Schedule K 1 Form N 35 Rev Shareholder's Share of Income 2021

What is the Schedule K 1 Form N 35 Rev Shareholder's Share Of Income

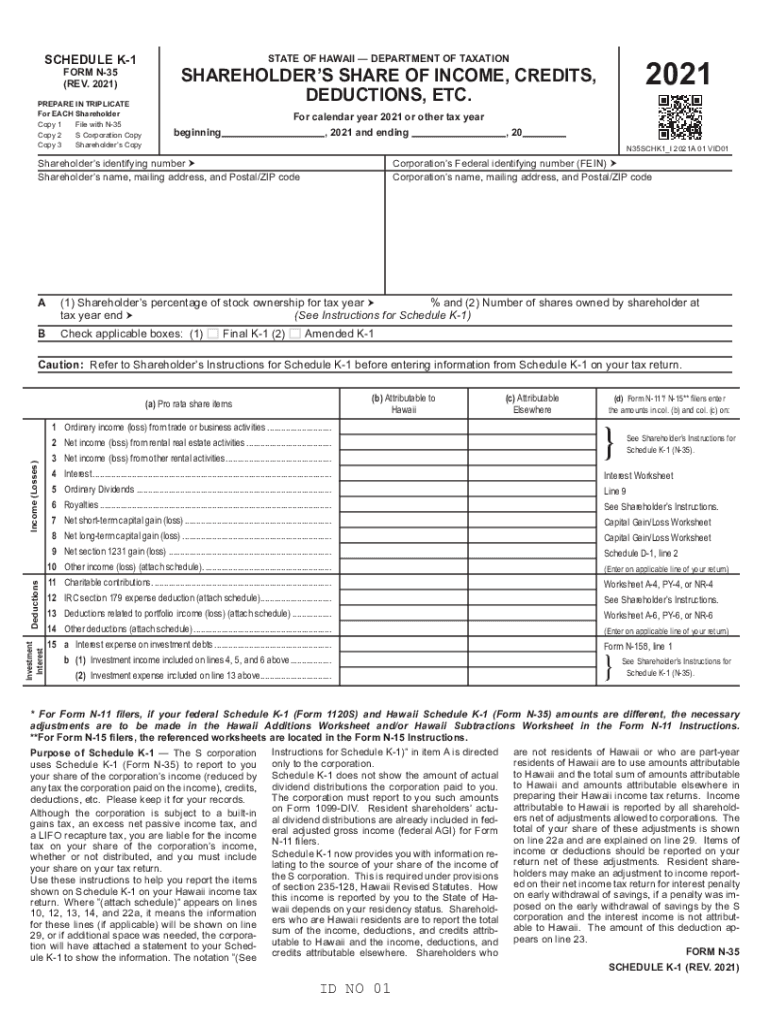

The Schedule K-1 Form N-35 is a tax document used in the state of Hawaii to report a shareholder's share of income, deductions, and credits from an S corporation. This form is essential for individuals who are shareholders in an S corporation, as it provides detailed information necessary for completing their personal income tax returns. The K-1 form outlines the income earned by the corporation and allocates it to each shareholder based on their ownership percentage. Understanding this form is crucial for accurate tax reporting and compliance with state tax laws.

Steps to complete the Schedule K 1 Form N 35 Rev Shareholder's Share Of Income

Completing the Schedule K-1 Form N-35 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the S corporation, including income statements and expense reports. Next, accurately input the corporation's income, deductions, and credits into the appropriate sections of the form. Ensure that the shareholder's information, such as name, address, and tax identification number, is correctly filled out. After completing the form, review it for any errors before submitting it along with your personal tax return. It is advisable to keep a copy for your records.

Legal use of the Schedule K 1 Form N 35 Rev Shareholder's Share Of Income

The Schedule K-1 Form N-35 is legally required for S corporations in Hawaii to report the income and deductions allocated to their shareholders. This form must be filed with the Hawaii Department of Taxation and is used to ensure that shareholders accurately report their share of the corporation's income on their personal tax returns. Failure to file this form or inaccuracies can lead to penalties and interest on unpaid taxes. Therefore, it is important to understand the legal implications of this form and ensure compliance with all relevant tax regulations.

IRS Guidelines

While the Schedule K-1 Form N-35 is specific to Hawaii, it is important to be aware of IRS guidelines regarding S corporations and K-1 forms. The IRS requires that S corporations issue K-1 forms to shareholders by the due date of the corporation's tax return. Shareholders must use the information reported on the K-1 to complete their federal tax returns. Understanding IRS guidelines helps ensure that all tax obligations are met and reduces the risk of audits or discrepancies in tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 Form N-35 align with the due dates for S corporation tax returns in Hawaii. Typically, S corporations must file their returns by the fifteenth day of the third month following the end of their tax year. For most corporations operating on a calendar year, this means the deadline is March 15. Shareholders should receive their K-1 forms by this date to accurately report their income on their personal tax returns. Awareness of these deadlines is essential to avoid late filing penalties.

Who Issues the Form

The Schedule K-1 Form N-35 is issued by S corporations in Hawaii to their shareholders. The corporation is responsible for preparing the form, which details each shareholder's share of income, deductions, and credits. It is crucial for shareholders to receive this form in a timely manner to ensure accurate tax reporting. The corporation must maintain accurate records to support the information reported on the K-1, as this documentation may be requested by tax authorities.

Quick guide on how to complete schedule k 1 form n 35 rev 2021 shareholders share of income

Accomplish Schedule K 1 Form N 35 Rev Shareholder's Share Of Income seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Schedule K 1 Form N 35 Rev Shareholder's Share Of Income on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The easiest way to modify and electronically sign Schedule K 1 Form N 35 Rev Shareholder's Share Of Income effortlessly

- Locate Schedule K 1 Form N 35 Rev Shareholder's Share Of Income and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark signNow sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting form searches, or mistakes that require reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Schedule K 1 Form N 35 Rev Shareholder's Share Of Income while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form n 35 rev 2021 shareholders share of income

Create this form in 5 minutes!

People also ask

-

What is a Schedule K-1 N-35?

The Schedule K-1 N-35 is a tax form used by partnerships to report income, deductions, and credits of partners. Understanding how to properly fill out this form is crucial to ensure compliance and accurate reporting for tax purposes.

-

How can airSlate SignNow assist with Schedule K-1 N-35?

airSlate SignNow simplifies the process of signing and managing Schedule K-1 N-35 documents. With its user-friendly interface, businesses can easily send, eSign, and store these forms securely, ensuring a seamless workflow.

-

Is airSlate SignNow compliant with tax regulations for Schedule K-1 N-35?

Yes, airSlate SignNow is designed to comply with industry standards and tax regulations, including those related to Schedule K-1 N-35. This guarantees that your electronic signatures are valid and legally binding, helping you stay compliant.

-

What are the pricing options for using airSlate SignNow for Schedule K-1 N-35?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to essential features for managing documents like Schedule K-1 N-35, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other accounting software for Schedule K-1 N-35?

Yes, airSlate SignNow offers numerous integrations with popular accounting software, streamlining the process of managing Schedule K-1 N-35 forms. This helps businesses synchronize their data and enhances productivity.

-

What are the benefits of using airSlate SignNow for Schedule K-1 N-35 documentation?

Using airSlate SignNow for Schedule K-1 N-35 documentation provides several benefits, including faster processing times, improved accuracy, and enhanced security. These features ensure that your forms are completed correctly and efficiently.

-

How secure is my information when using airSlate SignNow for Schedule K-1 N-35?

airSlate SignNow prioritizes security by utilizing advanced encryption and secure storage methods. This ensures that all information related to your Schedule K-1 N-35 documents is protected against unauthorized access.

Get more for Schedule K 1 Form N 35 Rev Shareholder's Share Of Income

- Commercial contractor package north dakota form

- Excavation contractor package north dakota form

- Renovation contractor package north dakota form

- Concrete mason contractor package north dakota form

- Demolition contractor package north dakota form

- Security contractor package north dakota form

- Insulation contractor package north dakota form

- Paving contractor package north dakota form

Find out other Schedule K 1 Form N 35 Rev Shareholder's Share Of Income

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter