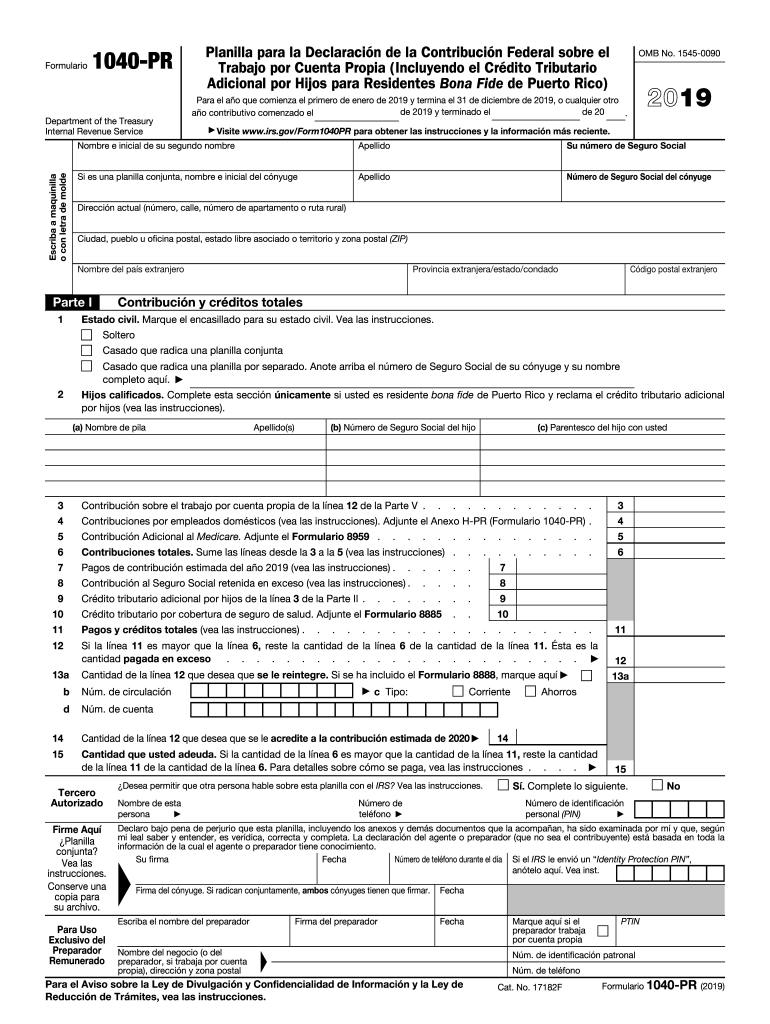

1040 Pr 2019

What is the 1040 PR?

The 1040 PR is a variant of the IRS Form 1040, specifically designed for residents of Puerto Rico. This form is used to report income, calculate taxes owed, and claim any applicable tax credits. Unlike the standard 1040 form used by most U.S. taxpayers, the 1040 PR accommodates the unique tax laws and regulations that apply to Puerto Rico. It is essential for individuals residing in Puerto Rico to use this form to ensure compliance with local tax requirements.

How to obtain the 1040 PR

To obtain the printable IRS Form 1040 PR, taxpayers can visit the official IRS website or contact the IRS directly. The form is available as a downloadable PDF, which can be printed for completion. Additionally, local tax offices in Puerto Rico may provide physical copies of the form. It is important to ensure that you are using the most current version of the form to avoid any issues during the filing process.

Steps to complete the 1040 PR

Completing the 1040 PR involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately on the form.

- Calculate your total tax liability using the provided tax tables and instructions.

- Claim any eligible credits or deductions to reduce your tax burden.

- Review the completed form for accuracy before signing and dating it.

Legal use of the 1040 PR

The 1040 PR is legally binding when filled out correctly and submitted to the IRS. To ensure its legal standing, taxpayers must comply with all relevant tax laws and regulations. This includes accurate reporting of income and proper documentation of any deductions or credits claimed. Utilizing a reliable eSignature platform can further enhance the legal validity of the submitted form, ensuring that all signatures are verifiable and compliant with electronic signature laws.

Filing Deadlines / Important Dates

Taxpayers should be aware of the important deadlines related to the 1040 PR. Typically, the filing deadline for this form aligns with the federal tax deadline, which is usually April 15. However, taxpayers in Puerto Rico may have specific extensions or additional deadlines based on local regulations. It is crucial to stay informed about any changes to these dates to avoid penalties for late filing.

Required Documents

When preparing to complete the 1040 PR, several documents are necessary:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation for tax deductions or credits claimed

- Previous year's tax return for reference

Form Submission Methods

The 1040 PR can be submitted through various methods. Taxpayers may choose to file electronically using approved e-filing software, which can streamline the process and provide immediate confirmation of submission. Alternatively, the form can be mailed to the appropriate IRS address, ensuring that it is postmarked by the filing deadline. In-person submissions may also be possible at designated IRS offices or local tax assistance centers.

Quick guide on how to complete 2019 form 1040 pr federal self employment contribution statement for residents of puerto rico

Complete 1040 Pr effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow supplies you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage 1040 Pr on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign 1040 Pr effortlessly

- Find 1040 Pr and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign 1040 Pr and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form 1040 pr federal self employment contribution statement for residents of puerto rico

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1040 pr federal self employment contribution statement for residents of puerto rico

How to generate an eSignature for the 2019 Form 1040 Pr Federal Self Employment Contribution Statement For Residents Of Puerto Rico in the online mode

How to make an electronic signature for your 2019 Form 1040 Pr Federal Self Employment Contribution Statement For Residents Of Puerto Rico in Google Chrome

How to generate an electronic signature for signing the 2019 Form 1040 Pr Federal Self Employment Contribution Statement For Residents Of Puerto Rico in Gmail

How to create an electronic signature for the 2019 Form 1040 Pr Federal Self Employment Contribution Statement For Residents Of Puerto Rico straight from your smartphone

How to generate an electronic signature for the 2019 Form 1040 Pr Federal Self Employment Contribution Statement For Residents Of Puerto Rico on iOS devices

How to create an eSignature for the 2019 Form 1040 Pr Federal Self Employment Contribution Statement For Residents Of Puerto Rico on Android OS

People also ask

-

What is the printable IRS form 1040?

The printable IRS form 1040 is the standard federal income tax form used by individual taxpayers in the United States to report their annual income. This form allows you to calculate your taxable income and determine any taxes owed or refunds due. Using a printable IRS form 1040 can simplify the filing process, making it more accessible to taxpayers.

-

Where can I find a printable IRS form 1040?

You can find a printable IRS form 1040 directly on the IRS website or through various online resources that provide tax forms. Once located, you can easily download, print, and fill out the form at your convenience. Many offices also offer printed copies of the form during tax season.

-

How do I fill out the printable IRS form 1040?

Filling out the printable IRS form 1040 requires you to gather all necessary financial documents such as W-2s, 1099s, and other income statements. Carefully follow the instructions provided with the form, ensuring that you report all income, deductions, and credits accurately. If you have any doubts, consulting a tax professional can be beneficial.

-

Can I eSign a printable IRS form 1040 with airSlate SignNow?

Yes, you can easily eSign a printable IRS form 1040 using airSlate SignNow. Our platform provides a user-friendly interface to upload and sign documents electronically, which streamlines the filing process. Plus, you can track the signing status and ensure that all required signatures are collected promptly.

-

Is airSlate SignNow a cost-effective solution for managing printable IRS forms?

Absolutely! airSlate SignNow offers competitive pricing plans that make it a cost-effective solution for managing documents, including printable IRS forms. By streamlining your document workflows and reducing paper usage, our platform can save you time and money throughout the tax filing process.

-

What features does airSlate SignNow offer for printable IRS form 1040 management?

airSlate SignNow provides features such as eSigning, document editing, and secure storage for your printable IRS form 1040. You can also utilize templates and automated reminders to ensure timely submission of your tax forms. Our platform emphasizes ease of use, making it suitable for individuals and businesses alike.

-

How does airSlate SignNow integrate with other software for tax management?

airSlate SignNow offers integrations with various software applications that facilitate tax management. You can easily connect it with accounting software, document management systems, and other productivity tools. This ensures that your printable IRS form 1040 and related documents flow seamlessly across your workflows.

Get more for 1040 Pr

- Teacher goal form

- Application central point school district 6 district6 form

- Employee personal details form

- How to use the pennsylvania will to live form suggestions and nrlc

- Nsa official youth roster national softball association form

- Money count deposit form club eastlake middle school elm sweetwaterschools

- Favorite things form

- What mandated reporters need to know about form

Find out other 1040 Pr

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe