1040 V Form 2015

What is the 1040 V Form

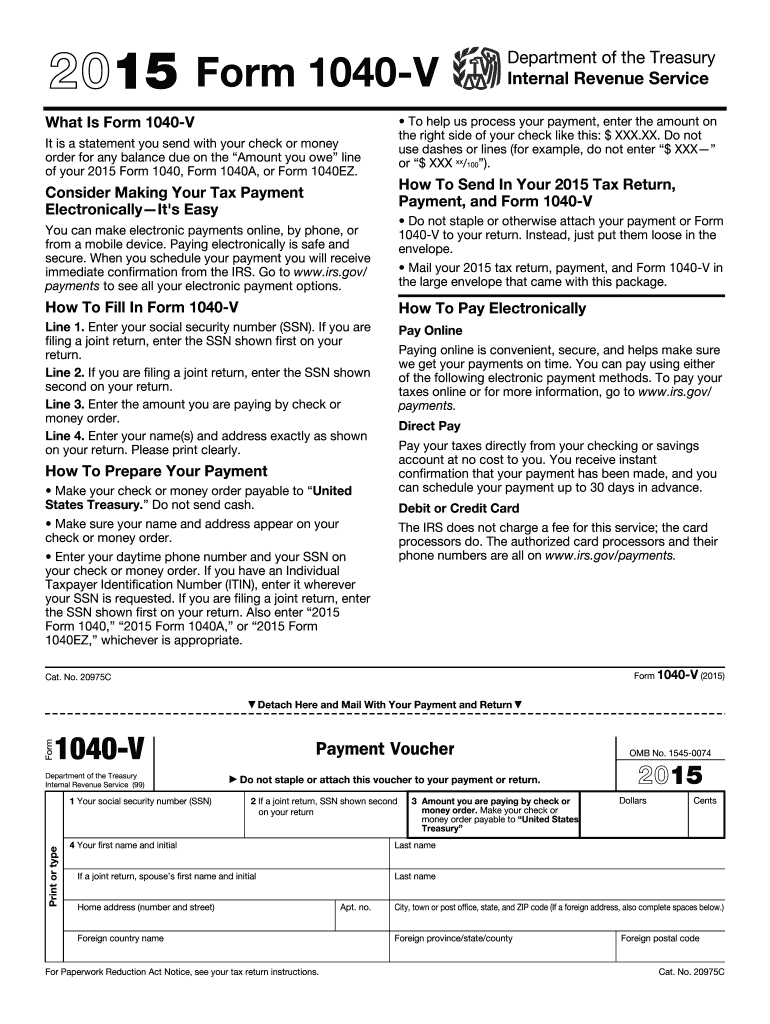

The 1040 V Form is a payment voucher used by taxpayers in the United States when submitting their federal income tax payments. It serves as a cover sheet that helps the Internal Revenue Service (IRS) process payments efficiently. This form is typically used when taxpayers are filing their Form 1040, 1040-SR, or 1040-NR and need to make a payment for any balance due. The 1040 V Form includes essential information such as the taxpayer's name, address, and the amount being paid, ensuring that the payment is correctly applied to the taxpayer's account.

How to use the 1040 V Form

Using the 1040 V Form is straightforward. First, ensure that you have completed your primary tax return form, such as the 1040. If you owe taxes, print the 1040 V Form, which can be obtained from the IRS website or tax preparation software. Fill in the required information, including your name, address, and the payment amount. Once completed, include the 1040 V Form with your payment when mailing it to the IRS. If you are e-filing, you typically do not need to submit the 1040 V Form, as electronic payments are processed differently.

Steps to complete the 1040 V Form

Completing the 1040 V Form involves several clear steps:

- Download the 1040 V Form from the IRS website or your tax software.

- Fill in your name and address as they appear on your tax return.

- Indicate the amount you are paying on the designated line.

- Review the information for accuracy to avoid any processing delays.

- Print the completed form and attach it to your payment.

- Mail the payment and the 1040 V Form to the appropriate IRS address based on your state.

Legal use of the 1040 V Form

The legal use of the 1040 V Form is governed by IRS regulations. It is important to use this form correctly to ensure that your payment is processed and credited to your tax account. Failure to use the form appropriately may result in delays or misapplication of your payment. The form must be submitted along with a check or money order made payable to the "United States Treasury." Always keep a copy of your payment and the 1040 V Form for your records.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 V Form align with the general deadlines for federal income tax returns. Typically, the deadline for filing your tax return and any associated payments is April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should be aware of these deadlines to avoid penalties and interest on late payments. Additionally, if you file for an extension, the payment due date remains April 15, even if the filing deadline is extended.

Required Documents

When preparing to use the 1040 V Form, certain documents are required to ensure accurate completion. These include:

- Your completed federal income tax return (Form 1040 or similar).

- Any supporting documentation related to income, deductions, or credits claimed.

- Your Social Security number or taxpayer identification number.

- Payment information, including the amount you owe.

Form Submission Methods (Online / Mail / In-Person)

The 1040 V Form can be submitted via mail along with your payment. If you are filing electronically, you typically do not need to submit the 1040 V Form, as electronic payments are processed directly through the IRS e-filing system. For those who prefer to pay in person, payments can also be made at designated IRS offices, but it is advisable to check in advance for availability and hours of operation. Always ensure that your payment method is secure and that you retain proof of payment for your records.

Quick guide on how to complete 1040 v 2015 form

Effortlessly Prepare 1040 V Form on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as a flawless eco-friendly option to traditional printed and signed papers, as you can easily locate the right document and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any holdups. Manage 1040 V Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign 1040 V Form effortlessly

- Find 1040 V Form and click Get Form to begin.

- Employ the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for such purposes.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign 1040 V Form while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040 v 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 1040 v 2015 form

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the 1040 V Form?

The 1040 V Form is a payment voucher used by taxpayers to submit their federal income tax payments to the IRS. It ensures that your payment is correctly applied to your account. Utilizing the 1040 V Form can help streamline your tax filing process and avoid potential delays.

-

How can airSlate SignNow assist with the 1040 V Form?

airSlate SignNow simplifies the process of filling out and eSigning the 1040 V Form. With our easy-to-use platform, you can quickly complete your payment voucher and send it securely to the IRS. This saves time and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow's services?

airSlate SignNow offers various pricing plans to fit businesses of all sizes. Our competitive pricing ensures that you get excellent value, especially when managing documents like the 1040 V Form. You can choose from monthly or annual subscriptions, with features designed to meet diverse needs.

-

Does airSlate SignNow provide any integrations for tax filing?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage documents related to the 1040 V Form. This connectivity helps ensure that your financial information is organized and accessible. Plus, it enhances your overall efficiency during tax season.

-

What features does airSlate SignNow offer for eSigning documents?

Our platform includes robust eSigning features to enhance the usage of the 1040 V Form. You can easily create templates, add fields, and track document statuses in real-time. This streamlines your signing process, allowing for quicker and more efficient tax submissions.

-

What benefits does using airSlate SignNow for the 1040 V Form provide?

Using airSlate SignNow to handle your 1040 V Form gives you convenience, security, and compliance. Our platform ensures that all signatures are legally binding and that documents are securely stored. This helps prevent the stress associated with tax filing and payment processes.

-

Is there customer support available for assistance with the 1040 V Form?

Absolutely! airSlate SignNow offers dedicated customer support to assist you with any questions regarding the 1040 V Form. Whether you need help with eSigning or navigating the platform, our support team is here to ensure you have a smooth experience.

Get more for 1040 V Form

Find out other 1040 V Form

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online