Form 1040 V Payment Voucher 2020

What is the Form 1040 V Payment Voucher

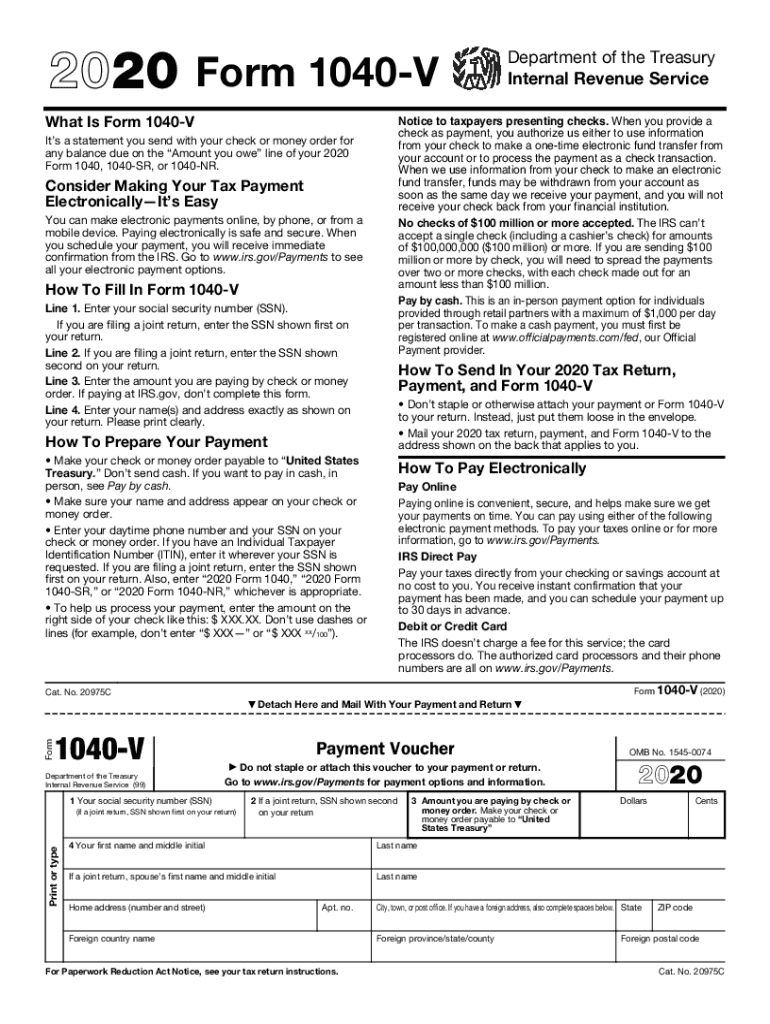

The Form 1040 V is a payment voucher used by taxpayers in the United States to submit their estimated tax payments to the Internal Revenue Service (IRS). This form is particularly important for individuals who are self-employed or have income that is not subject to withholding. By using the Form 1040 V, taxpayers can ensure that their payments are correctly applied to their tax accounts. It serves as a cover sheet that accompanies the payment, providing essential information to the IRS about the taxpayer's identity and the purpose of the payment.

How to use the Form 1040 V Payment Voucher

To effectively use the Form 1040 V, taxpayers must first complete the form with accurate information. This includes entering their name, address, Social Security number, and the amount of payment. Once the form is filled out, it should be submitted along with the payment. Taxpayers can send the payment via check or money order, made payable to the "United States Treasury." It is crucial to ensure that the payment is mailed to the correct address specified by the IRS for the type of payment being made, as this can vary based on the taxpayer's location and the nature of the payment.

Steps to complete the Form 1040 V Payment Voucher

Completing the Form 1040 V involves several straightforward steps:

- Obtain the latest version of the Form 1040 V from the IRS website or other reliable sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount of your payment clearly on the form.

- Sign and date the form, if required.

- Prepare your payment, ensuring it is in the correct format (check or money order).

- Mail the completed form and payment to the appropriate IRS address.

Legal use of the Form 1040 V Payment Voucher

The Form 1040 V is legally recognized as a valid method for making tax payments to the IRS. To ensure compliance, it is essential that taxpayers follow IRS guidelines when completing and submitting the form. This includes using the correct version of the form and adhering to deadlines for estimated tax payments. Proper use of the Form 1040 V helps to avoid penalties and interest that may arise from late or incorrect payments.

IRS Guidelines

The IRS provides specific guidelines for using the Form 1040 V. Taxpayers should refer to the IRS instructions for filing Form 1040 and the accompanying payment voucher. These guidelines outline important information such as filing deadlines, payment methods, and any updates to the form. Staying informed about these guidelines helps taxpayers ensure that their submissions are timely and accurate, minimizing the risk of issues with their tax accounts.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 V are critical to avoid penalties. Generally, estimated tax payments are due quarterly, with specific dates set by the IRS. For the current tax year, the deadlines typically fall on April 15, June 15, September 15, and January 15 of the following year. Taxpayers should mark these dates on their calendars and ensure that their payments are submitted on time to maintain compliance with IRS regulations.

Quick guide on how to complete 2020 form 1040 v payment voucher

Complete Form 1040 V Payment Voucher effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to acquire the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly without any hold-ups. Manage Form 1040 V Payment Voucher on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The most efficient way to modify and electronically sign Form 1040 V Payment Voucher with ease

- Locate Form 1040 V Payment Voucher and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Edit and electronically sign Form 1040 V Payment Voucher and ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1040 v payment voucher

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1040 v payment voucher

How to make an eSignature for your PDF file in the online mode

How to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What payment methods does airSlate SignNow accept?

airSlate SignNow accepts various payment methods, including credit cards and PayPal. Customers can easily manage their payment information within their account settings, ensuring a secure and seamless payment experience. This flexibility allows businesses to choose their preferred payment option for hassle-free transactions.

-

How can I view my billing and payment history?

You can easily view your billing and payment history by logging into your airSlate SignNow account. Navigate to the billing section, where you'll find detailed records of your payments, invoices, and subscription details. This transparency helps you keep track of your payment status and plan your expenses accordingly.

-

What are the pricing plans available for payment?

airSlate SignNow offers multiple pricing plans tailored to fit different business needs. Users can choose from a free trial for limited features or select premium plans that provide advanced capabilities, making it easier to manage payment processes. Each plan is designed to deliver value according to your company's requirements.

-

Is there a money-back guarantee for payments made?

Yes, airSlate SignNow offers a 30-day money-back guarantee for payments made on subscription plans. If you're not satisfied with the service, simply contact customer support within the guarantee period, and they will assist you in processing your refund. This policy ensures you can try the payment solution risk-free.

-

Can I change my payment plan after subscribing?

Absolutely! You can change your payment plan at any time by accessing your account settings. Whether you want to upgrade to a more feature-rich plan or downgrade to save costs, airSlate SignNow makes it simple to adjust your subscription to meet your evolving business needs.

-

Are there any additional fees associated with payment processing?

airSlate SignNow does not impose any hidden fees for payment processing; however, standard transaction fees may apply depending on your chosen payment method. It’s crucial to review the terms associated with your selected payment option to understand any applicable charges fully. This clarity allows you to manage your budget effectively.

-

How secure is my payment information with airSlate SignNow?

Your payment information is highly secure with airSlate SignNow, as the platform utilizes encryption and complies with industry-standard security protocols. This protection ensures that your sensitive payment data is safeguarded against unauthorized access. Rest assured, your financial information is treated with utmost confidentiality.

Get more for Form 1040 V Payment Voucher

- Conditional waiver and release of claim of lien upon final payment wisconsin form

- Wisconsin lien form

- Prime contractors notice of intention to file claim of lien individual wisconsin form

- Contractor notice lien form

- Wisconsin prime form

- Business credit application wisconsin form

- Wisconsin prime 497430682 form

- Individual credit application wisconsin form

Find out other Form 1040 V Payment Voucher

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy