1040v Form 2012

What is the 1040v Form

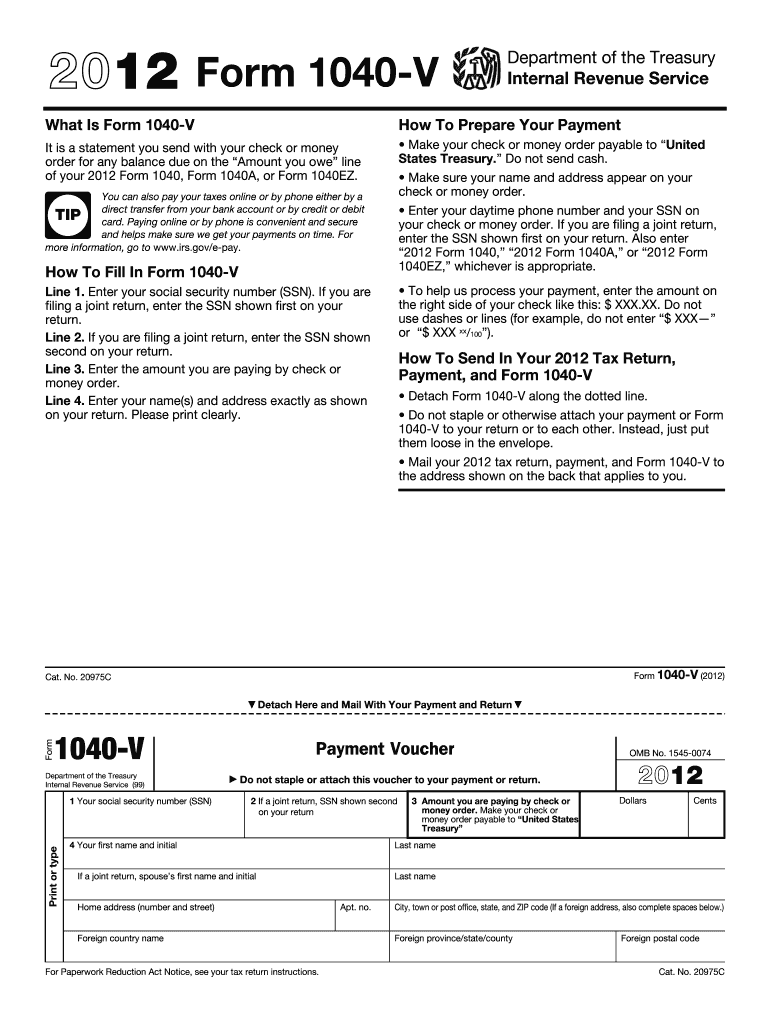

The 1040v Form is a payment voucher used by taxpayers in the United States when submitting their federal income tax returns. This form is specifically designed for individuals who are filing Form 1040, 1040-SR, or 1040-NR and need to make a payment to the Internal Revenue Service (IRS). The 1040v Form helps ensure that payments are properly credited to the taxpayer's account, facilitating a smoother processing of their tax return.

How to use the 1040v Form

To use the 1040v Form, taxpayers should first complete their federal income tax return. Once the return is finalized and any tax due is calculated, the taxpayer should fill out the 1040v Form. This involves providing personal information, such as name, address, and Social Security number, along with the amount being paid. The completed form should then be included with the payment and mailed to the IRS, ensuring that it reaches the correct address based on the taxpayer's location and whether they are filing electronically or by mail.

Steps to complete the 1040v Form

Completing the 1040v Form involves several straightforward steps:

- Gather necessary information, including your tax return details and payment amount.

- Fill out your name, address, and Social Security number on the form.

- Indicate the payment amount you are submitting.

- Sign and date the form, if required.

- Attach the 1040v Form to your payment and mail it to the appropriate IRS address.

Legal use of the 1040v Form

The 1040v Form is legally recognized as a valid method for submitting payments to the IRS. It is important for taxpayers to ensure that the form is completed accurately and submitted on time to avoid penalties. The use of this form helps maintain compliance with federal tax regulations and facilitates the proper processing of tax payments.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines when using the 1040v Form. Typically, the deadline for filing federal income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Payments submitted with the 1040v Form should also adhere to this deadline to avoid interest and penalties. It is advisable to check the IRS website for any updates or changes to these deadlines.

Form Submission Methods (Online / Mail / In-Person)

The 1040v Form can be submitted in several ways. Taxpayers can mail the form along with their payment to the IRS. For those who file their tax returns electronically, payments can often be made online through the IRS website. Additionally, some taxpayers may choose to make payments in person at designated IRS offices. It is important to verify the submission method that best suits individual circumstances and to ensure that payments are made on time.

Quick guide on how to complete 2012 1040v form

Effortlessly Prepare 1040v Form on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the right format and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without interruptions. Manage 1040v Form on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Edit and eSign 1040v Form with Ease

- Find 1040v Form and select Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form—via email, SMS, invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 1040v Form and ensure seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 1040v form

Create this form in 5 minutes!

How to create an eSignature for the 2012 1040v form

How to make an eSignature for your PDF document online

How to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the 1040v Form?

The 1040v Form is a payment voucher that accompanies your individual income tax return. It is designed for taxpayers who owe taxes and need to submit their payment along with the tax form. Understanding how to properly fill out and submit the 1040v Form can streamline your tax filing process.

-

How do I fill out the 1040v Form?

Filling out the 1040v Form involves entering your personal details, such as your name, address, and the amount you are paying. It is essential to check that your payment amount matches the tax liability calculated on your 1040 tax return. Make sure to follow the instructions carefully to avoid delays in processing.

-

Can I eSign the 1040v Form with airSlate SignNow?

Yes, you can easily eSign the 1040v Form using airSlate SignNow. The platform allows you to securely sign and send your tax documents electronically, saving you time and reducing paperwork. With airSlate SignNow, your eSignature is legally binding, ensuring compliance with IRS guidelines.

-

What features does airSlate SignNow offer for the 1040v Form?

airSlate SignNow offers a variety of features for the 1040v Form such as customizable templates, in-app signing, and document tracking. You can also integrate with popular tools to streamline your workflow. These features make managing your tax documents effortless and efficient.

-

Is there a cost associated with using airSlate SignNow for the 1040v Form?

Yes, airSlate SignNow offers several pricing plans, which can accommodate different needs when handling documents like the 1040v Form. Depending on the plan you choose, you can access advanced features that enhance document management. Visit the pricing page to find a plan that fits your budget.

-

What are the benefits of using airSlate SignNow for my 1040v Form?

Using airSlate SignNow for your 1040v Form simplifies the signing process and ensures that your documents are handled securely. With cloud storage, you can access your forms anytime, anywhere, while also reducing processing time. This benefits both individuals and businesses looking to optimize document workflows.

-

Can I integrate airSlate SignNow with other software when managing the 1040v Form?

Absolutely! airSlate SignNow offers integrations with popular software like Salesforce, Google Workspace, and more. These integrations make it easy to manage your 1040v Form alongside other business tools, creating a seamless workflow for your document management needs.

Get more for 1040v Form

- Osf my chart form

- Iv infusion waiver form

- Change your user id directv support atampampt form

- Medical questionnaire form

- Required documents that you will need to attach when submitting this form r r r r r copy of florida health insurance license

- Oxygen prescription template form

- Existing agency info sheet revised 07 12 form

- Allianz withdrawal form

Find out other 1040v Form

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple