Hawaii Form N 20 2016

What is the Hawaii Form N-20

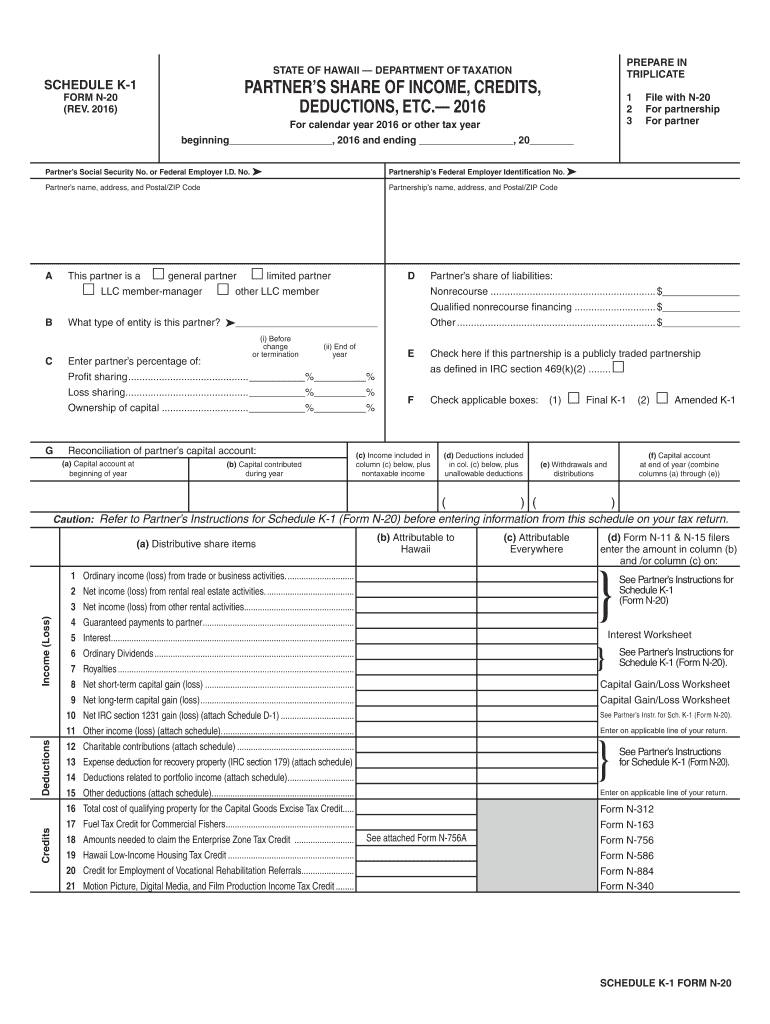

The Hawaii Form N-20 is a tax form specifically designed for corporations operating within the state of Hawaii. It is used to report income, deductions, and credits, allowing businesses to calculate their state tax liability accurately. This form is essential for corporations to comply with Hawaii's tax regulations and ensure proper reporting of financial activities. Understanding the specifics of this form is crucial for any corporation to maintain compliance and avoid potential penalties.

How to use the Hawaii Form N-20

Using the Hawaii Form N-20 involves several key steps. First, gather all necessary financial information, including income statements, expense reports, and any applicable deductions. Next, accurately fill out the form, ensuring that all figures are correct and align with your financial records. After completing the form, review it thoroughly for any errors before submission. Finally, submit the form to the appropriate state department by the designated deadline to ensure compliance and avoid penalties.

Steps to complete the Hawaii Form N-20

Completing the Hawaii Form N-20 requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather financial documents, including income statements and expense reports.

- Fill out the identification section with the corporation's name, address, and tax identification number.

- Report total income and allowable deductions in the designated sections.

- Calculate the tax liability based on the provided instructions.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Hawaii Form N-20

The Hawaii Form N-20 is legally binding and must be completed in accordance with state tax laws. Corporations are required to file this form annually, and failure to do so can result in penalties and interest on unpaid taxes. It is essential for businesses to understand the legal implications of submitting this form, including the requirement for accurate reporting and adherence to deadlines.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the Hawaii Form N-20 to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For example, if the tax year ends on December 31, the form is due by April 15 of the following year. It is important to stay informed about any changes in deadlines that may be announced by the state.

Form Submission Methods (Online / Mail / In-Person)

The Hawaii Form N-20 can be submitted through various methods. Corporations have the option to file the form online through the state’s tax portal, which is often the quickest method. Alternatively, the form can be mailed to the appropriate tax office or submitted in person. Each method has its own processing times and requirements, so businesses should choose the one that best suits their needs.

Quick guide on how to complete hawaii form n 20 2016

Your assistance manual on how to prepare your Hawaii Form N 20

If you’re wondering how to complete and submit your Hawaii Form N 20, here are some brief instructions on how to make tax reporting easier.

To begin, you just need to create your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that allows you to modify, generate, and finalize your income tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to modify responses as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps below to finalize your Hawaii Form N 20 within moments:

- Create your account and start working with PDFs in no time.

- Utilize our directory to obtain any IRS tax form; explore different versions and schedules.

- Click Get form to access your Hawaii Form N 20 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and correct any errors.

- Save modifications, print a copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that filing by mail can lead to increased errors and delayed refunds. Of course, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct hawaii form n 20 2016

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Can I fill out the SSC CHSL 2017 form while waiting for the 2016 results?

Yes you can.By now you should have started preparing also.We motivate students to crack govt exams while working.Join our YouTube channel SSC PATHSHALA and enjoy learning like never before.Classroom Program for English Mains: Classroom Program for English Mains - YouTube

-

How do I fill UPSC 2016 form?

Below some steps are given to apply online NDA 2017 application form, follow given below steps:Go to the website.Then click on part-1 registration and enter details like name, education qualification, date of birth and other required details.complete part-1 of online registration.Select the fee payment mode.Then go to part-1 registration of NDA Exam and upload scanned signature and photo in the prescribed format.Take print out of application forms after completing part-2 registration.Generate bank challan and then make payment of application fee. After fee payment check your application status by entering your registration number and date of birth.For more details you will check How to fill NDA Application Form.

-

How do I fill TMISAT 2016 form?

The forms are available on TMI's website from December onwards as far as I know.Tolani EducationThe instructions are very clear on it, if you still have doubts then you can email the college your querries on anything, they will get back to you in 3 days.

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

Create this form in 5 minutes!

How to create an eSignature for the hawaii form n 20 2016

How to make an eSignature for your Hawaii Form N 20 2016 online

How to make an eSignature for your Hawaii Form N 20 2016 in Chrome

How to make an electronic signature for signing the Hawaii Form N 20 2016 in Gmail

How to generate an eSignature for the Hawaii Form N 20 2016 straight from your smartphone

How to create an electronic signature for the Hawaii Form N 20 2016 on iOS

How to make an electronic signature for the Hawaii Form N 20 2016 on Android OS

People also ask

-

What is Hawaii Form N 20?

Hawaii Form N 20 is a tax form used for filing corporate income tax returns in the state of Hawaii. It is essential for businesses operating in Hawaii to accurately complete this form to comply with state tax regulations. Using airSlate SignNow can streamline the process of filling out and signing Hawaii Form N 20.

-

How can airSlate SignNow help me with Hawaii Form N 20?

airSlate SignNow provides an efficient way for businesses to complete and eSign Hawaii Form N 20. The platform simplifies document management, allowing users to electronically sign, send, and store these important tax forms securely. This saves time and ensures compliance with filing deadlines.

-

What are the pricing options for using airSlate SignNow to manage Hawaii Form N 20?

airSlate SignNow offers various pricing plans to cater to businesses of all sizes looking to manage their documents, including Hawaii Form N 20. Plans are available on a monthly or annual basis, with a free trial option to get started without any commitment. This flexibility allows you to choose the best solution for your business needs.

-

Are there any features specifically designed for handling Hawaii Form N 20 on airSlate SignNow?

Yes, airSlate SignNow includes features like document templates, custom workflows, and automated reminders that are particularly advantageous for handling Hawaii Form N 20. These features ensure that users can complete and file their tax documents on time while remaining organized and efficient.

-

What are the benefits of using airSlate SignNow for Hawaii Form N 20?

Using airSlate SignNow for Hawaii Form N 20 provides several benefits, including increased efficiency, reduced errors, and improved document security. The user-friendly interface allows for effortless eSigning and collaboration, which can help businesses save time and avoid complications during tax season.

-

Can I integrate airSlate SignNow with other tools to assist with Hawaii Form N 20?

Yes, airSlate SignNow offers robust integration capabilities with popular productivity tools and software, making it easier to manage Hawaii Form N 20 alongside other business processes. Integrating with platforms like Google Drive, Salesforce, and Microsoft Office enhances productivity and streamlines your document workflows.

-

Is airSlate SignNow suitable for small businesses filing Hawaii Form N 20?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, making it an excellent choice for small businesses filing Hawaii Form N 20. Its cost-effective plans, intuitive interface, and essential features help small businesses manage their documentation and eSigning needs without overwhelming complexity.

Get more for Hawaii Form N 20

- Blue cross of illinois application for payment consideration form

- Etihad airways visa form

- Public spa pool daily record sheet klamath county klamathcounty form

- Form 4a slp

- Immunization form stony brook university stonybrook

- 37326 required minimum distribution request form

- 1554 eta request for further processingsupplementary information

- Restaurant sale agreement template form

Find out other Hawaii Form N 20

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors