1040 Pr Form 2015

What is the 1040 Pr Form

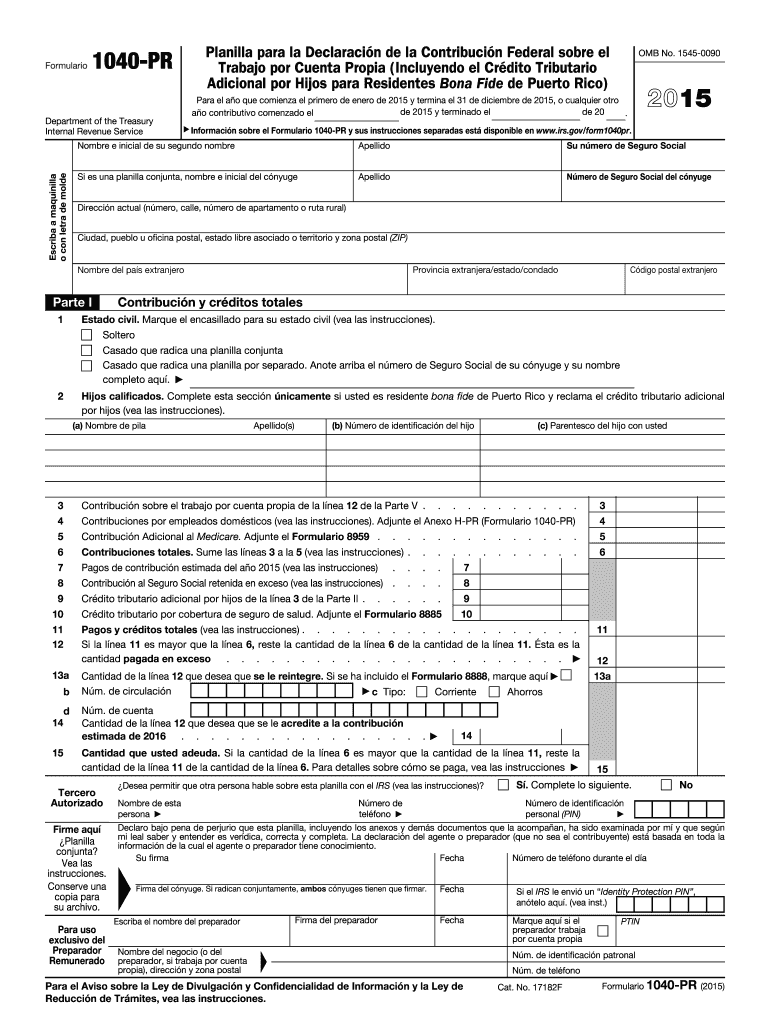

The 1040 Pr Form is a tax document specifically designed for residents of Puerto Rico who are required to report their income to the Internal Revenue Service (IRS). This form is used to calculate and report federal income tax obligations, allowing individuals to detail their income sources, deductions, and credits. Unlike the standard 1040 form used by most U.S. taxpayers, the 1040 Pr Form includes unique provisions that reflect the tax laws applicable to Puerto Rico residents.

How to use the 1040 Pr Form

Using the 1040 Pr Form involves several steps to ensure accurate tax reporting. Taxpayers must first gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Once the necessary information is collected, individuals can begin filling out the form, ensuring they report all income and claim applicable deductions. It is essential to follow the instructions provided with the form closely, as this will help avoid errors that could lead to delays or penalties.

Steps to complete the 1040 Pr Form

Completing the 1040 Pr Form involves a systematic approach to ensure accuracy. Here are the essential steps:

- Gather all income documentation, including W-2s and 1099s.

- Review the form instructions carefully to understand each section.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income accurately.

- Claim deductions and credits for which you qualify.

- Review the completed form for accuracy before submission.

Legal use of the 1040 Pr Form

The 1040 Pr Form is legally binding when completed and submitted according to IRS guidelines. It is essential for taxpayers to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or audits. The form must be signed and dated by the taxpayer, affirming that the information is correct to the best of their knowledge.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 Pr Form typically align with the federal tax filing deadlines. Generally, taxpayers must submit their forms by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to stay informed about any changes to filing dates to avoid late penalties.

Required Documents

When completing the 1040 Pr Form, several documents are necessary to ensure accurate reporting. These include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Documentation of any other income sources.

- Records of deductible expenses, such as medical costs or mortgage interest.

- Any relevant tax credits documentation.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the 1040 Pr Form. The form can be filed electronically through approved e-filing software, which may expedite processing times. Alternatively, individuals can mail their completed forms to the designated IRS address. In-person submission is also possible at certain IRS offices, providing another avenue for taxpayers who prefer face-to-face assistance.

Quick guide on how to complete 1040 pr 2015 form

Effortlessly Prepare 1040 Pr Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a fantastic eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and keep it securely stored online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents promptly, without any holdups. Manage 1040 Pr Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to Modify and eSign 1040 Pr Form with Ease

- Locate 1040 Pr Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools designed for this purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the information carefully and click the Done button to save your modifications.

- Choose your preferred method to send your form—via email, SMS, or shareable link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Edit and electronically sign 1040 Pr Form while ensuring excellent communication throughout every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040 pr 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 1040 pr 2015 form

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is the 1040 Pr Form and why is it important?

The 1040 Pr Form is a tax form used for filing personal income taxes in Puerto Rico. It is essential for residents to accurately report their income and claim any applicable deductions. Using the 1040 Pr Form ensures compliance with local tax regulations and avoids potential penalties.

-

How can airSlate SignNow help me with my 1040 Pr Form?

airSlate SignNow simplifies the process of completing and eSigning your 1040 Pr Form. With our easy-to-use interface, you can quickly fill out the form and securely send it for signatures, saving you time and effort. Plus, our platform ensures that your documents are safe and accessible.

-

Is there a cost associated with using airSlate SignNow for the 1040 Pr Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there is a fee for our services, many users find it cost-effective considering the efficiency gained in processing documents like the 1040 Pr Form. Check our pricing page for detailed information on subscription options.

-

What features does airSlate SignNow offer for managing the 1040 Pr Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for your 1040 Pr Form. These tools help streamline the document workflow, making it easier to manage submissions and ensure all signatures are collected promptly.

-

Can I integrate airSlate SignNow with other tools to manage my 1040 Pr Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including cloud storage services and CRM systems, to help you manage your 1040 Pr Form efficiently. This integration allows for easy access to documents and enhances collaboration among team members.

-

What are the benefits of using airSlate SignNow for the 1040 Pr Form compared to traditional methods?

Using airSlate SignNow for the 1040 Pr Form offers numerous benefits, including reduced paper usage, faster processing times, and enhanced security. Traditional methods can be cumbersome and time-consuming, while our digital solution allows you to complete and send your forms quickly and securely.

-

How secure is my data when using airSlate SignNow for the 1040 Pr Form?

Your data security is our top priority at airSlate SignNow. When you use our platform for the 1040 Pr Form, your information is encrypted and stored securely. We comply with industry standards to ensure that your sensitive information remains protected throughout the entire process.

Get more for 1040 Pr Form

- The guardian led series surface mount luminaire blends form

- Issr litter evaluation forms

- Partial lien waiver subcontractor or massdocs form

- Bull breeding soundness evaluation form

- Subaru certified checklist form

- Windstream lifeline 6026617 form

- Student life event waiver form

- Africa prudential registrars e dividend mandate form

Find out other 1040 Pr Form

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online