Form 1040 Pr 2012

What is the Form 1040 PR

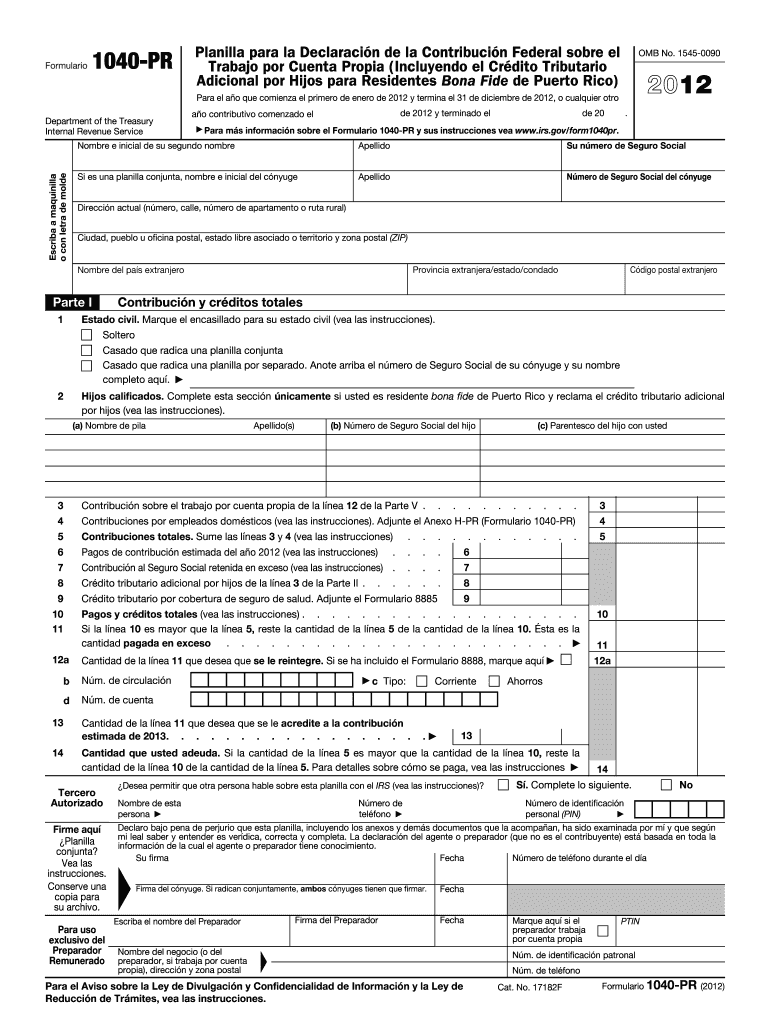

The Form 1040 PR is a tax return form specifically designed for residents of Puerto Rico. This form allows individuals to report their income and calculate their tax liability to the Puerto Rico Department of Treasury. Unlike the standard federal Form 1040, the 1040 PR is tailored to meet the unique tax regulations and requirements applicable to residents of Puerto Rico. It is essential for ensuring compliance with local tax laws and for claiming any applicable credits or deductions available to Puerto Rican taxpayers.

How to obtain the Form 1040 PR

The Form 1040 PR can be obtained directly from the official website of the Puerto Rico Department of Treasury. It is available for download in PDF format, allowing users to print and fill it out manually. Additionally, taxpayers can request a physical copy through local tax offices or community resource centers. Ensuring that you have the most current version of the form is crucial, as tax regulations can change annually.

Steps to complete the Form 1040 PR

Completing the Form 1040 PR involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as name, address, and Social Security number.

- Report all sources of income accurately, ensuring that you include both earned and unearned income.

- Claim any deductions or credits for which you qualify, such as the Earned Income Tax Credit or education credits.

- Calculate your total tax liability and determine if you owe additional taxes or are due a refund.

- Sign and date the form before submission to validate your return.

Legal use of the Form 1040 PR

The legal use of the Form 1040 PR is governed by the tax laws of Puerto Rico. To be considered valid, the form must be completed accurately and submitted by the designated filing deadline. Electronic signatures are permissible if they comply with local eSignature regulations. It is important to keep a copy of the submitted form and any supporting documents for your records, as they may be required for future reference or in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 PR typically align with the federal tax deadlines, which are usually April 15 of each year. However, taxpayers should verify specific dates as they can vary based on local holidays or changes in tax law. Extensions may be available, but it is essential to file for an extension before the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040 PR can be submitted through various methods to accommodate different preferences:

- Online: Taxpayers can file electronically using approved tax software that supports the Form 1040 PR.

- Mail: Completed forms can be mailed to the Puerto Rico Department of Treasury. It is advisable to use certified mail for tracking purposes.

- In-Person: Taxpayers may also submit their forms at designated tax offices in Puerto Rico, allowing for immediate confirmation of receipt.

Quick guide on how to complete 2012 form 1040 pr

Effortlessly prepare Form 1040 Pr on any device

Digital document administration has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can easily find the appropriate template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 1040 Pr on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to alter and eSign Form 1040 Pr with ease

- Find Form 1040 Pr and then click Get Form to commence.

- Utilize the tools we provide to complete your template.

- Highlight important segments of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your needs in document administration with just a few clicks from your chosen device. Modify and eSign Form 1040 Pr and ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 1040 pr

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 1040 pr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What is Form 1040 Pr and why is it important?

Form 1040 Pr is a critical tax form used by residents of Puerto Rico to report their annual income to the Internal Revenue Service. It is important because it ensures compliance with tax regulations and helps individuals calculate their tax obligations accurately, thereby avoiding potential penalties.

-

How can airSlate SignNow help me with Form 1040 Pr?

airSlate SignNow provides an efficient platform for electronic signatures, making it easy to complete and submit your Form 1040 Pr. With our user-friendly interface, you can quickly send and sign documents, enhancing your overall tax preparation process.

-

Is there a cost associated with using airSlate SignNow for Form 1040 Pr?

Yes, airSlate SignNow offers various pricing plans to meet different business needs. Our plans are cost-effective, allowing you to choose the one that best fits your requirements for eSigning important documents like Form 1040 Pr.

-

Can I integrate airSlate SignNow with other software for filing Form 1040 Pr?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software and cloud storage services. This allows you to streamline the process of filing Form 1040 Pr by managing all your documents effortlessly in one place.

-

What features does airSlate SignNow offer for completing Form 1040 Pr?

airSlate SignNow includes features such as customizable templates, document sharing, and secure electronic signatures specifically designed for forms like Form 1040 Pr. These features enhance accuracy and efficiency, enabling you to manage your tax paperwork effectively.

-

Is airSlate SignNow secure for handling sensitive information in Form 1040 Pr?

Yes, security is a top priority for airSlate SignNow. We utilize advanced encryption and data protection measures to ensure that your sensitive information, such as that found in Form 1040 Pr, is safe from unauthorized access or bsignNowes.

-

Can I use airSlate SignNow on mobile devices for Form 1040 Pr?

Yes, airSlate SignNow is fully compatible with mobile devices, allowing you to manage your documents and eSign Form 1040 Pr on-the-go. Our mobile app provides a convenient way to ensure that your forms are completed and submitted on time, no matter where you are.

Get more for Form 1040 Pr

- Due dates alabama department of revenue alabamagov form

- Do you have to pay back social security when someone dies form

- It103 v form

- California form 100 s california s corporation franchise or

- About form 8805 foreign partners information statement of

- Beneficiarys share of income deductions credits form

- California shareholders share of income deductions credits form

- 2020 ftb 3536 estimated fee for llcs 2020 ftb 3536 estimated fee for llcs form

Find out other Form 1040 Pr

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online