Form 1040 V Payment Voucher for Individuals 2024

What is the Form 1040 V Payment Voucher for Individuals

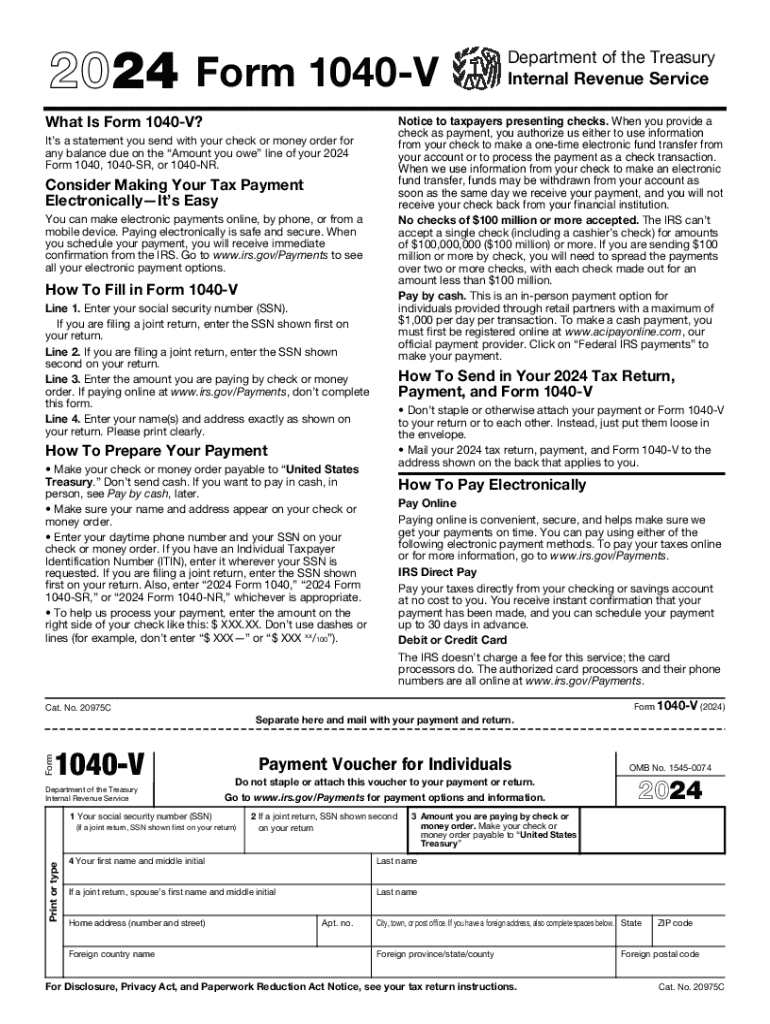

The Form 1040 V Payment Voucher is a document used by individuals to submit their tax payments to the Internal Revenue Service (IRS). This form serves as a cover sheet for payments made with a tax return, ensuring that the payment is properly credited to the taxpayer's account. It is particularly useful for those who are filing their tax returns by mail and wish to include a payment at the same time. The voucher includes essential information such as the taxpayer's name, address, and Social Security number, which helps the IRS match the payment with the corresponding tax return.

How to Use the Form 1040 V Payment Voucher for Individuals

To effectively use the Form 1040 V Payment Voucher, individuals should first complete their tax return. Once the return is finalized, they can print the Form 1040 V from the IRS website. After filling out the required information on the voucher, it should be included with the tax return when mailing it to the IRS. It is important to ensure that the payment is made via check or money order, payable to the "United States Treasury," and that the voucher is securely attached to the front of the return. This process helps to streamline the payment and filing process, reducing the risk of errors.

Steps to Complete the Form 1040 V Payment Voucher for Individuals

Completing the Form 1040 V Payment Voucher involves several straightforward steps:

- Download the Form 1040 V from the IRS website.

- Fill in your name, address, and Social Security number accurately.

- Enter the amount of your payment on the form.

- Prepare your payment by writing a check or obtaining a money order made out to the "United States Treasury."

- Attach the completed voucher to the front of your tax return.

- Mail your tax return and payment to the appropriate IRS address.

IRS Guidelines for Using the Form 1040 V Payment Voucher

The IRS provides specific guidelines for using the Form 1040 V Payment Voucher. Taxpayers should ensure that the voucher is only used for payments accompanying a tax return. It is crucial to verify that all information is accurate to avoid delays in processing. The IRS also recommends sending payments well before the tax deadline to ensure they are credited on time. Additionally, taxpayers can check the IRS website for any updates or changes to the payment process or requirements.

Filing Deadlines for the Form 1040 V Payment Voucher

Filing deadlines for the Form 1040 V Payment Voucher align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of these deadlines to avoid penalties and interest on late payments. It is advisable to submit the Form 1040 V and the associated payment well in advance of the deadline to ensure timely processing.

Required Documents for Submitting the Form 1040 V Payment Voucher

When submitting the Form 1040 V Payment Voucher, individuals must include certain required documents to ensure their payment is processed correctly. These documents typically include:

- The completed Form 1040 V Payment Voucher.

- Your completed tax return (Form 1040 or applicable variant).

- A check or money order for the payment amount, made out to the "United States Treasury."

Ensuring that all required documents are included will help prevent processing delays and ensure that the payment is applied correctly to the taxpayer's account.

Handy tips for filling out Form 1040 V Payment Voucher For Individuals online

Quick steps to complete and e-sign Form 1040 V Payment Voucher For Individuals online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a GDPR and HIPAA compliant solution for maximum straightforwardness. Use signNow to electronically sign and share Form 1040 V Payment Voucher For Individuals for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 v payment voucher for individuals

Create this form in 5 minutes!

How to create an eSignature for the form 1040 v payment voucher for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can airSlate SignNow help with tax payments?

airSlate SignNow streamlines the process of managing tax payments by allowing businesses to send and eSign necessary documents quickly. This ensures that all tax-related paperwork is completed efficiently, reducing the risk of errors and delays. With our platform, you can easily track the status of your tax documents, making tax payments more manageable.

-

What features does airSlate SignNow offer for tax payments?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for handling tax payments. These tools help ensure that your tax documents are accurate and compliant with regulations. Additionally, you can automate reminders for tax payment deadlines to avoid late fees.

-

Is airSlate SignNow cost-effective for managing tax payments?

Yes, airSlate SignNow offers a cost-effective solution for managing tax payments. Our pricing plans are designed to fit various business sizes and budgets, ensuring that you can access essential features without overspending. By reducing the time spent on paperwork, you can save money and focus on your core business activities.

-

Can I integrate airSlate SignNow with my accounting software for tax payments?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage tax payments. This integration allows for automatic syncing of financial data, ensuring that your tax documents are always up-to-date. You can streamline your workflow and reduce the chances of discrepancies in your tax filings.

-

What are the benefits of using airSlate SignNow for tax payments?

Using airSlate SignNow for tax payments provides numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our platform allows you to complete tax-related documents quickly and securely, reducing the risk of data bsignNowes. Additionally, you can maintain a clear audit trail for all your tax payments, which is crucial for compliance.

-

How does airSlate SignNow ensure the security of tax payment documents?

airSlate SignNow prioritizes the security of your tax payment documents by employing advanced encryption and secure cloud storage. This ensures that your sensitive information remains protected from unauthorized access. Our platform also complies with industry standards, giving you peace of mind when handling tax payments.

-

Is there a mobile app for airSlate SignNow to manage tax payments on the go?

Yes, airSlate SignNow offers a mobile app that allows you to manage tax payments from anywhere. With the app, you can send, sign, and track tax documents on your mobile device, ensuring that you never miss a deadline. This flexibility is especially beneficial for busy professionals who need to stay on top of their tax obligations.

Get more for Form 1040 V Payment Voucher For Individuals

- Cigarette inventory count sheet form

- Anatomy of a wave worksheet form

- Monthly maintenance report truck form

- Job application form jamaica

- 5 practices for orchestrating productive mathematics discussions pdf form

- Georgia form pt 61 pdf

- Ada authorization for release of medical information form

- Dsmv312 medical card mailingdoc nh form

Find out other Form 1040 V Payment Voucher For Individuals

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed