Hawaii Form N 20 2015

What is the Hawaii Form N-20

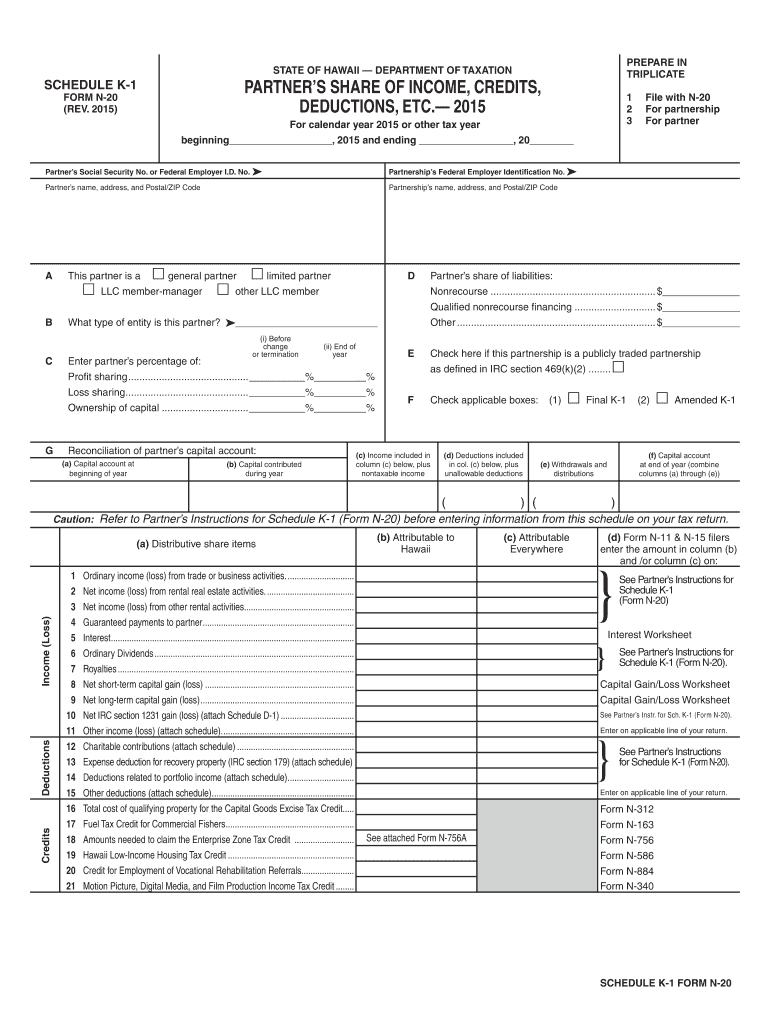

The Hawaii Form N-20 is a state tax return form specifically designed for corporations operating in Hawaii. This form is essential for corporations to report their income, deductions, and tax liabilities to the Hawaii Department of Taxation. The N-20 form is used by various business entities, including C corporations, to ensure compliance with state tax regulations. Completing this form accurately is crucial for maintaining good standing with state tax authorities.

How to use the Hawaii Form N-20

Using the Hawaii Form N-20 involves several steps to ensure accurate reporting of your corporation's financial information. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant deductions. Next, fill out the form carefully, entering your corporation's income, deductions, and credits as required. It is important to follow the instructions provided with the form to avoid errors. Once completed, the form can be submitted either electronically or via mail, depending on your preference and the requirements set by the Hawaii Department of Taxation.

Steps to complete the Hawaii Form N-20

Completing the Hawaii Form N-20 requires a systematic approach:

- Gather all financial records, including income, expenses, and previous tax returns.

- Obtain the latest version of the Form N-20 from the Hawaii Department of Taxation.

- Fill in the corporation's identifying information, including the name, address, and federal employer identification number (EIN).

- Report total income, detailing all sources of revenue.

- List all allowable deductions and credits to determine the taxable income.

- Calculate the total tax liability based on the applicable tax rates.

- Review the completed form for accuracy before submission.

Legal use of the Hawaii Form N-20

The Hawaii Form N-20 must be used in accordance with state tax laws and regulations. It is legally binding, and any inaccuracies or omissions can result in penalties or audits by the Hawaii Department of Taxation. Corporations are required to file this form annually, ensuring that all financial activities are reported accurately. Using the form correctly helps maintain compliance and avoid legal issues related to tax obligations.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines when filing the Hawaii Form N-20. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Timely filing is crucial to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Hawaii Form N-20 can be submitted through various methods to accommodate different preferences. Corporations can file electronically using the Hawaii Department of Taxation's online services, which is a convenient option that allows for quicker processing. Alternatively, the form can be mailed to the appropriate tax office, ensuring that it is postmarked by the due date. In-person submissions may also be accepted at designated tax offices, but it is advisable to check the latest guidelines from the Department of Taxation for any specific requirements.

Quick guide on how to complete hawaii form n 20 2015

Your assistance manual on how to prepare your Hawaii Form N 20

If you’re interested in learning how to finalize and submit your Hawaii Form N 20, here are a few brief guidelines to simplify tax submission.

To begin, you just need to set up your airSlate SignNow account to change how you handle documents online. airSlate SignNow is a highly intuitive and powerful document solution that allows you to modify, draft, and complete your tax documents effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and revert to amend responses as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing options.

Follow the instructions below to complete your Hawaii Form N 20 in just a few minutes:

- Create your account and start managing PDFs in minutes.

- Explore our library to find any IRS tax form; browse through different versions and schedules.

- Click Get form to access your Hawaii Form N 20 in our editor.

- Populate the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to include your legally-recognized eSignature (if necessary).

- Review your document and rectify any mistakes.

- Apply changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can lead to increased mistakes and delayed refunds. Furthermore, before electronically filing your taxes, verify the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct hawaii form n 20 2015

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

-

How do I fill up form for SNAP 2015?

Hey! Firstly I do hope that you know all about the SNAP as then you will be better prepared for the examination. The SNAP 2015 Application Form for the examination is completely online and is done in two stages namely the test registration and the registration to the individual colleges post the examination. In the linked article you will get the complee process of applying online. Good luck!

-

What is the link for filling out the CAT 2015 form?

CAT 2014

-

I am 2015 batch passed out with computer science in B.E. so may I fill the AMCAT form?

Yes! You definitely can.I too wrote my AMCAT exam last year (August 2015). I'm graduated in 2015 as well.But my suggestion to you - write AMCAT; but don't expect companies which offer CTC above 6LPA. If at all such companies do appear, they usually expect you to have 2+ years of experience.If you can prepare well, then you can try eLitmus. It's much, much better than AMCAT.Good luck!

-

What is last date for filling out an application form for the MH MBA CET 2015?

Pramesh Shrivastava Does Glocal provide long distance MBA as well. Any update would be really appreciated.

Create this form in 5 minutes!

How to create an eSignature for the hawaii form n 20 2015

How to generate an electronic signature for your Hawaii Form N 20 2015 in the online mode

How to make an eSignature for your Hawaii Form N 20 2015 in Google Chrome

How to create an eSignature for signing the Hawaii Form N 20 2015 in Gmail

How to generate an electronic signature for the Hawaii Form N 20 2015 straight from your mobile device

How to create an electronic signature for the Hawaii Form N 20 2015 on iOS

How to generate an electronic signature for the Hawaii Form N 20 2015 on Android OS

People also ask

-

What is Hawaii Form N 20?

Hawaii Form N 20 is the Individual Income Tax Return for residents of Hawaii. It is used to report income and calculate taxes owed to the state. Completing and submitting Hawaii Form N 20 is essential for compliance with state tax regulations.

-

How can airSlate SignNow help with Hawaii Form N 20?

airSlate SignNow simplifies the process of completing and eSigning Hawaii Form N 20. With its user-friendly interface, you can effortlessly fill out the form, add signatures, and send it securely. This saves you time and ensures that your documents are processed quickly.

-

Is airSlate SignNow cost-effective for filing Hawaii Form N 20?

Yes, airSlate SignNow offers competitive pricing plans that are cost-effective for both individuals and businesses. By using airSlate SignNow for your Hawaii Form N 20, you can save money on paper, printing, and mailing costs while ensuring a smooth filing process.

-

What features does airSlate SignNow offer for Hawaii Form N 20?

airSlate SignNow provides features like document templates, eSignature, document sharing, and real-time tracking for Hawaii Form N 20. These tools enhance your ability to complete the form accurately and efficiently, making the tax filing process seamless.

-

Can I integrate airSlate SignNow with other platforms for Hawaii Form N 20?

Absolutely! airSlate SignNow offers a variety of integrations with popular business tools such as Google Drive, Dropbox, and CRM systems. This allows you to easily access and manage your Hawaii Form N 20 alongside your other documents.

-

What are the benefits of using airSlate SignNow for Hawaii Form N 20?

Using airSlate SignNow for your Hawaii Form N 20 ensures quick and secure document handling. You benefit from features such as automated reminders, improved collaboration, and enhanced security, making your tax filing experience easier and more efficient.

-

Is there customer support available for using airSlate SignNow with Hawaii Form N 20?

Yes, airSlate SignNow provides excellent customer support to assist you with Hawaii Form N 20. Whether you have questions about features or need assistance in the filing process, the support team is ready to help you navigate any challenges.

Get more for Hawaii Form N 20

- International student application form education training and

- Elleebana lash lift criteria checklist form pop lash ampamp beauty

- Dlsu reconsideration form

- Geometry assignment find the measure of each angle indicated worksheet answers 42316009 form

- Citizens arrest minnesota form

- Pclepubbookscontract lawchaptersfinals oregon state bar form

- Restitution agreement template 787747025 form

- Restorative practice treatment agreement template form

Find out other Hawaii Form N 20

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF