Form 1040 V Payment Voucher 2021

What is the Form 1040 V Payment Voucher

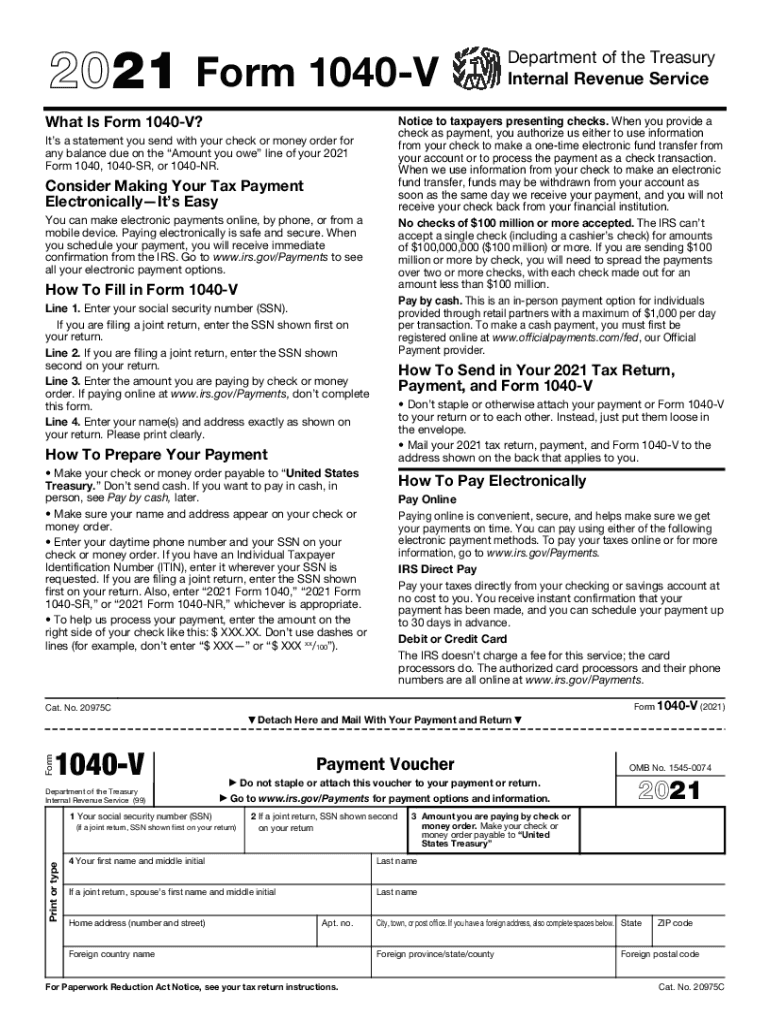

The Form 1040 V is a payment voucher used by taxpayers in the United States to submit payments for their federal income tax returns. It is specifically designed for individuals who owe tax and are filing their Form 1040. This voucher helps ensure that the payment is properly credited to the taxpayer's account with the IRS. By including the Form 1040 V with your payment, you provide essential information, such as your name, address, and Social Security number, which aids in the accurate processing of your payment.

How to use the Form 1040 V Payment Voucher

Using the Form 1040 V is straightforward. After calculating your tax liability on your Form 1040, if you find that you owe money, you should complete the payment voucher. Fill in your personal details, including your name, address, and Social Security number. Then, indicate the amount you are paying. Attach your payment, which can be a check or money order made out to the "United States Treasury," and send it along with the completed voucher to the appropriate IRS address. Ensure that you mail it in time to avoid penalties.

Steps to complete the Form 1040 V Payment Voucher

To complete the Form 1040 V, follow these steps:

- Gather your tax documents, including your completed Form 1040.

- Obtain the Form 1040 V from the IRS website or your tax preparer.

- Fill in your name, address, and Social Security number in the designated fields.

- Enter the amount you are paying on the voucher.

- Prepare your payment, ensuring it is made out to the "United States Treasury."

- Attach the payment to the voucher.

- Mail the completed Form 1040 V and payment to the appropriate IRS address based on your location.

Legal use of the Form 1040 V Payment Voucher

The Form 1040 V is legally recognized as a valid method for submitting tax payments to the IRS. By using this form, taxpayers comply with federal tax regulations, ensuring that their payments are processed correctly. It is important to follow the IRS guidelines for completing and submitting the voucher to maintain compliance and avoid potential penalties.

Key elements of the Form 1040 V Payment Voucher

Key elements of the Form 1040 V include:

- Taxpayer Information: Name, address, and Social Security number.

- Payment Amount: The total amount being submitted.

- IRS Address: The appropriate mailing address for the payment based on the taxpayer's location.

- Payment Method: Typically a check or money order.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 V align with the federal tax return deadlines. Typically, individual tax returns are due on April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to submit the Form 1040 V and any accompanying payment by the due date to avoid late fees and interest charges.

Quick guide on how to complete 2021 form 1040 v payment voucher

Prepare Form 1040 V Payment Voucher seamlessly on any device

Digital document management has gained signNow traction with both businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents efficiently without delays. Manage Form 1040 V Payment Voucher on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Form 1040 V Payment Voucher effortlessly

- Obtain Form 1040 V Payment Voucher and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign Form 1040 V Payment Voucher and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1040 v payment voucher

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1040 v payment voucher

The way to generate an e-signature for your PDF document online

The way to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the 1040 v form and how does airSlate SignNow help with it?

The 1040 v form is used for payments that accompany your 1040 tax return. With airSlate SignNow, you can easily eSign and send your 1040 v documents securely and quickly, ensuring a hassle-free submission process.

-

What features does airSlate SignNow offer for managing 1040 v documents?

airSlate SignNow provides features like customizable templates, automated workflows, and in-depth tracking for your 1040 v documents. These tools help streamline the process, reduce errors, and save time when handling tax-related forms.

-

How does the pricing structure of airSlate SignNow work for 1040 v form users?

airSlate SignNow offers flexible pricing plans that cater to both individuals and businesses handling 1040 v forms. Each plan includes access to essential features that simplify the signing and management of tax documents without breaking your budget.

-

Can I integrate airSlate SignNow with other software for handling 1040 v forms?

Yes, airSlate SignNow seamlessly integrates with various applications like Google Drive, Salesforce, and Microsoft Office, which can enhance your management of 1040 v forms. This integration helps you to streamline your workflow and ensures all your documents are organized.

-

What are the benefits of using airSlate SignNow for signing 1040 v forms?

Using airSlate SignNow for 1040 v forms offers a range of benefits, including improved efficiency and reduced paperwork. The platform allows for quick eSigning, which can signNowly expedite processing and reduce the time spent on tax documentation.

-

Is airSlate SignNow suitable for both individuals and businesses dealing with 1040 v forms?

Absolutely! airSlate SignNow is designed to meet the needs of both individuals and businesses managing 1040 v forms. Its intuitive interface and flexible features make it easy for anyone to navigate and complete their tax documents.

-

Are my 1040 v documents secure with airSlate SignNow?

Yes, security is a top priority for airSlate SignNow. All 1040 v documents are encrypted during transmission and storage, ensuring that your sensitive information remains protected throughout the eSigning process.

Get more for Form 1040 V Payment Voucher

- Virginia legal last will and testament form for married person with adult and minor children

- Vermont legal last will and testament form for divorced person not remarried with adult children

- Vermont legal last will and testament form for divorced person not remarried with minor children

- Washington deed in lieu of foreclosure husband and wife to corporation form

- Washington legal last will and testament form for single person with adult children

- Washington legal last will and testament form for divorced person not remarried with no children

- Washington legal will form

- Washington legal last will and testament form for married person with adult and minor children

Find out other Form 1040 V Payment Voucher

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors