Schedule K 1 Form N 35 Rev Shareholder's Share of Income, Credits, Deductions, Etc Forms 2017

What is the Schedule K-1 Form N-35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

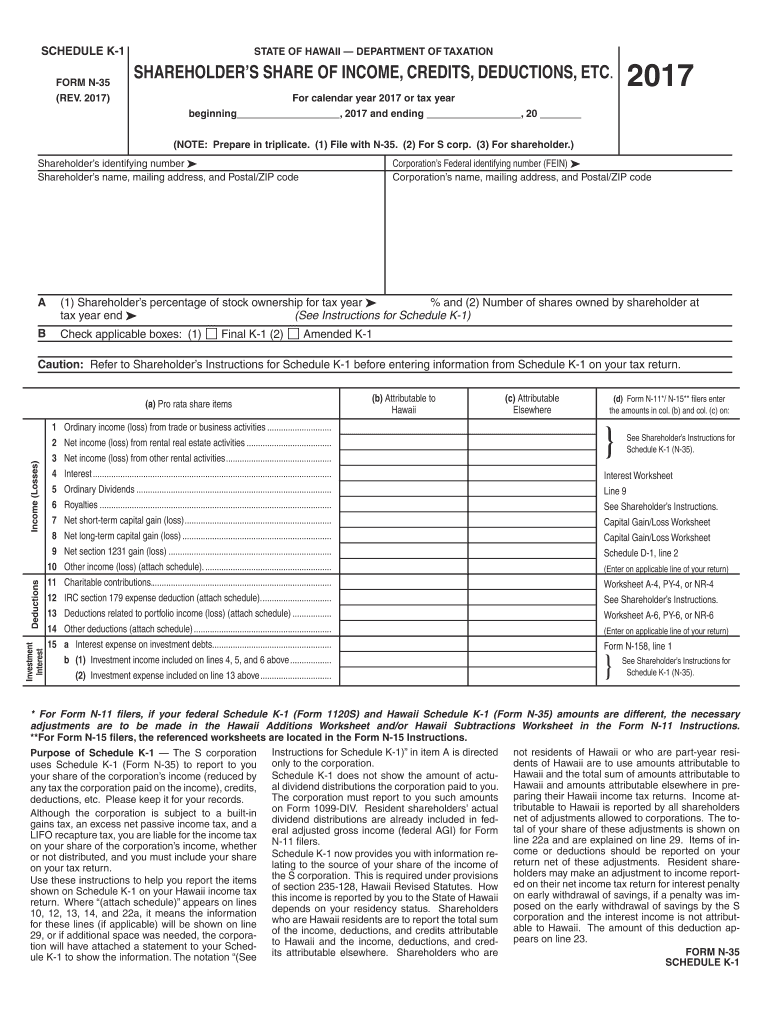

The Schedule K-1 Form N-35 Rev is a crucial tax document used by partnerships, S corporations, and certain estates and trusts to report each shareholder's share of income, credits, deductions, and other tax-related items. This form provides detailed information on how much income or loss each shareholder must report on their individual tax returns. It is essential for ensuring accurate tax reporting and compliance with IRS regulations.

Steps to Complete the Schedule K-1 Form N-35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

Filling out the Schedule K-1 Form N-35 Rev involves several key steps:

- Gather necessary information: Collect all relevant financial data, including income, deductions, and credits for the tax year.

- Fill in the entity information: Enter the name, address, and Employer Identification Number (EIN) of the partnership or S corporation.

- Report shareholder information: Include the shareholder's name, address, and identification number.

- Detail income and deductions: Accurately report each type of income, deductions, and credits allocated to the shareholder.

- Review for accuracy: Double-check all entries to ensure compliance with IRS guidelines.

- Provide copies: Distribute copies of the completed form to each shareholder and retain a copy for your records.

How to Obtain the Schedule K-1 Form N-35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

The Schedule K-1 Form N-35 Rev can be obtained from various sources. Most commonly, businesses that issue the form will provide it directly to shareholders. Additionally, the form is available on the IRS website and can be downloaded for easy access. Ensure that you are using the most current version of the form to comply with IRS regulations.

Legal Use of the Schedule K-1 Form N-35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

The Schedule K-1 Form N-35 Rev is legally required for partnerships and S corporations to report income and deductions to their shareholders. It must be completed accurately and submitted in accordance with IRS deadlines. Failure to provide this form can result in penalties for both the issuing entity and the shareholders. It is essential to understand the legal implications of this form to ensure compliance and avoid potential issues with the IRS.

IRS Guidelines for the Schedule K-1 Form N-35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

The IRS provides specific guidelines for completing and filing the Schedule K-1 Form N-35 Rev. These guidelines include instructions on how to report various types of income, deductions, and credits. It is important for both the issuing entity and the shareholders to familiarize themselves with these guidelines to ensure that the information reported is accurate and compliant with federal tax laws. Regular updates from the IRS may also affect how the form is completed, so staying informed is crucial.

Filing Deadlines for the Schedule K-1 Form N-35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

Filing deadlines for the Schedule K-1 Form N-35 Rev align with the tax deadlines for partnerships and S corporations. Generally, the form must be provided to shareholders by March 15 of the following year for calendar year filers. It is essential to adhere to these deadlines to avoid penalties and ensure timely tax reporting. Shareholders should also be aware of their own filing deadlines when reporting the information from the K-1 on their personal tax returns.

Quick guide on how to complete schedule k 1 form n 35 rev 2017 shareholders share of income credits deductions etc forms 2017

Your assistance manual on how to prepare your Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

If you're wondering how to complete and submit your Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms, here are some brief instructions on how to simplify tax reporting.

To begin, you only need to create your airSlate SignNow profile to transform the way you manage documents online. airSlate SignNow is an extremely user-friendly and robust document platform that enables you to modify, generate, and finalize your tax paperwork with ease. With its editor, you can alternate between text, checkboxes, and eSignatures and return to make changes as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and easy sharing options.

Follow these steps to finish your Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms in just a few minutes:

- Set up your account and start working on PDFs quickly.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Obtain form to open your Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and correct any mistakes.

- Save your modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Remember that filing on paper can result in errors and delay refunds. Before e-filing your taxes, be sure to check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form n 35 rev 2017 shareholders share of income credits deductions etc forms 2017

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form n 35 rev 2017 shareholders share of income credits deductions etc forms 2017

How to make an eSignature for the Schedule K 1 Form N 35 Rev 2017 Shareholders Share Of Income Credits Deductions Etc Forms 2017 in the online mode

How to create an eSignature for your Schedule K 1 Form N 35 Rev 2017 Shareholders Share Of Income Credits Deductions Etc Forms 2017 in Chrome

How to generate an eSignature for signing the Schedule K 1 Form N 35 Rev 2017 Shareholders Share Of Income Credits Deductions Etc Forms 2017 in Gmail

How to create an electronic signature for the Schedule K 1 Form N 35 Rev 2017 Shareholders Share Of Income Credits Deductions Etc Forms 2017 right from your mobile device

How to generate an electronic signature for the Schedule K 1 Form N 35 Rev 2017 Shareholders Share Of Income Credits Deductions Etc Forms 2017 on iOS

How to make an electronic signature for the Schedule K 1 Form N 35 Rev 2017 Shareholders Share Of Income Credits Deductions Etc Forms 2017 on Android OS

People also ask

-

What is the Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms?

The Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms is a tax document issued to shareholders showing their share of the entity's income, credits, and deductions. It is crucial for individuals to accurately report their income to the IRS. Using airSlate SignNow ensures you can electronically sign and send this form with ease.

-

How can airSlate SignNow help streamline the process of filing Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms?

airSlate SignNow boosts your efficiency by allowing you to prepare, sign, and send Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms online. Its user-friendly interface simplifies the document workflow, reducing the time spent on manual processes. This means you can focus more on your business rather than paperwork.

-

What are the pricing options for using airSlate SignNow for Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms?

airSlate SignNow offers competitive pricing plans that cater to various business sizes and needs, ensuring you get great value when managing your Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms. Different tiers are available depending on the volume of documents and features required. It's advisable to check our website for the latest pricing details and packages.

-

Are there any integrations available with airSlate SignNow for Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms?

Yes, airSlate SignNow seamlessly integrates with various platforms including CRM systems, accounting software, and cloud storage services. This allows for a smooth workflow when handling Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms and other documents. The integration capabilities enhance efficiency by eliminating the need for double data entry.

-

What features does airSlate SignNow offer to assist with Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms?

airSlate SignNow offers features such as customizable templates, advanced security measures, and tracking capabilities which are essential for handling Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms. These tools help you maintain compliance while ensuring that your documents are properly signed and stored. Enhanced collaboration features also allow for easy sharing with stakeholders.

-

Can I use airSlate SignNow on mobile devices for Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms?

Absolutely! airSlate SignNow is accessible on both iOS and Android devices, allowing you to manage your Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms on the go. Whether you're in the office or away, you can review, sign, and send your documents securely. The mobile app provides full functionality similar to the desktop version.

-

What benefits can businesses expect from using airSlate SignNow for Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms?

Using airSlate SignNow for Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced collaboration. By transitioning to digital signing, businesses can speed up their workflow considerably. This ultimately leads to improved productivity and better compliance with tax regulations.

Get more for Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

Find out other Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now