Schedule K 1 Form N 35 Rev Shareholder's Share of Income, Credits, Deductions, Etc Forms 2016

What is the Schedule K-1 Form N-35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

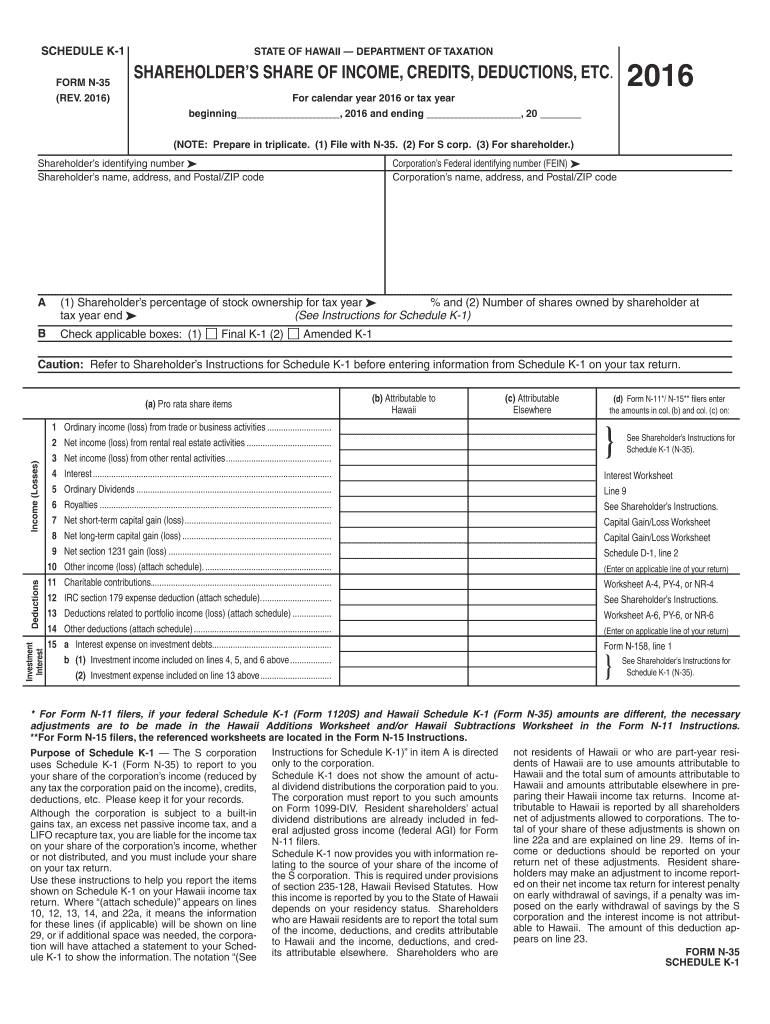

The Schedule K-1 Form N-35 Rev is a tax document used primarily by partnerships, S corporations, estates, and trusts to report the income, deductions, and credits allocated to each shareholder or partner. This form provides detailed information on each shareholder's share of the entity's income, which is essential for individual tax filings. It ensures that shareholders can accurately report their income on their personal tax returns, reflecting their proportional share of the entity's financial activities.

Steps to Complete the Schedule K-1 Form N-35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

Completing the Schedule K-1 Form N-35 Rev involves several key steps:

- Gather Necessary Information: Collect all relevant financial information from the partnership or S corporation, including income statements, deductions, and credits.

- Fill Out the Form: Enter the entity’s details, including the name, address, and taxpayer identification number. Then, input the shareholder's information, such as their share of income, deductions, and credits.

- Review for Accuracy: Double-check all entries for accuracy to ensure compliance with IRS guidelines. Incorrect information can lead to penalties or delays in processing.

- Distribute the Form: Provide each shareholder with their completed Schedule K-1, as they will need it for their personal tax returns.

Legal Use of the Schedule K-1 Form N-35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

The Schedule K-1 Form N-35 Rev is legally required for partnerships and S corporations to report income distributions to shareholders. This form must be issued to each shareholder by the entity to comply with IRS regulations. Accurate completion and timely distribution of the form are essential to avoid legal issues, including penalties for non-compliance. Shareholders must use the information provided on the K-1 to report their share of income on their individual tax returns, ensuring that all tax obligations are met.

IRS Guidelines for the Schedule K-1 Form N-35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

The IRS has established specific guidelines for the Schedule K-1 Form N-35 Rev to ensure accurate reporting of income and deductions. These guidelines outline the necessary information that must be included on the form, as well as the deadlines for submission. It is crucial for both the issuing entity and the shareholders to adhere to these guidelines to avoid discrepancies during tax filing. The IRS also provides resources and support for understanding the requirements associated with this form, helping taxpayers comply with federal tax laws.

Filing Deadlines for the Schedule K-1 Form N-35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

Filing deadlines for the Schedule K-1 Form N-35 Rev are aligned with the tax filing deadlines for partnerships and S corporations. Typically, the form must be issued to shareholders by March 15 of the following tax year. It is important for entities to meet this deadline to ensure shareholders have adequate time to prepare their individual tax returns. Failure to provide the K-1 by the deadline can result in penalties for the entity and complicate the tax filing process for shareholders.

Examples of Using the Schedule K-1 Form N-35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

Examples of using the Schedule K-1 Form N-35 Rev include various scenarios where partnerships and S corporations distribute income to shareholders. For instance, if a partnership generates a profit of $100,000 and has four equal partners, each partner would receive a K-1 reporting $25,000 as their share of income. Similarly, if the entity incurs deductible expenses, these would also be reported on the K-1, allowing shareholders to reduce their taxable income accordingly. Understanding these examples can help shareholders better navigate their tax obligations and maximize their deductions.

Quick guide on how to complete schedule k 1 form n 35 rev 2016 shareholders share of income credits deductions etc forms 2016

Your assistance manual on how to prepare your Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

If you’re unsure about how to complete and submit your Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms, here are some concise guidelines to facilitate your tax filing process.

To start, you simply need to create your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an intuitive and powerful document tool that enables you to edit, draft, and finalize your tax forms with ease. With its editing capabilities, you can toggle between text, checkboxes, and electronic signatures and return to modify responses as necessary. Simplify your tax administration with sophisticated PDF editing, eSigning, and easy sharing options.

Adhere to the steps below to complete your Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms within minutes:

- Create your account and start working on PDFs in just a few minutes.

- Utilize our directory to locate any IRS tax document; browse through variations and schedules.

- Hit Get form to access your Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms in our editor.

- Complete the mandatory fillable sections with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if applicable).

- Examine your document and correct any discrepancies.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Kindly be aware that submitting physically may lead to increased return errors and delay refunds. Moreover, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form n 35 rev 2016 shareholders share of income credits deductions etc forms 2016

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form n 35 rev 2016 shareholders share of income credits deductions etc forms 2016

How to generate an electronic signature for your Schedule K 1 Form N 35 Rev 2016 Shareholders Share Of Income Credits Deductions Etc Forms 2016 in the online mode

How to make an electronic signature for the Schedule K 1 Form N 35 Rev 2016 Shareholders Share Of Income Credits Deductions Etc Forms 2016 in Google Chrome

How to create an electronic signature for signing the Schedule K 1 Form N 35 Rev 2016 Shareholders Share Of Income Credits Deductions Etc Forms 2016 in Gmail

How to create an eSignature for the Schedule K 1 Form N 35 Rev 2016 Shareholders Share Of Income Credits Deductions Etc Forms 2016 from your mobile device

How to make an eSignature for the Schedule K 1 Form N 35 Rev 2016 Shareholders Share Of Income Credits Deductions Etc Forms 2016 on iOS

How to create an electronic signature for the Schedule K 1 Form N 35 Rev 2016 Shareholders Share Of Income Credits Deductions Etc Forms 2016 on Android

People also ask

-

What is the Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms?

The Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms is a tax document that reports a shareholder's share of income, credits, and deductions from a corporation. It is essential for accurate tax filing and ensuring compliance with tax laws. Understanding this form is crucial for shareholders as it outlines their tax obligations.

-

How can airSlate SignNow help me manage the Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms?

airSlate SignNow provides an efficient solution for sending and eSigning the Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms. With our user-friendly interface, you can easily upload, send, and collect signatures on these forms, streamlining the process signNowly for your business.

-

What features does airSlate SignNow offer for handling Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms?

Our platform offers a range of features for the Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms, including template creation, cloud storage, and secure eSigning. Additionally, you can track document status in real-time, ensuring that your forms are completed and submitted on time.

-

Is there a pricing plan for using airSlate SignNow for Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms?

Yes, airSlate SignNow offers several pricing plans that cater to different business needs, including affordable options for managing the Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms. We provide a cost-effective solution that enables businesses to efficiently handle document workflows without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms?

Absolutely! airSlate SignNow seamlessly integrates with a variety of third-party applications, enhancing the management of the Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms. You can connect with popular accounting, CRM, and productivity tools, making your document handling process more efficient.

-

What are the benefits of using airSlate SignNow for Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms?

Using airSlate SignNow for the Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms offers numerous benefits, such as increased efficiency, reduced turnaround time, and enhanced security. Our platform helps eliminate paper-based processes, saving you time and resources while ensuring compliance with tax regulations.

-

Is it easy to eSign the Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms using airSlate SignNow?

Yes, eSigning the Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms using airSlate SignNow is incredibly easy. Our intuitive platform allows users to sign documents on any device with just a few clicks, ensuring a hassle-free experience that keeps your workflow moving smoothly.

Get more for Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

- From no13 see rules28 and 37g form

- Shriram demat account form

- Walk through observation form

- Aris employee packet form

- Cardholder dispute letter cyprus credit union form

- Observation survey summary sheet form

- Queensland law societyform 6 lpanotice by a practising certificate holder of a conviction of an offence or of a charge for a

- Nsw grey wolf award application form scouts australia

Find out other Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile