Schedule K 1, Form N 20, Rev , Partner's Share of Income 2021

What is the Schedule K-1, Form N-20?

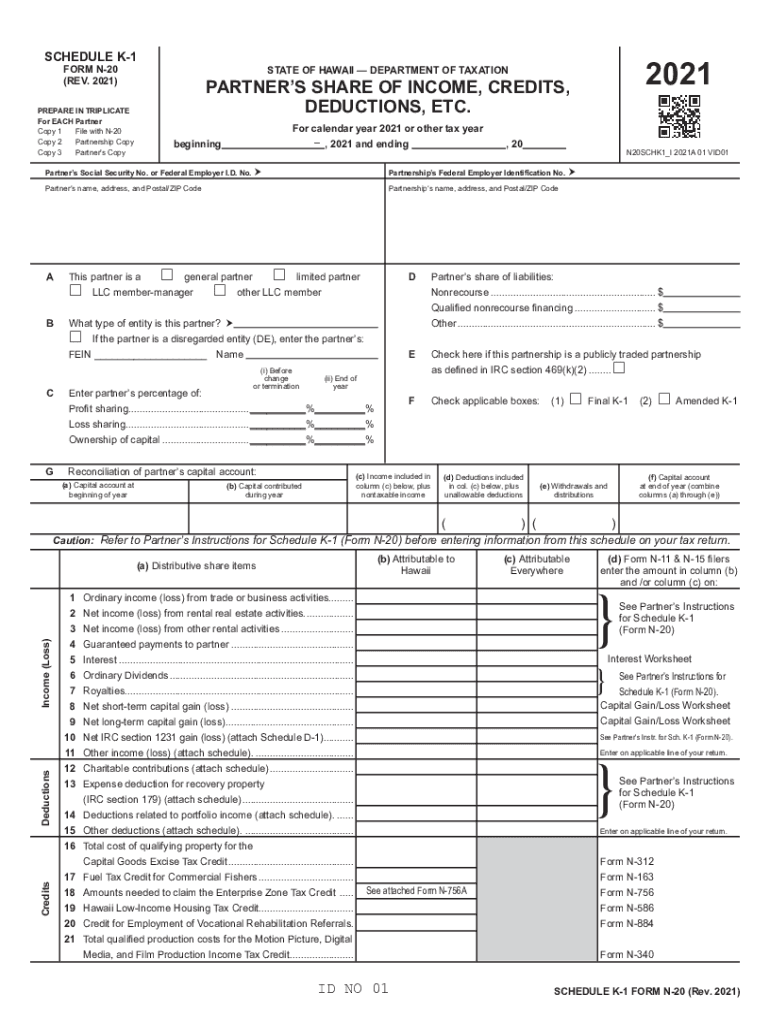

The Schedule K-1, Form N-20, is a crucial document used in Hawaii for reporting a partner's share of income, deductions, and credits from partnerships. This form is essential for individuals who are involved in partnerships or multi-member LLCs, as it provides detailed information about each partner's financial stake in the entity. The Schedule K-1 must be filed with the Hawaii income tax return and is used to ensure accurate reporting of income on individual tax returns.

Steps to Complete the Schedule K-1, Form N-20

Completing the Schedule K-1, Form N-20 involves several key steps:

- Gather necessary financial documents, including partnership agreements and previous tax returns.

- Determine each partner's share of income, deductions, and credits based on the partnership's financial statements.

- Fill out the Schedule K-1 by entering the partner's name, address, and taxpayer identification number.

- Report the partner's share of income, deductions, and any other relevant information in the appropriate sections of the form.

- Review the completed form for accuracy before submitting it with the partnership's tax return.

Legal Use of the Schedule K-1, Form N-20

The Schedule K-1, Form N-20, is legally binding when completed accurately and submitted in compliance with Hawaii tax laws. It must be filed by partnerships and multi-member LLCs to report each partner's share of income and deductions. Failure to file or inaccuracies can lead to penalties and issues with tax compliance. Therefore, it is important to ensure that all information is correct and that the form is submitted by the required deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1, Form N-20, align with the general tax filing deadlines in Hawaii. Typically, partnerships must file their tax returns by the fifteenth day of the fourth month following the close of their taxable year. For most partnerships operating on a calendar year, this means the due date is April 15. It is essential to adhere to these deadlines to avoid penalties and interest on late filings.

Who Issues the Form?

The Schedule K-1, Form N-20, is issued by partnerships or multi-member LLCs to their partners. Each partner receives a copy of the K-1, which details their share of the partnership's income, deductions, and credits. It is the responsibility of the partnership to ensure that each partner receives their K-1 in a timely manner so they can accurately report their income on their individual tax returns.

Key Elements of the Schedule K-1, Form N-20

Key elements of the Schedule K-1, Form N-20, include:

- Partner's name and identification information.

- Partnership's name and identification information.

- Partner's share of income, deductions, and credits.

- Specific instructions for reporting the information on individual tax returns.

- Details on any distributions received by the partner during the tax year.

Quick guide on how to complete schedule k 1 form n 20 rev 2021 partners share of income

Complete Schedule K 1, Form N 20, Rev , Partner's Share Of Income effortlessly on any device

Online document administration has surged in popularity among businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed papers, as you can easily locate the needed template and securely maintain it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly with no holdups. Manage Schedule K 1, Form N 20, Rev , Partner's Share Of Income on any system using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Schedule K 1, Form N 20, Rev , Partner's Share Of Income with ease

- Locate Schedule K 1, Form N 20, Rev , Partner's Share Of Income and then click Get Form to commence.

- Use the tools we provide to complete your form.

- Emphasize vital sections of your documents or obscure sensitive information using tools tailored for that purpose by airSlate SignNow.

- Craft your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether via email, text message (SMS), a shared link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the tedious search for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Schedule K 1, Form N 20, Rev , Partner's Share Of Income to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form n 20 rev 2021 partners share of income

Create this form in 5 minutes!

People also ask

-

What is hitax hawaii gov and how can it benefit my business?

Hitax hawaii gov is a government platform that enables Hawaii residents to manage their tax filings online efficiently. By integrating with airSlate SignNow, businesses can easily send and eSign documents related to tax processes, streamlining communication and document handling.

-

How much does airSlate SignNow cost for users in Hawaii?

AirSlate SignNow offers competitive pricing plans that cater to different business sizes and needs. For users looking to utilize hitax hawaii gov services, the affordability of airSlate SignNow ensures you can efficiently manage tax-related documents without breaking the bank.

-

What features does airSlate SignNow offer for enhancing my workflow?

AirSlate SignNow offers several features such as document eSigning, templates, and secure document storage. These capabilities can signNowly enhance your workflow, especially when handling documents related to hitax hawaii gov, ensuring compliance and efficiency.

-

Can airSlate SignNow be integrated with existing software I use?

Yes, airSlate SignNow seamlessly integrates with numerous applications including CRMs and cloud storage services. This compatibility allows you to easily incorporate tools that link directly to hitax hawaii gov, enhancing your business's operational efficiency.

-

Is airSlate SignNow compliant with legal regulations in relation to hitax hawaii gov?

Absolutely! AirSlate SignNow is designed to comply with legal standards for electronic signatures, ensuring that all documents signed for hitax hawaii gov meet the necessary requirements for authenticity and security.

-

What benefits does airSlate SignNow provide over traditional document signing methods?

Using airSlate SignNow to eSign documents provides numerous benefits including reduced turnaround times and increased convenience. Especially when dealing with hitax hawaii gov documents, this digital approach eliminates the hassles associated with physical signatures.

-

How secure is airSlate SignNow for handling sensitive tax documents?

AirSlate SignNow employs industry-leading security measures including encryption and user authentication to protect your documents. This level of security is particularly vital when dealing with sensitive information related to hitax hawaii gov.

Get more for Schedule K 1, Form N 20, Rev , Partner's Share Of Income

- North dakota identity 497317829 form

- Identity theft by known imposter package north dakota form

- Nd assets form

- Essential documents for the organized traveler package north dakota form

- North dakota personal form

- Postnuptial agreements package north dakota form

- Letters of recommendation package north dakota form

- North dakota mechanics form

Find out other Schedule K 1, Form N 20, Rev , Partner's Share Of Income

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile