Schedule K 1 Form N 35 Rev Shareholder's Hawaii Gov 2014

What is the Schedule K-1 Form N-35 Rev Shareholder's Hawaii gov

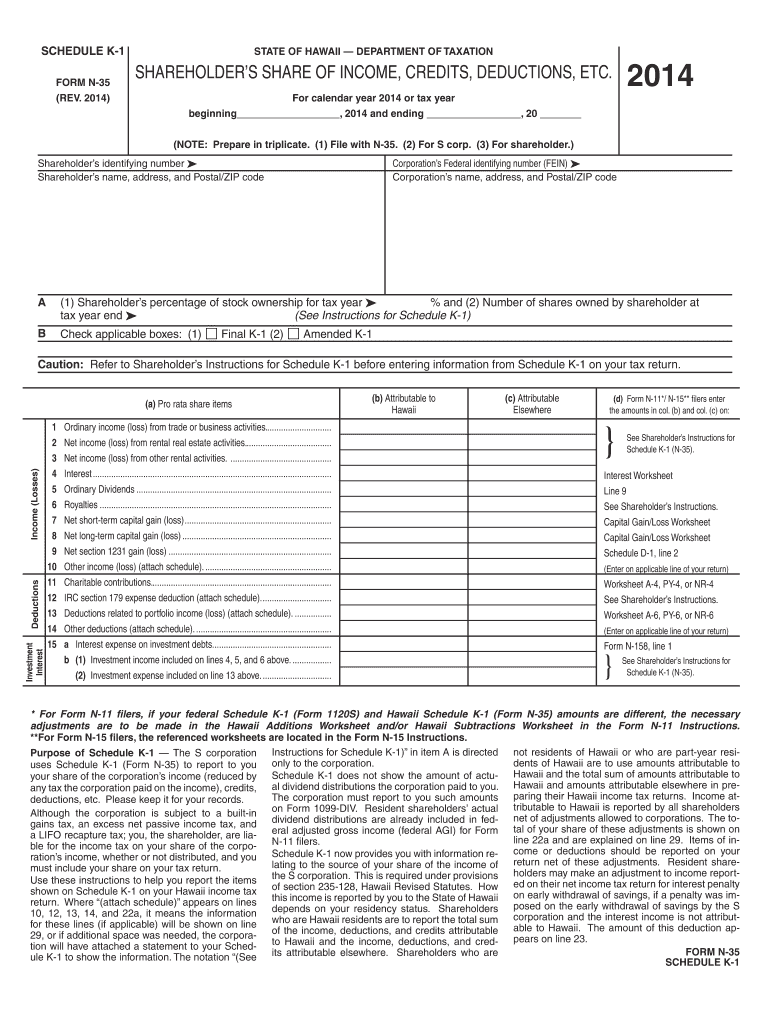

The Schedule K-1 Form N-35 Rev is a tax document used in Hawaii for reporting income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form provides detailed information about each shareholder's share of the entity's income, which is essential for accurate personal income tax filing. The form is crucial for ensuring compliance with state tax laws and for reporting income that may not be captured through traditional W-2 forms.

How to use the Schedule K-1 Form N-35 Rev Shareholder's Hawaii gov

Using the Schedule K-1 Form N-35 Rev involves several steps. First, the entity must prepare the form by accurately reporting each shareholder's share of income, deductions, and credits. Once completed, the form is distributed to shareholders, who will use the information to report their income on their personal tax returns. It is important for shareholders to review the form for accuracy and to consult with a tax professional if they have questions about how to report the information on their tax filings.

Steps to complete the Schedule K-1 Form N-35 Rev Shareholder's Hawaii gov

Completing the Schedule K-1 Form N-35 Rev requires careful attention to detail. Here are the general steps:

- Gather necessary financial information from the partnership or corporation.

- Fill out the entity's information, including name, address, and taxpayer identification number.

- Report the income, deductions, and credits allocated to each shareholder accurately.

- Provide each shareholder's details, including their name, address, and share of ownership.

- Review the completed form for accuracy before distribution.

Legal use of the Schedule K-1 Form N-35 Rev Shareholder's Hawaii gov

The Schedule K-1 Form N-35 Rev is legally required for entities in Hawaii that operate as partnerships or S corporations. It must be filed with the Hawaii Department of Taxation and provided to each shareholder. Failing to issue this form can result in penalties for the entity and may complicate shareholders' tax filings. Therefore, it is essential to ensure that the form is completed accurately and submitted on time.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 Form N-35 Rev align with the tax filing deadlines for partnerships and S corporations in Hawaii. Typically, the form must be filed by the 15th day of the third month following the close of the entity's tax year. Shareholders should receive their K-1 forms by this deadline to ensure they can accurately report their income on their personal tax returns. It is important to stay informed about any changes in deadlines that may occur due to state regulations or tax law updates.

Form Submission Methods (Online / Mail / In-Person)

The Schedule K-1 Form N-35 Rev can be submitted through various methods. Entities can file the form electronically using approved tax software that complies with Hawaii's filing requirements. Alternatively, the form can be mailed to the Hawaii Department of Taxation. In-person submissions are also an option, although electronic filing is often encouraged for efficiency and accuracy. Regardless of the method chosen, it is vital to retain copies of the filed forms for record-keeping purposes.

Quick guide on how to complete schedule k 1 form n 35 rev 2014 shareholder39s hawaiigov

Your assistance manual on how to prepare your Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov

If you’re curious about how to generate and send your Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov, here are a few brief steps to make tax submission signNowly simpler.

To begin, you simply need to set up your airSlate SignNow account to revolutionize your online paperwork management. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, produce, and finish your income tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to adjust responses as necessary. Streamline your tax handling with sophisticated PDF editing, eSigning, and easy sharing options.

Follow the steps below to complete your Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov in a matter of minutes:

- Create your account and start editing PDFs in moments.

- Utilize our directory to find any IRS tax form; browse through various versions and schedules.

- Click Get form to open your Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov in our editor.

- Complete the necessary fillable fields with your data (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if needed).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, send it to your intended recipient, and download it onto your device.

Refer to this manual for electronically filing your taxes with airSlate SignNow. Be aware that submitting by mail can lead to errors and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form n 35 rev 2014 shareholder39s hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form n 35 rev 2014 shareholder39s hawaiigov

How to make an eSignature for the Schedule K 1 Form N 35 Rev 2014 Shareholder39s Hawaiigov in the online mode

How to generate an electronic signature for your Schedule K 1 Form N 35 Rev 2014 Shareholder39s Hawaiigov in Chrome

How to create an electronic signature for putting it on the Schedule K 1 Form N 35 Rev 2014 Shareholder39s Hawaiigov in Gmail

How to generate an electronic signature for the Schedule K 1 Form N 35 Rev 2014 Shareholder39s Hawaiigov straight from your smart phone

How to create an eSignature for the Schedule K 1 Form N 35 Rev 2014 Shareholder39s Hawaiigov on iOS devices

How to create an electronic signature for the Schedule K 1 Form N 35 Rev 2014 Shareholder39s Hawaiigov on Android OS

People also ask

-

What is the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov?

The Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov is a tax document used by corporations to report income, deductions, and credits to shareholders. This form is essential for shareholders to accurately report their shares of the corporation's income on their personal tax returns in Hawaii.

-

How can airSlate SignNow assist with the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov?

airSlate SignNow simplifies the process of filling out and eSigning the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov. Our platform allows users to electronically sign documents securely and ensures compliance with state regulations, making tax season much easier for individuals and businesses.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow offers competitive pricing plans tailored to fit various business needs. Users can choose from different subscription levels, ensuring access to features suitable for managing the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov and other documents without breaking the bank.

-

Are there any integrations available with airSlate SignNow for tax preparation software?

Yes, airSlate SignNow integrates seamlessly with popular tax preparation software, enhancing the user experience when completing the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov. This allows users to streamline their workflow and maintain accurate records throughout the tax season.

-

What features make airSlate SignNow a good choice for managing tax-related documents?

AirSlate SignNow offers various features such as electronic signatures, document templates, and secure cloud storage, which are critical for managing tax-related documents like the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov. These features not only save time but also ensure compliance and security.

-

Can I share the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov with multiple recipients using airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily share the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov with multiple recipients. The platform allows you to send documents for eSignatures to various stakeholders simultaneously, facilitating a faster and more efficient signing process.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow is designed with security measures to protect sensitive tax documents, including the Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov. Our platform uses encryption, secure storage, and compliance with data protection regulations to ensure your documents remain confidential and secure.

Get more for Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov

- Usa cd blos fill form

- Donor profile template vaservice form

- Blank sun worksheet form

- Mid atlantic imaging centers scheduling protocols for form

- Get the corrective action plan sample pdffiller form

- Physical therapys role role in the in the educational setting form

- Tbppd test for was completed on form

- New patient registration 10082020 docx form

Find out other Schedule K 1 Form N 35 Rev Shareholder's Hawaii gov

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe