1040 Pr Form 2014

What is the 1040 Pr Form

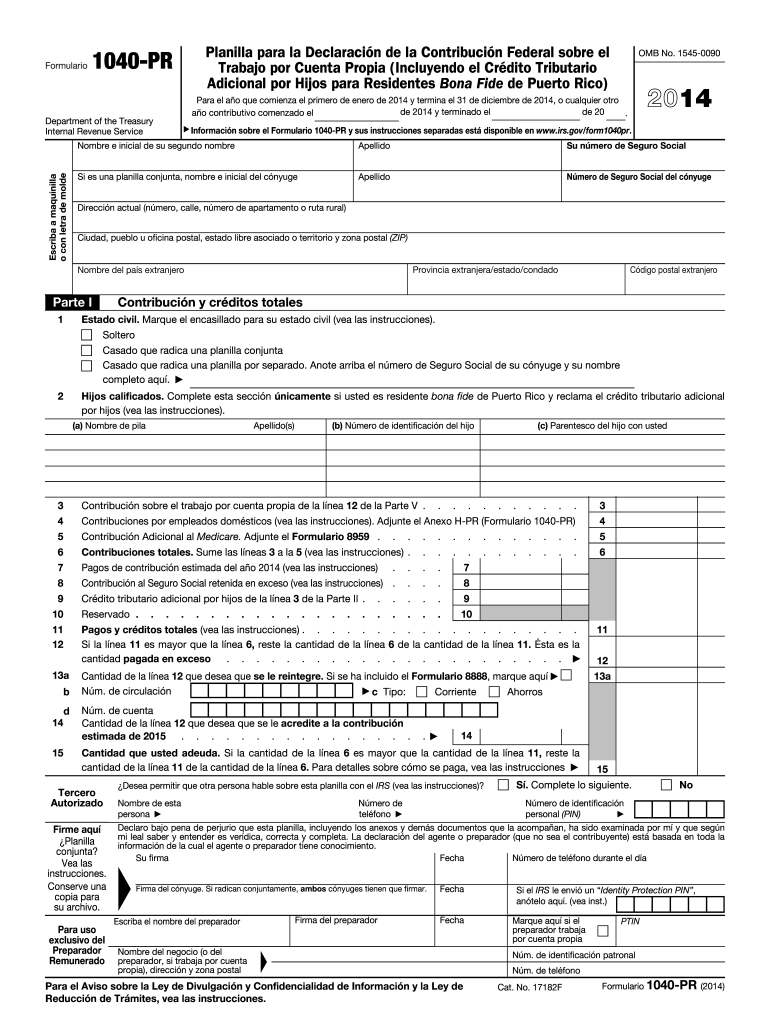

The 1040 Pr Form is a tax return form specifically designed for residents of Puerto Rico. This form is used to report income, calculate taxes owed, and claim any applicable credits or deductions. Unlike the standard 1040 form used by most U.S. taxpayers, the 1040 Pr Form takes into account the unique tax laws and requirements applicable to residents of Puerto Rico. It is essential for individuals who earn income in Puerto Rico to use this form to ensure compliance with local tax regulations.

How to use the 1040 Pr Form

Using the 1040 Pr Form involves several key steps. First, gather all necessary financial documents, such as W-2s, 1099s, and any other income statements. Next, follow the instructions provided with the form to accurately report your income and deductions. It is important to ensure that all entries are correct to avoid potential issues with the Internal Revenue Service (IRS). After completing the form, review it thoroughly for accuracy before submitting it.

Steps to complete the 1040 Pr Form

Completing the 1040 Pr Form requires a systematic approach:

- Gather all income documentation, including W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- Claim any deductions or credits you are eligible for.

- Calculate your total tax liability based on the provided tax tables.

- Sign and date the form before submitting it.

Key elements of the 1040 Pr Form

The 1040 Pr Form includes several critical sections that taxpayers must complete. These sections typically encompass personal information, income reporting, deductions, tax credits, and a summary of tax liability. Additionally, the form may include specific schedules for reporting particular types of income or deductions. Understanding each element is vital for accurate completion and compliance with tax laws.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the 1040 Pr Form. Typically, the deadline for submitting this form aligns with the federal tax deadline, which is usually April 15. However, it is advisable to check for any specific extensions or changes announced by the IRS or local tax authorities. Timely filing helps avoid penalties and ensures that taxpayers remain compliant with their tax obligations.

Required Documents

To complete the 1040 Pr Form accurately, certain documents are necessary. These include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Documentation for any other sources of income.

- Records of deductible expenses, such as medical bills or educational expenses.

- Proof of tax credits, if applicable.

Legal use of the 1040 Pr Form

The 1040 Pr Form is legally recognized for tax purposes in Puerto Rico. To ensure its validity, taxpayers must adhere to specific guidelines set forth by the IRS and local tax authorities. This includes accurate reporting of income, proper documentation of deductions, and timely submission of the form. Failure to comply with these legal requirements can result in penalties or audits.

Quick guide on how to complete 2014 1040 pr form

Set Up 1040 Pr Form Effortlessly on Any Device

Web-based document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documentation, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle 1040 Pr Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign 1040 Pr Form with Ease

- Find 1040 Pr Form and click Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or conceal sensitive details using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all information and click the Finish button to save your changes.

- Select how you want to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require new printed copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign 1040 Pr Form and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 1040 pr form

Create this form in 5 minutes!

How to create an eSignature for the 2014 1040 pr form

The best way to make an electronic signature for a PDF document in the online mode

The best way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the 1040 Pr Form and why do I need it?

The 1040 Pr Form is a tax form used by residents of Puerto Rico to report their income and calculate their tax liability. It is essential for ensuring compliance with local tax regulations and avoiding potential penalties. Using airSlate SignNow, you can easily prepare and eSign your 1040 Pr Form online, streamlining the filing process.

-

How does airSlate SignNow simplify the process of completing the 1040 Pr Form?

airSlate SignNow simplifies the process of completing the 1040 Pr Form by providing an intuitive interface that allows you to fill out, edit, and eSign documents seamlessly. With its user-friendly design, you can manage your tax forms with ease, ensuring you have all the necessary information at your fingertips.

-

Is there a cost associated with using airSlate SignNow for the 1040 Pr Form?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs, including features specifically for handling documents like the 1040 Pr Form. You can choose a plan that fits your budget and unlock additional features for enhanced document management and eSigning capabilities.

-

Can I integrate airSlate SignNow with other software for managing my 1040 Pr Form?

Absolutely! airSlate SignNow offers integrations with popular software solutions, enabling you to manage your 1040 Pr Form alongside other business applications. This integration capability enhances your workflow and allows for seamless data transfer, making tax filing more efficient.

-

What are the benefits of using airSlate SignNow for my 1040 Pr Form?

Using airSlate SignNow for your 1040 Pr Form provides several benefits, including increased efficiency and the ability to eSign documents securely online. Additionally, the platform ensures that your documents are legally binding and compliant with tax regulations, giving you peace of mind during the filing process.

-

Is it safe to eSign my 1040 Pr Form using airSlate SignNow?

Yes, eSigning your 1040 Pr Form with airSlate SignNow is completely safe. The platform employs industry-standard security measures to protect your sensitive information, ensuring that your documents remain confidential and secure throughout the signing process.

-

How can I access my signed 1040 Pr Form after using airSlate SignNow?

After eSigning your 1040 Pr Form with airSlate SignNow, you can easily access your signed documents from your account dashboard. The platform allows you to download, share, or print your completed forms at any time, making it convenient to keep track of your tax documents.

Get more for 1040 Pr Form

- 40 celebration drive suite 100 box 270446 rochester ny 14627 phone 1 585 275 2866 form

- Prior authorization pa informationpharmacymedicaidohiogov

- Pdf subject examinations content outlines and sample items form

- Childrens financial assistance application english form

- Illinois library organtissue donor drive lifegoesoncom form

- Physicians statement for occupational disability tmrs40oc physicians statement for occupational disability tmrs40oc form

- Rider status form

- Building inspections port st lucie form

Find out other 1040 Pr Form

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online