Form 1040 ES PR Federales Estimadas Del Trabajo Por 2022-2026

What is the Form 1040 ES PR Federales Estimadas Del Trabajo Por

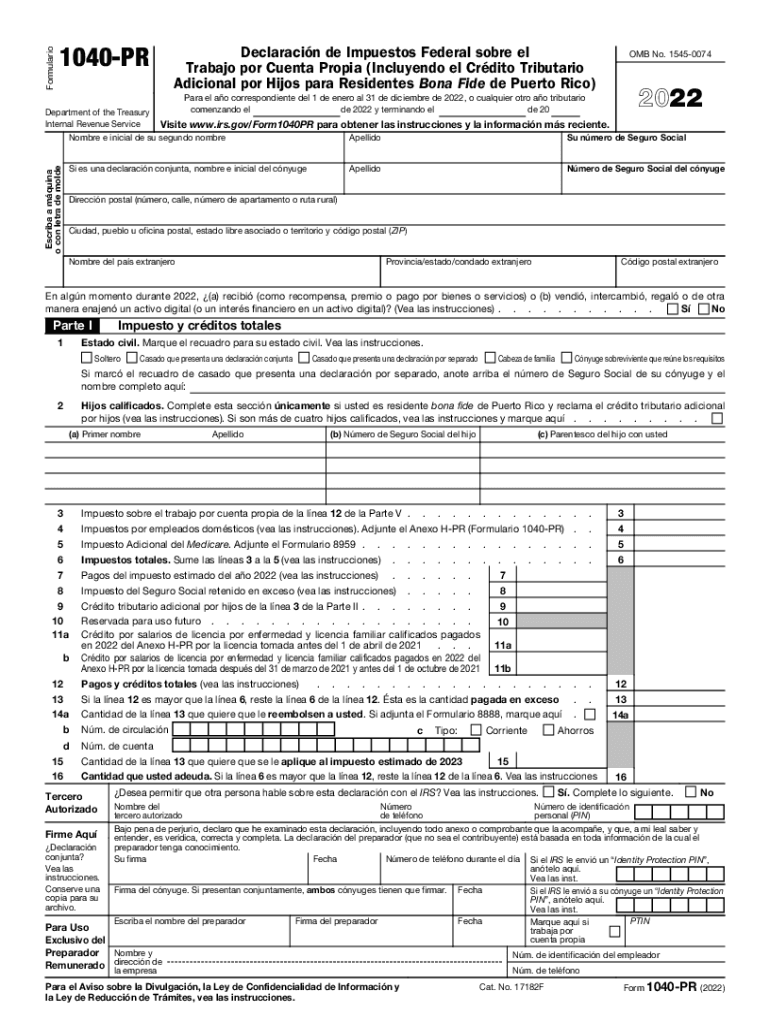

The Form 1040 ES PR is specifically designed for individuals in Puerto Rico who need to make estimated tax payments to the IRS. This form is essential for self-employed individuals, business owners, or anyone who expects to owe tax of one thousand dollars or more when filing their annual return. The estimated payments help taxpayers avoid penalties by ensuring they meet their tax obligations throughout the year.

How to use the Form 1040 ES PR Federales Estimadas Del Trabajo Por

Using the Form 1040 ES PR involves a few straightforward steps. First, determine your expected income for the year to calculate your estimated tax liability. Next, complete the form by providing necessary information, including your name, address, and Social Security number. Afterward, you can submit the form along with your estimated payment either online or by mail. It's important to keep a copy of the form for your records and to track your payments throughout the year.

Steps to complete the Form 1040 ES PR Federales Estimadas Del Trabajo Por

Completing the Form 1040 ES PR involves several key steps:

- Gather your financial information, including income and deductions.

- Calculate your estimated tax liability using the IRS guidelines.

- Fill out the form accurately, ensuring all personal details are correct.

- Choose your payment method, either electronic or by check.

- Submit the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 ES PR are crucial to avoid penalties. Typically, estimated tax payments are due quarterly, with specific deadlines falling on the fifteenth day of April, June, September, and January of the following year. It's essential to mark these dates on your calendar to ensure timely submissions.

Penalties for Non-Compliance

Failure to submit the Form 1040 ES PR or to make the required estimated payments can result in penalties. The IRS may impose a penalty if you do not pay enough tax throughout the year or if you file the form late. Understanding these penalties can help motivate timely compliance and avoid unnecessary financial burdens.

Key elements of the Form 1040 ES PR Federales Estimadas Del Trabajo Por

The key elements of the Form 1040 ES PR include sections for personal information, income details, and estimated tax calculations. Additionally, the form provides space for payment information and instructions on how to remit your payments. Each section is designed to guide taxpayers through the process of reporting their estimated tax obligations clearly and effectively.

Quick guide on how to complete form 1040 es pr federales estimadas del trabajo por

Easily prepare Form 1040 ES PR Federales Estimadas Del Trabajo Por on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without any delays. Handle Form 1040 ES PR Federales Estimadas Del Trabajo Por on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Form 1040 ES PR Federales Estimadas Del Trabajo Por with ease

- Obtain Form 1040 ES PR Federales Estimadas Del Trabajo Por and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select your delivery method for the form, whether by email, SMS, invitation link, or download it on your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Form 1040 ES PR Federales Estimadas Del Trabajo Por to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 es pr federales estimadas del trabajo por

Create this form in 5 minutes!

How to create an eSignature for the form 1040 es pr federales estimadas del trabajo por

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for making an IRS estimated tax payment online?

To make an IRS estimated tax payment online, you can visit the IRS website and utilize their online payment options. With airSlate SignNow, you can securely eSign the necessary forms required for your payment. This streamlined process ensures that your payment is submitted accurately and on time.

-

How can airSlate SignNow help with my IRS estimated tax payment online?

airSlate SignNow simplifies the process of preparing and sending documents necessary for your IRS estimated tax payment online. Our platform allows you to create, send, and eSign tax forms quickly and securely. By using our service, you can ensure that you stay compliant while saving valuable time.

-

Are there any fees associated with making IRS estimated tax payments online through airSlate SignNow?

While the IRS does not charge a fee for making estimated tax payments online, airSlate SignNow has its own subscription plans. These plans are cost-effective and provide access to features that simplify document management and eSigning, making your IRS estimated tax payment process even smoother.

-

What features does airSlate SignNow offer to assist with IRS estimated tax payment online?

airSlate SignNow offers a variety of features to assist with IRS estimated tax payments online, including templates for tax documents, customizable workflows, and secure eSigning options. Additionally, our platform ensures document tracking and compliance, so you have peace of mind throughout the payment process.

-

Can I integrate airSlate SignNow with other accounting software for IRS estimated tax payments online?

Yes, airSlate SignNow can be integrated with various accounting software to streamline your IRS estimated tax payment online. Our platform supports integrations with popular tools which enhance your workflow and ensure your tax documentation is handled seamlessly. This saves you time and reduces manual data entry.

-

Is airSlate SignNow secure for handling IRS estimated tax payments online?

Absolutely, airSlate SignNow prioritizes security to protect your sensitive information during IRS estimated tax payments online. We utilize encryption and secure connections to ensure that all documents are safely transmitted and stored. This dedication to security allows you to focus on your taxes without worry.

-

What benefits can I expect from using airSlate SignNow for IRS estimated tax payments online?

Using airSlate SignNow for your IRS estimated tax payment online can save you time, reduce errors, and enhance compliance with tax regulations. Our user-friendly interface allows you to quickly prepare and sign documents, ensuring that your payments are made efficiently. You can also track the status of your submissions easily.

Get more for Form 1040 ES PR Federales Estimadas Del Trabajo Por

- Mobile home purchase agreement california form

- Baseball tryout evaluation form excel

- Target application form

- Usps exam 710 720 725 730 form

- Lic assignment form no 3848 pdf download

- Home care delivered form

- Subject insurance coverage request for elecare or elecare jr specify specific product form

- Proposal template downloads form

Find out other Form 1040 ES PR Federales Estimadas Del Trabajo Por

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple