Schedule K 1 Form N 35 Rev Shareholder's Share Hawaii Gov 2018

What is the Schedule K-1 Form N-35?

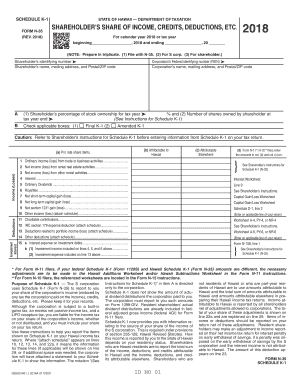

The Schedule K-1 Form N-35 is a tax document used in Hawaii for reporting the income, deductions, and credits of shareholders in an S corporation. This form is essential for ensuring that shareholders accurately report their share of the corporation's income on their personal tax returns. The Schedule K-1 provides detailed information about each shareholder's share of income, which is crucial for compliance with state tax regulations.

Steps to Complete the Schedule K-1 Form N-35

Completing the Schedule K-1 Form N-35 involves several key steps:

- Gather necessary financial documents, including income statements and expense reports from the S corporation.

- Fill out the form with accurate information regarding the corporation's income and each shareholder's share.

- Ensure that all calculations are correct to avoid discrepancies that could lead to penalties.

- Review the completed form for accuracy before submitting it to the appropriate tax authorities.

How to Obtain the Schedule K-1 Form N-35

The Schedule K-1 Form N-35 can be obtained through the Hawaii Department of Taxation's official website or by contacting their office directly. It is also advisable to consult with a tax professional who can provide guidance on obtaining the form and ensuring it is filled out correctly. The form is typically available in a downloadable format, making it easy to access and complete online.

Legal Use of the Schedule K-1 Form N-35

The Schedule K-1 Form N-35 is legally required for S corporations in Hawaii to report income to shareholders. Accurate completion and submission of this form are essential for compliance with both state and federal tax laws. Failure to file the form or providing incorrect information can result in penalties and interest on unpaid taxes. It is important for shareholders to understand their obligations regarding this form to avoid any legal issues.

Key Elements of the Schedule K-1 Form N-35

Key elements of the Schedule K-1 Form N-35 include:

- Shareholder's name and address

- Corporation's name and employer identification number (EIN)

- Details of the shareholder's share of income, deductions, and credits

- Signature of an authorized officer of the corporation

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Schedule K-1 Form N-35. Typically, the form must be filed by the due date of the S corporation's tax return, which is generally the fifteenth day of the third month following the end of the tax year. For example, if the tax year ends on December 31, the form is due by March 15 of the following year. Shareholders should also be mindful of their personal tax return deadlines, as the information from the K-1 is needed to complete their filings.

Quick guide on how to complete schedule k 1 form n 35 rev 2018 shareholders share hawaiigov

Your assistance manual on how to prepare your Schedule K 1 Form N 35 Rev Shareholder's Share Hawaii gov

If you’re interested in learning how to create and submit your Schedule K 1 Form N 35 Rev Shareholder's Share Hawaii gov, here are some brief instructions on how to simplify tax submission.

To begin, you simply need to register your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, create, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, check boxes, and electronic signatures and revisit to amend information as needed. Streamline your tax management with sophisticated PDF editing, eSigning, and easy sharing.

Follow the steps below to finalize your Schedule K 1 Form N 35 Rev Shareholder's Share Hawaii gov in just a few minutes:

- Establish your account and commence working on PDFs within moments.

- Utilize our catalog to find any IRS tax form; peruse through versions and schedules.

- Click Get form to access your Schedule K 1 Form N 35 Rev Shareholder's Share Hawaii gov in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to incorporate your legally-binding eSignature (if needed).

- Review your document and correct any mistakes.

- Store changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please keep in mind that filing on paper may lead to error returns and delayed refunds. Certainly, before e-filing your taxes, verify the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form n 35 rev 2018 shareholders share hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form n 35 rev 2018 shareholders share hawaiigov

How to create an eSignature for the Schedule K 1 Form N 35 Rev 2018 Shareholders Share Hawaiigov online

How to generate an electronic signature for the Schedule K 1 Form N 35 Rev 2018 Shareholders Share Hawaiigov in Chrome

How to make an electronic signature for signing the Schedule K 1 Form N 35 Rev 2018 Shareholders Share Hawaiigov in Gmail

How to create an electronic signature for the Schedule K 1 Form N 35 Rev 2018 Shareholders Share Hawaiigov from your smart phone

How to make an electronic signature for the Schedule K 1 Form N 35 Rev 2018 Shareholders Share Hawaiigov on iOS devices

How to generate an electronic signature for the Schedule K 1 Form N 35 Rev 2018 Shareholders Share Hawaiigov on Android OS

People also ask

-

What is the schedule form N35 and how can airSlate SignNow help?

The schedule form N35 is a crucial document for various business processes. airSlate SignNow provides an easy-to-use platform to fill out, send, and eSign the schedule form N35 efficiently. This streamlines your workflow, ensuring your documents are processed promptly and securely.

-

What features does airSlate SignNow offer for managing the schedule form N35?

airSlate SignNow includes several features that enhance the management of the schedule form N35. You can easily upload, fill, and eSign documents, as well as set reminders for due dates. Additionally, our platform offers secure storage for all your forms, ensuring they are accessible whenever needed.

-

How does pricing work for using airSlate SignNow with the schedule form N35?

Our pricing for airSlate SignNow is competitive and offers various plans to fit different business needs. You can choose from basic to advanced features based on the volume of documents you handle, including the schedule form N35. Check our website for specific pricing details and whether your business qualifies for any special offers.

-

Can I integrate airSlate SignNow with other software for the schedule form N35?

Yes, airSlate SignNow seamlessly integrates with numerous third-party applications, making it easy to work with the schedule form N35 alongside your existing tools. Popular integrations include CRM systems, cloud storage providers, and workflow management tools. This connectivity enhances efficiency and ensures your document management is streamlined.

-

What benefits does electronic signing provide for the schedule form N35?

Using airSlate SignNow for electronic signing of the schedule form N35 brings signNow advantages. It reduces turnaround times dramatically as documents can be signed from anywhere, at any time. Additionally, it eliminates paper-based processes, reducing costs and enhancing security.

-

Is airSlate SignNow user-friendly for completing the schedule form N35?

Absolutely! airSlate SignNow is designed with user experience in mind. Our intuitive interface makes it easy for anyone to fill out and eSign the schedule form N35 without prior training. Plus, our customer support team is available to assist with any questions.

-

What security measures are in place for handling the schedule form N35?

airSlate SignNow prioritizes security and compliance for all documents, including the schedule form N35. We employ advanced encryption protocols to safeguard your information and ensure that all electronic signatures are legally binding and verifiable. Your data's integrity is our top priority.

Get more for Schedule K 1 Form N 35 Rev Shareholder's Share Hawaii gov

- Cub scout budget worksheet form

- Face to face referral form at home health services

- Tarot disclaimer template form

- Napa fa enrollment form rev 1 1 2013doc

- Utmb mychart form

- Maryland wills list of interested persons form

- Application for certificate of birth resulting in stillbirth nebraska form

- Addiction and recovery treatment services arts provider attestation form

Find out other Schedule K 1 Form N 35 Rev Shareholder's Share Hawaii gov

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts