Form HI DoT N 20 Schedule K 1 Fill Online 2023-2026

What is the Form HI DoT N 20 Schedule K 1

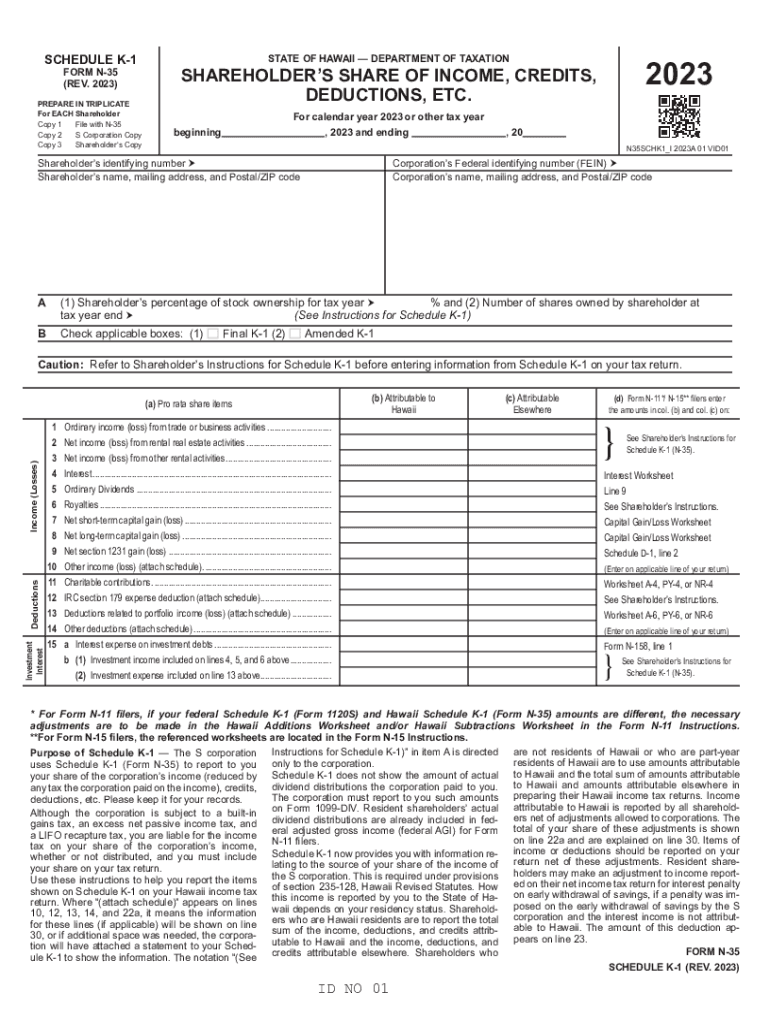

The Form HI DoT N 20 Schedule K 1 is a tax document used in Hawaii for reporting income, deductions, and credits from partnerships, S corporations, and other pass-through entities. This form is essential for shareholders or partners to accurately report their share of the entity's income on their personal tax returns. It provides detailed information on the income allocated to each partner or shareholder, ensuring compliance with state tax regulations.

How to use the Form HI DoT N 20 Schedule K 1

To use the Form HI DoT N 20 Schedule K 1, individuals must first receive the completed form from the partnership or S corporation in which they hold an interest. This form outlines the income, deductions, and credits attributable to each partner or shareholder. Once received, the information must be transferred to the individual's personal tax return, typically on Form 1040, ensuring that all reported figures align with the entity's filings.

Steps to complete the Form HI DoT N 20 Schedule K 1

Completing the Form HI DoT N 20 Schedule K 1 involves several key steps:

- Obtain the form from the partnership or S corporation.

- Review the income, deductions, and credits reported on the form.

- Transfer the relevant information to your personal tax return accurately.

- Ensure all figures match the partnership or S corporation's tax filings.

- File your tax return by the designated deadline.

Key elements of the Form HI DoT N 20 Schedule K 1

The key elements of the Form HI DoT N 20 Schedule K 1 include:

- Partner or shareholder's name and taxpayer identification number.

- Entity's name and identification number.

- Income allocated to the partner or shareholder.

- Deductions and credits available to the partner or shareholder.

- Any other relevant tax information required for accurate reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Form HI DoT N 20 Schedule K 1 typically align with the deadlines for personal income tax returns. Generally, the form must be filed by April 15 of the following year. However, if the partnership or S corporation has a different fiscal year, the deadline may vary. It is important for partners and shareholders to be aware of these dates to avoid penalties.

Penalties for Non-Compliance

Failure to comply with the reporting requirements for the Form HI DoT N 20 Schedule K 1 can result in penalties. These may include fines for late filing or inaccuracies in reporting income. Additionally, partners or shareholders may face increased scrutiny from tax authorities, which can lead to audits or further legal complications. It is crucial to ensure accurate and timely submission to avoid these issues.

Quick guide on how to complete form hi dot n 20 schedule k 1 fill online

Effortlessly prepare Form HI DoT N 20 Schedule K 1 Fill Online on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Form HI DoT N 20 Schedule K 1 Fill Online seamlessly on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

How to modify and eSign Form HI DoT N 20 Schedule K 1 Fill Online with ease

- Locate Form HI DoT N 20 Schedule K 1 Fill Online and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Form HI DoT N 20 Schedule K 1 Fill Online to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form hi dot n 20 schedule k 1 fill online

Create this form in 5 minutes!

How to create an eSignature for the form hi dot n 20 schedule k 1 fill online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hawaii Schedule K-1, and how is it used?

The Hawaii Schedule K-1 is a form used by partnerships to report income, deductions, and credits allocated to each partner. It plays a crucial role in federal and state tax filings for partnership entities operating in Hawaii, ensuring appropriate tax compliance.

-

How can airSlate SignNow help streamline the process of filing Hawaii Schedule K-1?

airSlate SignNow simplifies the process of eSigning and sending documents, including the Hawaii Schedule K-1. By providing an easy-to-use interface, businesses can quickly prepare and distribute K-1 forms to partners for eSignatures, saving time and reducing paperwork.

-

Are there any additional costs associated with using airSlate SignNow for Hawaii Schedule K-1 management?

airSlate SignNow offers a cost-effective pricing model which includes a range of features helpful for managing documents like the Hawaii Schedule K-1. There are different subscription plans available, allowing businesses to select the one that best fits their needs without hidden fees.

-

What features does airSlate SignNow offer specifically for handling Hawaii Schedule K-1 forms?

airSlate SignNow provides features such as customizable templates, secure eSigning, and automated workflows that are specifically beneficial for managing Hawaii Schedule K-1 forms. These features ensure accuracy and compliance while improving efficiency in document handling.

-

Can airSlate SignNow be integrated with other accounting software for Hawaii Schedule K-1 processing?

Yes, airSlate SignNow can integrate with various accounting software, making it easier to manage Hawaii Schedule K-1 forms. This integration allows for a seamless flow of information between platforms, enhancing efficiency and accuracy in reporting.

-

What are the benefits of using airSlate SignNow for Hawaii Schedule K-1 eSigning?

Using airSlate SignNow for Hawaii Schedule K-1 eSigning offers numerous benefits, including faster turnaround times, improved document security, and reduced operational costs. With electronic signatures, you ensure compliance while providing convenience to all involved parties.

-

Is airSlate SignNow compliant with Hawaii's regulations for Schedule K-1?

Absolutely, airSlate SignNow complies with Hawaii's regulations for electronic document transactions, including the Hawaii Schedule K-1. The platform adheres to legal standards, ensuring that all eSigned documents are valid and enforceable in the state of Hawaii.

Get more for Form HI DoT N 20 Schedule K 1 Fill Online

Find out other Form HI DoT N 20 Schedule K 1 Fill Online

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast