Irs Form 1040 V 2016

What is the Irs Form 1040 V

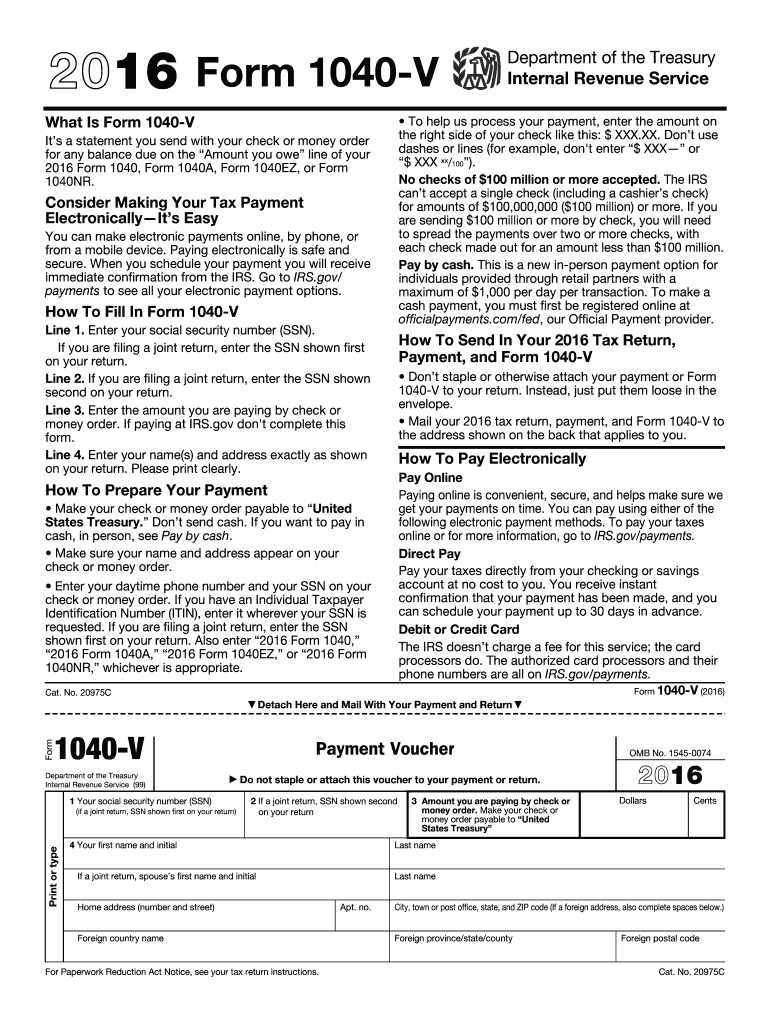

The IRS Form 1040 V is a payment voucher used by taxpayers in the United States when submitting their federal income tax payments. This form is particularly important for individuals who owe taxes and wish to make their payments through the mail. It helps ensure that the payment is correctly applied to the taxpayer's account. The form includes essential information such as the taxpayer's name, address, and Social Security number, along with the payment amount. Using Form 1040 V can streamline the payment process and help avoid potential delays in processing by the IRS.

How to use the Irs Form 1040 V

Using the IRS Form 1040 V is straightforward. Taxpayers should complete the form by filling in their personal information, including their name, address, and Social Security number. After entering the payment amount, the form should be included with the payment, typically a check or money order, made out to the "United States Treasury." It is crucial to ensure that the payment is sent to the correct address, which can vary based on the taxpayer's location and the type of payment being made. By following these steps, taxpayers can ensure their payments are processed efficiently.

Steps to complete the Irs Form 1040 V

Completing the IRS Form 1040 V involves several key steps:

- Begin by downloading the form from the IRS website or obtaining a physical copy.

- Fill in your name, address, and Social Security number accurately.

- Enter the payment amount you are submitting.

- Make your payment via check or money order, ensuring it is payable to the "United States Treasury."

- Attach the completed Form 1040 V to your payment.

- Mail the payment and form to the appropriate address for your location and payment type.

Legal use of the Irs Form 1040 V

The IRS Form 1040 V is legally recognized as a valid method for submitting federal tax payments. When used correctly, it helps ensure that payments are accurately credited to the taxpayer's account. Compliance with IRS guidelines is essential to avoid penalties or issues with payment processing. Taxpayers should retain a copy of the form and any payment documentation for their records, as this can be useful in case of discrepancies or audits.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 1040 V typically align with the annual tax filing deadline, which is usually April 15 for most taxpayers. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to be aware of these dates to avoid late payment penalties. Additionally, taxpayers who file for an extension should note that any payments due must still be made by the original deadline to avoid interest and penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit their IRS Form 1040 V payments primarily through the mail. Payments should be sent to the designated IRS address based on the taxpayer's location and payment type. While electronic payment methods are available, such as through the IRS Direct Pay or Electronic Federal Tax Payment System (EFTPS), the Form 1040 V specifically pertains to mailed payments. In-person submissions are generally not accepted for this form.

Quick guide on how to complete 2016 irs form 1040 v

Effortlessly Complete Irs Form 1040 V on Any Device

Managing documents online has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Irs Form 1040 V on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Irs Form 1040 V with Ease

- Locate Irs Form 1040 V and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information using features provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal authority as a traditional wet ink signature.

- Verify all your details and click on the Done button to save your modifications.

- Select your preferred method for sending your form—via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Form 1040 V to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 irs form 1040 v

Create this form in 5 minutes!

How to create an eSignature for the 2016 irs form 1040 v

How to create an electronic signature for your 2016 Irs Form 1040 V online

How to create an electronic signature for your 2016 Irs Form 1040 V in Chrome

How to make an eSignature for signing the 2016 Irs Form 1040 V in Gmail

How to make an electronic signature for the 2016 Irs Form 1040 V right from your smart phone

How to generate an electronic signature for the 2016 Irs Form 1040 V on iOS

How to make an eSignature for the 2016 Irs Form 1040 V on Android OS

People also ask

-

What is IRS Form 1040 V and why do I need it?

IRS Form 1040 V is a payment voucher used to submit payments along with your individual tax return. If you owe taxes and are filing your Form 1040, including IRS Form 1040 V ensures that your payment is correctly applied to your account. This form simplifies the process of submitting payments, making it easier to manage your tax obligations.

-

How can airSlate SignNow help me with IRS Form 1040 V?

AirSlate SignNow streamlines the process of signing and sending IRS Form 1040 V by providing an easy-to-use eSignature solution. You can quickly upload your completed form, eSign it, and send it securely to the IRS or your tax professional. This saves time and reduces the hassle of printing and mailing documents.

-

Is there a cost associated with using airSlate SignNow for IRS Form 1040 V?

Yes, while airSlate SignNow offers a free trial, there are subscription plans available for ongoing use. These plans are cost-effective and designed to meet the needs of individuals and businesses who frequently handle documents like IRS Form 1040 V. You can choose a plan that suits your volume of document transactions.

-

What features does airSlate SignNow offer for handling IRS Form 1040 V?

AirSlate SignNow provides features such as templates, bulk sending, and secure storage that make handling IRS Form 1040 V efficient. You can create a reusable template for the form, send it to multiple recipients for signature, and store it securely in the cloud for easy access. This enhances your document management process.

-

Can I integrate airSlate SignNow with other applications for IRS Form 1040 V?

Yes, airSlate SignNow integrates seamlessly with various applications including CRMs and cloud storage services. This means you can easily pull in customer data and automate the sending of IRS Form 1040 V, making your workflow more efficient. Integrations enhance your productivity by minimizing manual entry.

-

Is airSlate SignNow secure for sending IRS Form 1040 V?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that documents like IRS Form 1040 V are transmitted securely. All documents are encrypted, and the platform complies with regulations such as GDPR and HIPAA. You can trust that your sensitive information is protected.

-

How do I get started with airSlate SignNow for IRS Form 1040 V?

Getting started with airSlate SignNow for IRS Form 1040 V is simple. You can sign up for a free trial on our website, where you'll have access to all the features to manage your documents. Once registered, you can upload your forms, create templates, and start sending them for eSignature.

Get more for Irs Form 1040 V

Find out other Irs Form 1040 V

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract