signature for the Schedule K 1 Form N 20 Rev 2013 Partneramp39s Share Hawaiigov right from your smart phone

How to create an eSignature for the Schedule K 1 Form N 20 Rev 2013 Partneramp39s Share Hawaiigov on iOS devices

How to generate an electronic signature for the Schedule K 1 Form N 20 Rev 2013 Partneramp39s Share Hawaiigov on Android OS

People also ask

-

What is Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov. used for?

Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov. is used to report each partner's share of income, deductions, and credits from partnerships operating in Hawaii. This form is crucial for partners to accurately report their income on their individual tax returns. Understanding this form helps ensure compliance with state tax regulations.

-

How can airSlate SignNow help with Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov. documents?

airSlate SignNow streamlines the process of preparing and signing Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov. documents, making it easier for partners to collaborate and finalize necessary paperwork. With our eSignature solution, you can send, sign, and manage documents securely and efficiently, accelerating tax preparation.

-

Is airSlate SignNow cost-effective for managing Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov. forms?

Yes, airSlate SignNow offers a cost-effective solution for managing Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov. forms. Our pricing plans are designed to accommodate businesses of all sizes, providing flexibility and accessibility without compromising on features.

-

What integrations does airSlate SignNow offer for managing tax-related documents like Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov.?

airSlate SignNow integrates seamlessly with various accounting and document management software, helping you manage your Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov. forms efficiently. This integration allows for easy data transfer and ensures that your documents are always up to date.

-

Can I customize templates for Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov. in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and customize templates for Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov. forms. This feature saves you time and ensures that all necessary fields are included for each partner, simplifying the document preparation process.

-

How secure is airSlate SignNow for handling Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov. documents?

Security is a top priority at airSlate SignNow. We employ advanced encryption and compliance measures to ensure that all Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov. documents are protected and handled with the utmost confidentiality, giving you peace of mind.

-

What benefits can I expect from using airSlate SignNow for Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov. forms?

Using airSlate SignNow for your Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov. forms offers numerous benefits, including enhanced collaboration, faster turnaround times, and reduced paper clutter. Our user-friendly interface ensures that your team can easily navigate the signing process.

Get more for Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov

- Nn0283e form

- Alaska administrator designee form

- Demande de prise en charge opca 3 votre opca opca3plus form

- City of sanford contractor registration form

- Checklist alta hospitalar coopuscombr form

- Sba form 1086

- Declaration and certification of finances dcf uic office of uic imba form

- Minor s parental consent royale business club international form

Find out other Schedule K 1, Form N 20, Rev , Partner's Share Hawaii gov

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT