Irs 1040 Es Payment Voucher Form 2017

What is the Irs 1040 Es Payment Voucher Form

The IRS 1040-ES Payment Voucher Form is a document used by taxpayers in the United States to make estimated tax payments for the upcoming tax year. This form is particularly relevant for individuals who are self-employed or have income that is not subject to withholding. By using this voucher, taxpayers can ensure that they meet their tax obligations throughout the year, rather than waiting until the tax filing deadline. The form allows for quarterly payments, helping to manage tax liabilities effectively.

How to use the Irs 1040 Es Payment Voucher Form

To use the IRS 1040-ES Payment Voucher Form, taxpayers should first calculate their estimated tax liability for the year. This involves assessing income, deductions, and credits to determine the amount owed. Once the estimated tax is calculated, the taxpayer fills out the payment voucher, indicating the amount being paid and the quarter for which the payment is intended. The completed form should then be submitted along with the payment to the appropriate IRS address, ensuring that it is sent on or before the due date to avoid penalties.

Steps to complete the Irs 1040 Es Payment Voucher Form

Completing the IRS 1040-ES Payment Voucher Form involves several key steps:

- Gather your financial information, including income, deductions, and any credits.

- Calculate your estimated tax liability using IRS guidelines or tax software.

- Obtain the latest version of the IRS 1040-ES Payment Voucher Form from the IRS website.

- Fill out the form, providing your personal information and the estimated payment amount.

- Review the form for accuracy, ensuring all required fields are completed.

- Submit the form along with your payment by mail or electronically, depending on your preference.

Key elements of the Irs 1040 Es Payment Voucher Form

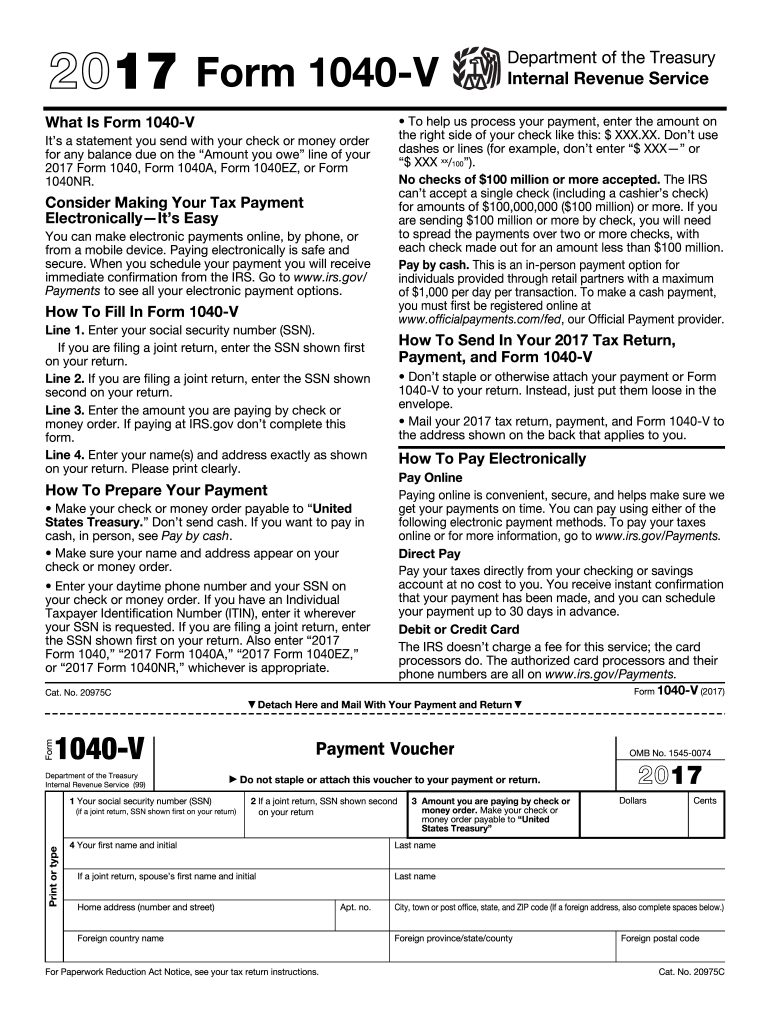

The IRS 1040-ES Payment Voucher Form includes several key elements that are essential for proper submission:

- Taxpayer Information: This section requires the taxpayer's name, address, and Social Security number.

- Payment Amount: Taxpayers must indicate the amount of estimated tax being paid for the quarter.

- Quarter Identification: The form specifies which quarter the payment is for, helping the IRS allocate the payment correctly.

- Signature: While not always required, signing the form can serve as a confirmation of the payment intention.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the IRS 1040-ES Payment Voucher Form. Payments can be made electronically through the IRS website, where taxpayers can use direct debit or credit card options. Alternatively, taxpayers may choose to mail the completed form and payment to the appropriate IRS address. In-person submissions are generally not available for this form, as the IRS encourages electronic payments for efficiency and security.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the IRS 1040-ES Payment Voucher Form. Estimated tax payments are typically due on the fifteenth day of April, June, September, and January of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes. Taxpayers should mark their calendars to ensure timely submissions and maintain compliance with IRS requirements.

Quick guide on how to complete irs 1040 es payment voucher 2017 form

Discover the easiest method to complete and sign your Irs 1040 Es Payment Voucher Form

Are you still spending time on preparing your official documents on paper instead of doing it digitally? airSlate SignNow provides a superior way to fill out and sign your Irs 1040 Es Payment Voucher Form and similar forms for public services. Our advanced electronic signature solution equips you with everything necessary to handle paperwork swiftly while adhering to legal standards - comprehensive PDF editing, managing, protecting, signing, and sharing functionalities are all available through a user-friendly interface.

There are just a few steps needed to fill out and sign your Irs 1040 Es Payment Voucher Form:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to include in your Irs 1040 Es Payment Voucher Form.

- Move between the fields with the Next button to avoid missing anything.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Mask sections that are no longer relevant.

- Click on Sign to create a legally binding electronic signature using your preferred method.

- Insert the Date beside your signature and finish your task with the Done button.

Store your completed Irs 1040 Es Payment Voucher Form in the Documents folder of your profile, download it, or send it to your preferred cloud storage. Our service also provides adaptable file sharing options. There’s no need to print your forms when you can submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct irs 1040 es payment voucher 2017 form

FAQs

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

Create this form in 5 minutes!

How to create an eSignature for the irs 1040 es payment voucher 2017 form

How to generate an electronic signature for your Irs 1040 Es Payment Voucher 2017 Form in the online mode

How to create an electronic signature for your Irs 1040 Es Payment Voucher 2017 Form in Chrome

How to generate an eSignature for putting it on the Irs 1040 Es Payment Voucher 2017 Form in Gmail

How to generate an eSignature for the Irs 1040 Es Payment Voucher 2017 Form straight from your mobile device

How to generate an electronic signature for the Irs 1040 Es Payment Voucher 2017 Form on iOS devices

How to create an eSignature for the Irs 1040 Es Payment Voucher 2017 Form on Android OS

People also ask

-

What is the Irs 1040 Es Payment Voucher Form?

The Irs 1040 Es Payment Voucher Form is a document used by individuals to submit estimated tax payments to the IRS. This form helps taxpayers ensure that they pay the correct amount on time, thereby avoiding penalties. airSlate SignNow makes it easier to fill out and eSign this form electronically.

-

How can airSlate SignNow help in filling out the Irs 1040 Es Payment Voucher Form?

airSlate SignNow provides an intuitive platform that simplifies the process of completing the Irs 1040 Es Payment Voucher Form. Users can easily input their information, save progress, and eSign documents whenever needed, streamlining the entire process for better efficiency.

-

Is it safe to eSign the Irs 1040 Es Payment Voucher Form using airSlate SignNow?

Yes, using airSlate SignNow to eSign the Irs 1040 Es Payment Voucher Form is safe and secure. The platform employs robust security measures to protect personal and sensitive information, ensuring that your eSigned documents are safe from unauthorized access.

-

What features does airSlate SignNow offer for managing the Irs 1040 Es Payment Voucher Form?

airSlate SignNow offers features such as template creation, document sharing, and real-time tracking to enhance the management of the Irs 1040 Es Payment Voucher Form. Users can collaborate easily, ensuring all necessary parties have access to the document for review and eSigning, making the process smoother.

-

Are there any costs associated with using airSlate SignNow for the Irs 1040 Es Payment Voucher Form?

airSlate SignNow offers various pricing plans, making it a cost-effective solution for managing documents, including the Irs 1040 Es Payment Voucher Form. Depending on your needs, you can choose from different tiers, each designed to fit various business sizes and use cases.

-

Can I integrate airSlate SignNow with other applications for the Irs 1040 Es Payment Voucher Form?

Absolutely! airSlate SignNow provides integration capabilities with popular applications like Google Drive, Dropbox, and Microsoft Office. This allows users to easily import and export the Irs 1040 Es Payment Voucher Form and work seamlessly within their preferred workflows.

-

What are the benefits of using airSlate SignNow for the Irs 1040 Es Payment Voucher Form?

Using airSlate SignNow for the Irs 1040 Es Payment Voucher Form offers numerous benefits, including enhanced speed, reduced paperwork, and increased compliance. Additionally, users can enjoy a professional experience that ensures timely filing, avoiding delays and potential fines.

Get more for Irs 1040 Es Payment Voucher Form

Find out other Irs 1040 Es Payment Voucher Form

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast