Schedule K 1, Form N 20, Rev , Partner's Share of Income 2019

What is Schedule K-1, Form N-20?

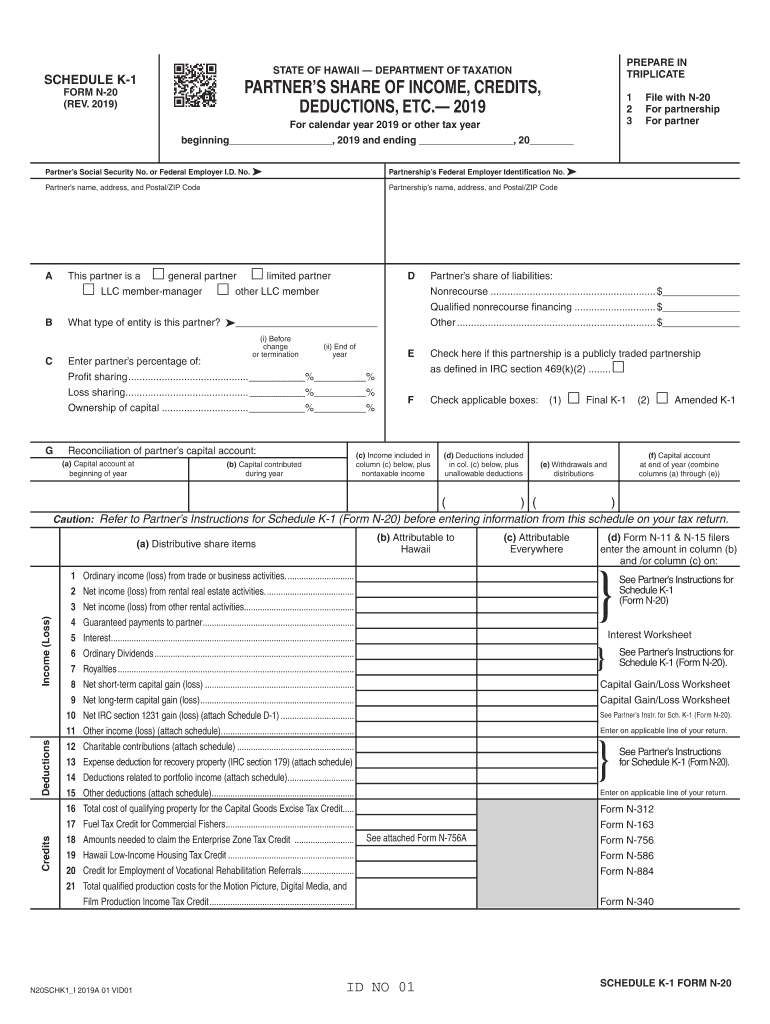

Schedule K-1, Form N-20, is a tax document used in Hawaii to report a partner's share of income, deductions, and credits from partnerships. This form is essential for individuals who are partners in a partnership, as it provides detailed information needed to accurately complete their personal income tax returns. The information reported on this form helps ensure that each partner is taxed appropriately on their share of the partnership's income.

How to Use Schedule K-1, Form N-20

To effectively use Schedule K-1, Form N-20, partners should first review the information provided on the form. It includes various sections detailing the partner's share of income, deductions, and credits. Partners must accurately report these figures on their individual tax returns, typically on Form N-11 or N-15, depending on their filing status. It's important to keep a copy of the K-1 for personal records and to ensure that all reported figures are consistent with the partnership's tax filings.

Steps to Complete Schedule K-1, Form N-20

Completing Schedule K-1, Form N-20 involves several key steps:

- Gather necessary information, including the partnership's tax identification number and the partner's share of income and deductions.

- Fill out the form accurately, ensuring that all income, deductions, and credits are reported in the correct sections.

- Review the completed form for accuracy and completeness.

- Distribute copies of the completed K-1 to all partners and retain a copy for your records.

Legal Use of Schedule K-1, Form N-20

The legal use of Schedule K-1, Form N-20 is crucial for compliance with Hawaii tax laws. This form must be accurately completed and filed to ensure that partners are taxed correctly on their share of the partnership's income. Failure to provide accurate information can lead to penalties and interest from the state tax authority. Therefore, it is essential for partners to understand their responsibilities regarding this form and to ensure that it is filed in accordance with state regulations.

Filing Deadlines for Schedule K-1, Form N-20

Filing deadlines for Schedule K-1, Form N-20 typically align with the partnership's tax return due date. Generally, partnerships must file their tax returns by the fifteenth day of the fourth month following the end of their tax year. Partners should ensure they receive their K-1 forms in a timely manner to complete their individual tax returns before the filing deadline. It is advisable to consult with a tax professional to confirm specific deadlines and requirements based on individual circumstances.

Who Issues Schedule K-1, Form N-20?

Schedule K-1, Form N-20 is issued by partnerships to their partners. The partnership is responsible for preparing and distributing the K-1 forms to each partner after the partnership's tax return has been filed. Each partner receives a K-1 that reflects their share of the partnership's income, deductions, and credits, which they will then use to report on their personal tax returns. It is important for partnerships to ensure that these forms are accurate and distributed in a timely manner to facilitate proper tax reporting by the partners.

Quick guide on how to complete schedule k 1 form n 20 rev 2019 partners share of income

Prepare Schedule K 1, Form N 20, Rev , Partner's Share Of Income effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Schedule K 1, Form N 20, Rev , Partner's Share Of Income on any device using airSlate SignNow’s Android or iOS applications and streamline any document-centric process today.

How to modify and eSign Schedule K 1, Form N 20, Rev , Partner's Share Of Income with ease

- Locate Schedule K 1, Form N 20, Rev , Partner's Share Of Income and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive data with tools that airSlate SignNow offers specifically for that function.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Schedule K 1, Form N 20, Rev , Partner's Share Of Income and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form n 20 rev 2019 partners share of income

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form n 20 rev 2019 partners share of income

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What are hitax hawaii gov forms n 20?

Hitax hawaii gov forms n 20 are specific tax forms required for filing income taxes in Hawaii. These forms help residents report their income and claim deductions as per Hawaii tax laws. Utilizing airSlate SignNow, you can easily fill out and submit these forms digitally.

-

How does airSlate SignNow help with hitax hawaii gov forms n 20?

AirSlate SignNow provides a streamlined process for filling out hitax hawaii gov forms n 20. With its user-friendly interface, you can complete and eSign these forms quickly, ensuring compliance with state regulations without the hassle of paper forms.

-

Is there a cost associated with using airSlate SignNow for hitax hawaii gov forms n 20?

Yes, there is a pricing structure for using airSlate SignNow to manage hitax hawaii gov forms n 20. However, it is designed to be cost-effective and offers various subscription plans to fit the needs of different users, from individuals to businesses.

-

What features does airSlate SignNow offer for handling hitax hawaii gov forms n 20?

AirSlate SignNow offers several features for hitax hawaii gov forms n 20, including document editing, eSigning, and secure storage. Additional features like templates and collaborative tools make it easy for multiple parties to work on the same documents.

-

Can I integrate airSlate SignNow with other applications for hitax hawaii gov forms n 20?

Yes, airSlate SignNow supports integrations with various applications that can enhance your experience with hitax hawaii gov forms n 20. You can connect it with cloud storage services, CRMs, and productivity tools to create a seamless workflow.

-

What are the benefits of using airSlate SignNow for hitax hawaii gov forms n 20?

Using airSlate SignNow for hitax hawaii gov forms n 20 streamlines the tax filing process. It reduces the time spent on paperwork, minimizes errors, and provides secure storage for your documents, making it simpler to manage your tax obligations.

-

Is there customer support available for queries related to hitax hawaii gov forms n 20?

Absolutely! AirSlate SignNow offers dedicated customer support for any inquiries related to hitax hawaii gov forms n 20. Whether you have questions about how to complete forms or need assistance with the platform, our support team is available to help.

Get more for Schedule K 1, Form N 20, Rev , Partner's Share Of Income

- Subcontractors agreement virginia form

- Va pay workers form

- Virginia workers compensation 497427945 form

- Option to purchase addendum to residential lease lease or rent to own virginia form

- Virginia prenuptial premarital agreement uniform premarital agreement act with financial statements virginia

- Virginia prenuptial form

- Amendment to prenuptial or premarital agreement virginia form

- Financial statements only in connection with prenuptial premarital agreement virginia form

Find out other Schedule K 1, Form N 20, Rev , Partner's Share Of Income

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT