About Form 1040 V, Payment VoucherInternal Revenue Service2020 Form 1040 V IRS Tax Forms2020 Form 1040 V IRS Tax FormsFederal Fo 2022

Understanding Form 1040 V, Payment Voucher

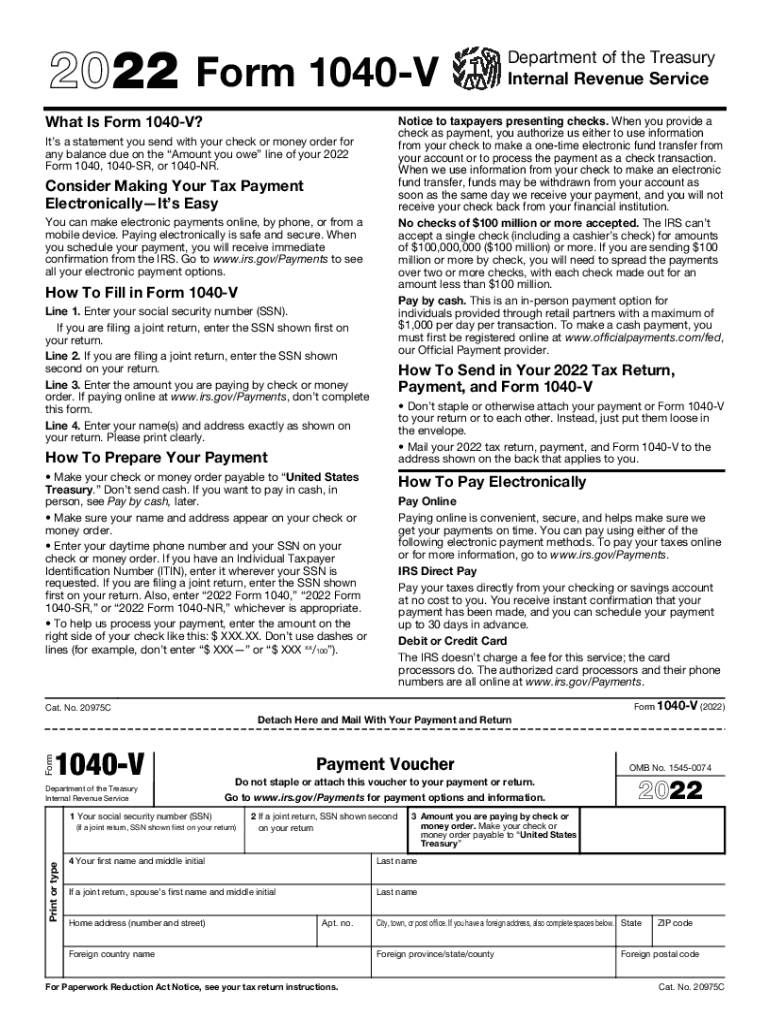

The 2020 Form 1040 V is a payment voucher used by taxpayers in the United States to submit payments along with their federal income tax returns. This form is essential for individuals who owe taxes and wish to ensure their payments are properly credited to their tax accounts. The voucher includes specific information such as the taxpayer's name, address, and Social Security number, which helps the Internal Revenue Service (IRS) accurately process the payment.

Steps to Complete Form 1040 V

Filling out the 2020 Form 1040 V involves several straightforward steps:

- Begin by entering your name and address at the top of the form.

- Provide your Social Security number, ensuring it matches the number on your tax return.

- Indicate the amount you are paying on the designated line.

- Review all entered information for accuracy before submitting the form.

Once completed, the form should be submitted along with your payment to the appropriate IRS address, which can vary based on your location and whether you are filing electronically or by mail.

Obtaining Form 1040 V

The 2020 Form 1040 V can be easily obtained through several methods. It is available for download directly from the IRS website, where you can access a printable version. Additionally, many tax preparation software programs include this form as part of their services, allowing for seamless integration into your tax filing process. Local libraries and tax assistance centers may also provide physical copies of the form.

Legal Use of Form 1040 V

Using the 2020 Form 1040 V correctly is crucial for compliance with IRS regulations. The form serves as a legal document that confirms the taxpayer's intent to pay any owed taxes. It is important to ensure that the form is filled out accurately and submitted on time to avoid penalties. The IRS recognizes electronic submissions of the form, provided that all legal requirements are met, including proper signatures and documentation.

Key Elements of Form 1040 V

The 2020 Form 1040 V includes several key elements that taxpayers must be aware of:

- Taxpayer Information: Name, address, and Social Security number.

- Payment Amount: The total amount being submitted with the voucher.

- Submission Instructions: Guidelines on where and how to send the form and payment.

Understanding these elements helps ensure that the form is filled out correctly and that payments are processed without issues.

Form Submission Methods

Taxpayers can submit the 2020 Form 1040 V through various methods:

- By Mail: Send the completed form and payment to the IRS address specified for your state.

- Electronically: If filing electronically, follow the software's instructions for submitting the payment voucher.

Choosing the right submission method is essential for timely processing and to avoid any potential delays in payment acknowledgment.

Quick guide on how to complete about form 1040 v payment voucherinternal revenue service2020 form 1040 v irs tax forms2020 form 1040 v irs tax formsfederal

Complete About Form 1040 V, Payment VoucherInternal Revenue Service2020 Form 1040 V IRS Tax Forms2020 Form 1040 V IRS Tax FormsFederal Fo seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent environmentally friendly option to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any obstacles. Manage About Form 1040 V, Payment VoucherInternal Revenue Service2020 Form 1040 V IRS Tax Forms2020 Form 1040 V IRS Tax FormsFederal Fo on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign About Form 1040 V, Payment VoucherInternal Revenue Service2020 Form 1040 V IRS Tax Forms2020 Form 1040 V IRS Tax FormsFederal Fo with ease

- Obtain About Form 1040 V, Payment VoucherInternal Revenue Service2020 Form 1040 V IRS Tax Forms2020 Form 1040 V IRS Tax FormsFederal Fo and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign About Form 1040 V, Payment VoucherInternal Revenue Service2020 Form 1040 V IRS Tax Forms2020 Form 1040 V IRS Tax FormsFederal Fo while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1040 v payment voucherinternal revenue service2020 form 1040 v irs tax forms2020 form 1040 v irs tax formsfederal

Create this form in 5 minutes!

How to create an eSignature for the about form 1040 v payment voucherinternal revenue service2020 form 1040 v irs tax forms2020 form 1040 v irs tax formsfederal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2020 form 1040 v printable and how can I access it?

The 2020 form 1040 v printable is a payment voucher that accompanies your federal income tax return. You can easily access and download it from the IRS website or through our platform, ensuring you have the most up-to-date version for your tax filings.

-

How does airSlate SignNow help with the 2020 form 1040 v printable?

With airSlate SignNow, you can easily upload, eSign, and send your 2020 form 1040 v printable securely. Our user-friendly interface ensures that you can manage your documents efficiently, reducing the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for the 2020 form 1040 v printable?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different needs. You can choose a plan that best suits your budget, and gain access to exclusive features for managing your 2020 form 1040 v printable and other documents.

-

Can I integrate airSlate SignNow with other software when using the 2020 form 1040 v printable?

Absolutely! airSlate SignNow integrates seamlessly with various popular software solutions, allowing you to streamline your workflow. This means you can manage the 2020 form 1040 v printable alongside your favorite tools for a more efficient experience.

-

What are the benefits of using airSlate SignNow for eSigning the 2020 form 1040 v printable?

Using airSlate SignNow for eSigning the 2020 form 1040 v printable offers unmatched convenience, as you can sign documents from anywhere, at any time. Our secure platform ensures that your sensitive information is protected while you complete your tax forms quickly.

-

How can I ensure my 2020 form 1040 v printable is securely sent?

airSlate SignNow uses advanced encryption protocols to ensure that your 2020 form 1040 v printable is securely sent and received. You can have peace of mind knowing that your personal information remains confidential throughout the process.

-

Can multiple users collaborate on the 2020 form 1040 v printable with airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the 2020 form 1040 v printable. This feature is particularly beneficial for businesses that require additional input or approvals on tax documents, enhancing teamwork and efficiency.

Get more for About Form 1040 V, Payment VoucherInternal Revenue Service2020 Form 1040 V IRS Tax Forms2020 Form 1040 V IRS Tax FormsFederal Fo

Find out other About Form 1040 V, Payment VoucherInternal Revenue Service2020 Form 1040 V IRS Tax Forms2020 Form 1040 V IRS Tax FormsFederal Fo

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document