Schedule K 1 Form N 35 Rev Shareholder's Hawaii Gov 2015

What is the Schedule K-1 Form N-35 Rev Shareholder's Hawaii gov

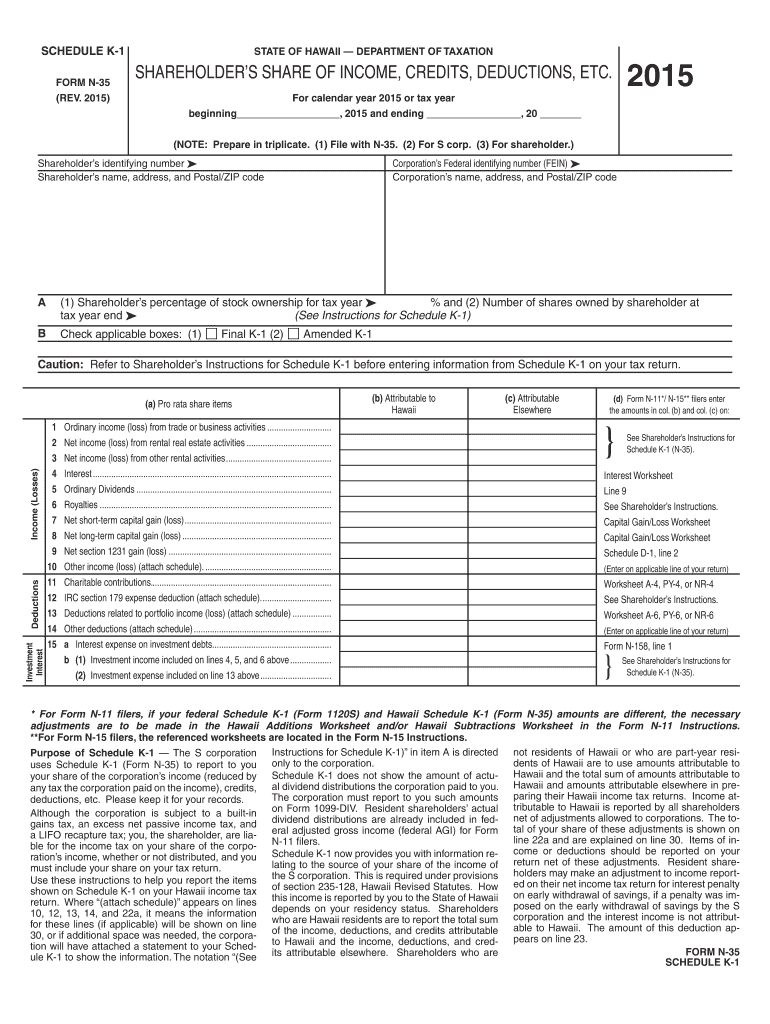

The Schedule K-1 Form N-35 Rev is a tax document used in Hawaii for reporting income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form provides shareholders with the necessary information to report their share of the entity's income on their personal tax returns. It is essential for ensuring compliance with state tax laws and for accurate tax reporting.

How to use the Schedule K-1 Form N-35 Rev Shareholder's Hawaii gov

To use the Schedule K-1 Form N-35 Rev, shareholders must first receive the completed form from the entity in which they hold shares. This form will detail the income, deductions, and credits allocated to the shareholder. Shareholders should then use this information to complete their individual tax returns, ensuring that all figures are accurately reported to the Hawaii Department of Taxation.

Steps to complete the Schedule K-1 Form N-35 Rev Shareholder's Hawaii gov

Completing the Schedule K-1 Form N-35 Rev involves several key steps:

- Obtain the form from the entity you are a shareholder in.

- Review the income, deductions, and credits reported on the form.

- Ensure that all information is accurate and matches your records.

- Use the information to fill out your personal tax return.

- Keep a copy of the K-1 for your records.

Legal use of the Schedule K-1 Form N-35 Rev Shareholder's Hawaii gov

The Schedule K-1 Form N-35 Rev is legally required for shareholders of partnerships and S corporations in Hawaii. It serves as an official record of income distribution and is necessary for compliance with state tax regulations. Failing to accurately report the information from this form can lead to penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

Shareholders must be aware of the filing deadlines associated with the Schedule K-1 Form N-35 Rev. Typically, the form should be issued by the entity by March 15 of the following tax year. Shareholders must include the information on their personal tax returns, which are generally due by April 15. It is crucial to stay informed about any changes to these deadlines to avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

The Schedule K-1 Form N-35 Rev can be submitted electronically or by mail. For electronic submissions, shareholders can use approved e-filing software that supports Hawaii tax forms. If submitting by mail, ensure that the form is sent to the appropriate address provided by the Hawaii Department of Taxation. In-person submissions may also be an option at designated tax offices.

Quick guide on how to complete schedule k 1 form n 35 rev 2015 shareholderamp39s hawaiigov

Your assistance manual on how to prepare your Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov

If you’re wondering how to create and dispatch your Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov, here are a few concise instructions on how to simplify tax processing.

To start, you simply need to set up your airSlate SignNow account to alter how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, draft, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to adjust responses when necessary. Enhance your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our catalog to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov in our editor.

- Input the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper filing can lead to return mistakes and postpone reimbursements. Before e-filing your taxes, please check the IRS website for submission rules specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form n 35 rev 2015 shareholderamp39s hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form n 35 rev 2015 shareholderamp39s hawaiigov

How to make an eSignature for the Schedule K 1 Form N 35 Rev 2015 Shareholderamp39s Hawaiigov online

How to make an electronic signature for the Schedule K 1 Form N 35 Rev 2015 Shareholderamp39s Hawaiigov in Chrome

How to generate an electronic signature for putting it on the Schedule K 1 Form N 35 Rev 2015 Shareholderamp39s Hawaiigov in Gmail

How to create an electronic signature for the Schedule K 1 Form N 35 Rev 2015 Shareholderamp39s Hawaiigov right from your smartphone

How to generate an eSignature for the Schedule K 1 Form N 35 Rev 2015 Shareholderamp39s Hawaiigov on iOS

How to create an electronic signature for the Schedule K 1 Form N 35 Rev 2015 Shareholderamp39s Hawaiigov on Android OS

People also ask

-

What is the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov?

The Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov is a tax form used by shareholders in Hawaii to report income, deductions, and credits. This form ensures that you accurately report your share of a corporation's income and it is crucial for tax compliance. Using airSlate SignNow can streamline the process of filling out and submitting this form.

-

How can airSlate SignNow help with the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov?

airSlate SignNow simplifies the process of completing the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov by providing easy-to-use templates and workflows. You can eSign and send documents directly from the platform, ensuring timely and secure submissions. This service minimizes errors and improves overall efficiency.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans to accommodate different business needs, starting with a free trial allowing you to explore the platform. Plans include various features such as personalized templates and team collaboration options, ensuring that you can efficiently manage the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov. Detailed pricing is available on our website.

-

Can I integrate airSlate SignNow with other software to manage the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov?

Yes, airSlate SignNow has robust integration options with various software, including popular accounting systems and CRMs. This allows you to streamline the management of documents like the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov across different platforms. The integration helps centralize your workflows and improve productivity.

-

What features does airSlate SignNow offer for users dealing with tax forms?

airSlate SignNow offers features such as secure eSigning, document templates, and collaboration tools designed for tax forms like the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov. You'll also benefit from customizable workflows that enhance the efficiency of preparing and submitting documentation, making tax season less burdensome.

-

Is airSlate SignNow suitable for small businesses needing to process the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective for small businesses, making it ideal for processing the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov. The platform provides all the necessary tools without overwhelming complexity, allowing small businesses to stay compliant with less effort.

-

What are the benefits of using airSlate SignNow over traditional methods for the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov?

Using airSlate SignNow offers several advantages over traditional paper methods for the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov. You can save time with digital forms, reduce printing costs, and enhance security with encrypted eSignatures. Additionally, the platform allows for easy tracking and management of submissions, signNowly improving workflow efficiency.

Get more for Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov

- Dental cbct report template form

- Zillow rental spreadsheet form

- Horse riding and liability release form

- Champs classroom activity worksheet reproducible template pps k12 or form

- Antrag auf leistungen nach dem unterhaltsvorschussgesetz uvg jugendhilfezentrum fr alfter swisttal und wachtberg kalkofenstrae form

- Request to change payment collection method cs1979 form

- Postaladdressif form

- Mr300 surrender of number plates form number plate surrender

Find out other Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe